A New Chapter in Funding History

Long before Kickstarter and Indiegogo buzzed into existence, visionaries relied on patronage systems and informal community backing to turn bold ideas into reality. From the Medicis’ support of Renaissance art to adventurers pooling resources at London coffee houses, collective funding has deep roots. Yet the digital age sparked a seismic shift: crowdfunding became accessible to anyone with an internet connection, reshaping entrepreneurship, creativity, and philanthropy. This article uncovers the pioneers who invented modern crowdfunding, examines its rapid evolution, and explores why this model revolutionized how projects get funded.

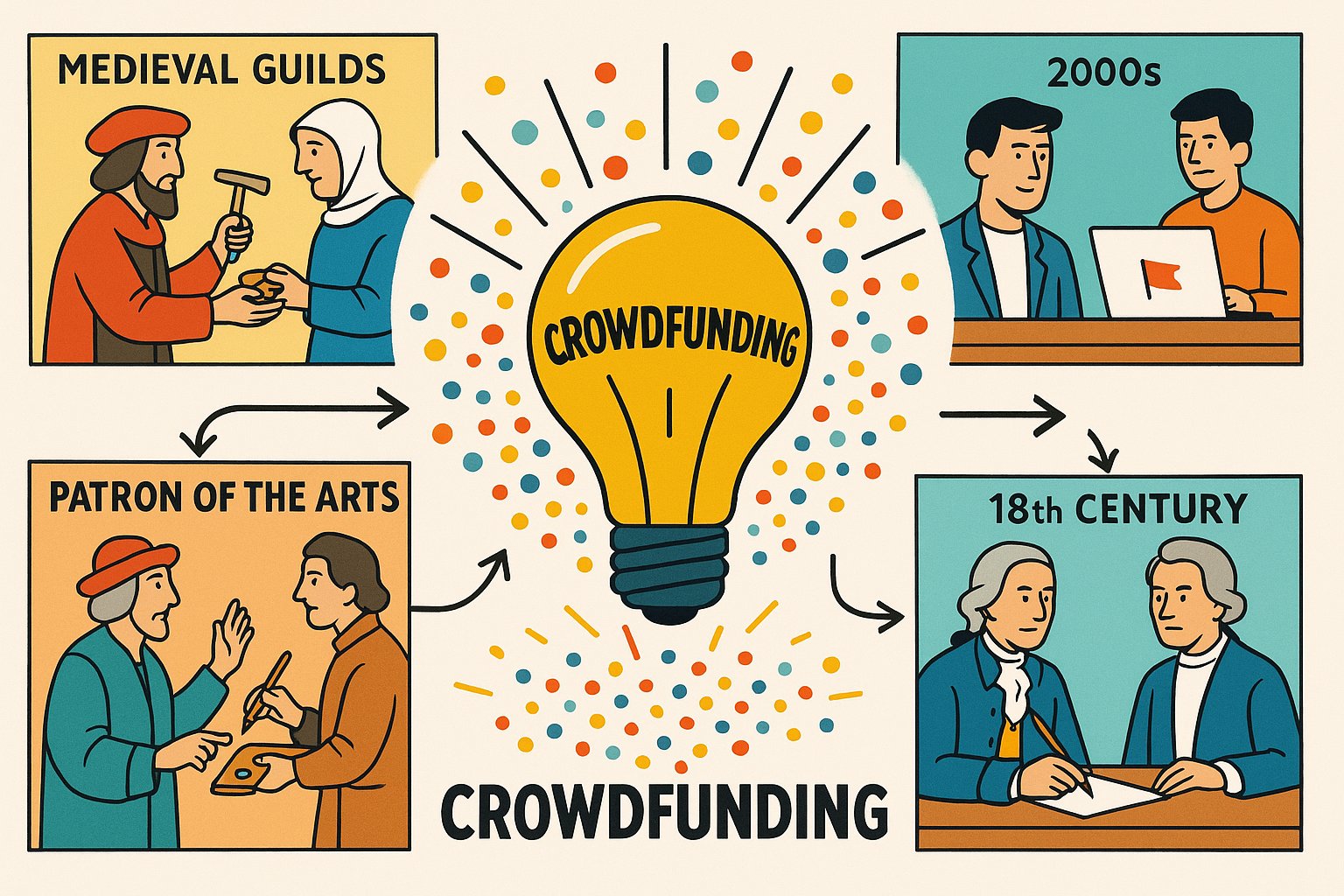

From Renaissance Patrons to Digital Dreamers

The concept of pooling resources dates back centuries. Wealthy families in Florence bankrolled master artists—Michelangelo carved under Medici patronage, and Leonardo da Vinci painted for dukes. In 1688, Lloyd’s Coffee House patrons gathered to share maritime risks, laying groundwork for today’s insurance markets. These early examples illustrated a simple truth: many small contributors could underwrite grand ventures. Fast-forward to the early 2000s, when the internet’s connective power offered a way to democratize funding, unlocking possibilities far beyond exclusive elite circles.

The Spark That Lit the Crowdfunding Flame

In 2001, musician Brian Camelio dared to bypass record labels by launching ArtistShare, the first online platform where fans directly funded creative projects. Camelio’s vision was radical: rather than waiting for corporate approval, artists could seek support from the communities most passionate about their work. By offering unique rewards—private concerts, early album access, personalized updates—ArtistShare proved that genuine fan engagement could drive project financing. This reward-based approach codified the mechanics of modern crowdfunding: transparent goals, tiered incentives, and direct creator-backers relationships.

Enter the Big Players: Kickstarter and Beyond

The late 2000s saw a flood of platforms building on Camelio’s blueprint. Indiegogo debuted in 2008 with a flexible funding model, allowing creators to keep contributions even if they fell short of targets. A year later, Kickstarter’s founders—Perry Chen, Yancey Strickler, and Charles Adler—introduced an all-or-nothing framework: campaigns succeeded only if they reached their goal, ensuring backers that funded projects truly had the resources to deliver. These platforms polished the user experience with intuitive interfaces, curated project categories, and community features, propelling crowdfunding into mainstream consciousness.

Microloans and Equity: Expanding the Crowd’s Reach

