Unleashing the Power of Community-Driven Finance

In a world where traditional funding avenues often feel gated behind venture capitalists and stringent bank requirements, crowdfunding rises as a beacon of possibility. Imagine harnessing the collective enthusiasm of thousands—if not millions—of individuals who believe in your vision and are eager to see it come to life. Whether you’re an artisan crafting bespoke watches, a social entrepreneur tackling environmental challenges, or a developer building the next blockchain platform, crowdfunding levels the playing field. It empowers creators to validate their ideas, secure pre-launch buzz, and build meaningful relationships with supporters long before the first dollar of revenue is earned. But not all crowdfunding is created equal. To navigate this vibrant ecosystem, you need to understand its five dynamic models—each with its own rhythm, rewards, and considerations. Strap in as we explore the landscape of reward, equity, donation, debt, and royalty crowdfunding, revealing how each path can supercharge your journey from idea to impact.

Igniting Dreams: The Allure of Reward-Based Campaigns

Reward-based crowdfunding transforms backers into excited patrons who eagerly await the unveiling of a product or experience. Picture a sleek new gadget poised to revolutionize your daily routine, offered at an exclusive early-bird price, complete with limited-edition color options and founder’s club access. This is the magic of platforms like Kickstarter and Indiegogo, where creators set funding goals and craft tiered perks that reward supporters for each pledge level. The allure lies in the tangible promise: backers aren’t simply donating; they’re pre-ordering the next big thing.

Behind the scenes, creators meticulously plan their reward tiers to balance perceived value with production feasibility. Early adopters often receive attractive discounts or unique add-ons, while higher-tier supporters might enjoy VIP events, behind-the-scenes updates, or personalized versions of the end product. This structure not only fuels momentum—encouraging backers to upgrade their contributions—but also offers creators invaluable market insights. Successful campaigns can validate demand, refine features based on feedback, and secure partnerships with manufacturers.

Yet, the journey isn’t without its twists. Fulfilling rewards on time requires precise logistics: sourcing materials, coordinating assembly, and managing global shipping. Unexpected delays can strain creator-backers relationships, making transparent communication vital. By openly sharing progress updates, challenges, and revised timelines, creators maintain trust and keep the community engaged. For backers, supporting a reward-based campaign means embracing the adventure, complete with its surprises and milestones.

Turning Fans into Co-Owners: The Equity Crowdfunding Revolution