Crowdfunding’s impact soon expanded beyond creative endeavors. In 2005, Kiva pioneered peer-to-peer microloans, enabling anyone to lend as little as $25 to entrepreneurs in developing regions. This model married social good with financial empowerment, allowing backers to support small businesses globally. Equity crowdfunding followed in the early 2010s: platforms like SeedInvest and Crowdcube navigated securities regulations to let contributors purchase shares in startups. These innovations broadened crowdfunding’s scope, proving that collective financing could fuel everything from tech unicorns to grassroots social enterprises.

Why Crowdfunding Upended Traditional Finance

What made crowdfunding so transformative? First, it removed gatekeepers. Entrepreneurs no longer needed bank loans with onerous terms or venture capitalists’ approval. Second, crowdfunding validated market demand in real time: when backers pledge, they signal belief in a project’s viability. Third, transparent funding goals and progress bars built trust—contributors saw where every dollar went. Finally, direct interaction fostered community: backers became advocates, eager to share campaigns with friends. This democratization accelerated innovation cycles and propelled niche ideas—such as artisanal beverages or community gardens—onto the global stage.

Iconic Campaigns That Defined the Era

Several runaway successes showcased crowdfunding’s power to vault projects into the limelight. The Pebble Time smartwatch smashed records on Kickstarter in 2015, raising over $20 million and foretelling the wearables boom. Veronica Mars fans rallied in 2013 to fund a feature film, contributing $5.7 million and bypassing the studios. Indiegogo’s Flow Hive, an ingenious beehive design, captured more than $12 million in 2015 by offering eco-friendly rewards that resonated with a global audience. These campaigns taught vital lessons: crystal-clear storytelling, compelling incentives, and community-driven momentum unlock exponential growth.

The Psychology of Pledges: What Drives Backers

Crowdfunding taps deep-seated human motivations. Backers often feel a personal stake in a creator’s journey, transforming pledges into acts of support rather than mere transactions. Social proof—visible pledge milestones and glowing testimonials—triggers herd behavior, enticing fence-sitters to join the crowd. Early-bird rewards create urgency and exclusivity, while regular updates and interactive polls give backers a sense of agency and belonging. These psychological levers combined can turn a casual browser into an enthusiastic advocate who shares the campaign within their networks.

Key Elements That Propel Campaigns

-

Emotional Connection: Authentic storytelling that reveals the creator’s passion and challenges.

-

Scarcity and Urgency: Time-limited rewards to prompt immediate action.

-

Social Proof: Milestone celebrations and backer highlights to showcase momentum.

-

Interactive Engagement: Polls, surveys, and live Q&A sessions that involve contributors in decision-making.

Societal Shifts: Broadening Access and Inclusion

Crowdfunding unlocked capital for underrepresented voices. Women-led startups raised billions through reward-based campaigns, challenging venture capital’s historic gender gap. Minority entrepreneurs and social activists leveraged donation models to fund community projects often overlooked by traditional funders. Nonprofits used platforms like GoFundMe to mobilize grassroots support for disaster relief and medical treatments, empowering local voices and ensuring swift response times. This shift toward inclusive financing mirrors broader societal calls for equity, amplifying diverse perspectives and solutions on a global scale.

Regulatory Waves and the Road Ahead

As crowdfunding matured, governments worldwide grappled with balancing innovation against investor protection. The U.S. JOBS Act of 2012 opened equity crowdfunding to non-accredited investors under defined limits, while Europe enacted its own regulatory frameworks to govern cross-border offerings. Compliance measures—mandatory disclosures, fraud prevention, and investment caps—added complexity but also built trust. Looking forward, advancements like blockchain-based smart contracts promise further transparency and reduced fees, potentially democratizing crowdfunding even more by eliminating intermediaries and streamlining compliance.

Technology’s Role in Scaling the Crowd

Crowdfunding’s ascent rode on technological breakthroughs: ubiquitous high-speed internet, mobile accessibility, and integrated payment gateways made pledging seamless. Data analytics empowered creators to monitor backer demographics, optimize marketing spend, and refine reward tiers mid-campaign. Social media algorithms amplified viral momentum, turning supporters into brand ambassadors. Emerging tools—AI-driven backer recommendations and immersive 360° campaign previews—offer tantalizing glimpses of crowdfunding’s future, where hyper-personalized experiences and decentralized networks could redefine collective funding once again.

Crowdfunding’s Legacy: From Side Hustles to Startups

Today, entrepreneurs weave crowdfunding into multifaceted funding strategies. A successful campaign doubles as a powerful pitch deck for angel investors or accelerators, showcasing validated demand and a built-in customer base. Backers often convert into loyal customers, fueling post-campaign sales through e-commerce channels. Repeat creators use data-driven insights from previous campaigns to refine pricing strategies, tailor reward offerings, and target high-conversion markets. Crowdfunding has evolved from a niche tool into a cornerstone of startup ecosystems, embedding community engagement at the heart of business growth.

Lessons Learned and Common Pitfalls

Despite its triumphs, crowdfunding carries risks. Overly ambitious funding goals or vague value propositions can doom a campaign before it begins. Complex reward structures may confuse backers and increase fulfillment headaches. Delayed manufacturing or shipping snafus erode backer trust and tarnish reputations. Equity crowdfunding raises concerns about investment liquidity and regulatory compliance. Recognizing these pitfalls emphasizes the need for meticulous planning, clear communication, and realistic timelines. When setbacks occur, transparent updates and goodwill gestures—such as bonus rewards or discounts on future products—can help maintain backer confidence.

Gazing into the Future: Next-Gen Crowdfunding

The next wave of crowdfunding promises bold experimentation. Subscription-based models—exemplified by Patreon—sustain ongoing creative work through monthly pledges. Niche platforms cater to industries like real estate, scientific research, and renewable energy, offering specialized tools and communities. Decentralized finance (DeFi) and tokenization hint at permissionless crowdfunding networks that cut out intermediaries and reduce fees to near zero. As technologies converge, the core principle remains unchanged: enabling communities to unite around shared visions, pool resources, and bring dreams to life in ways once unimaginable.

Final Reflections on a Funding Revolution

From the Medicis’ grand commissions to Brian Camelio’s ArtistShare, from Kiva’s microloans to Kickstarter’s record-shattering campaigns, crowdfunding has rewritten the script of how projects get funded. It shattered traditional barriers, empowered diverse creators, and forged communities united by common passions. As we look ahead, the spirit of crowdfunding—collaborative, transparent, and inclusive—continues to inspire innovations that redefine possibility. The crowd’s voice has never been louder, and its power to enact change has forever altered the landscape of finance and creativity.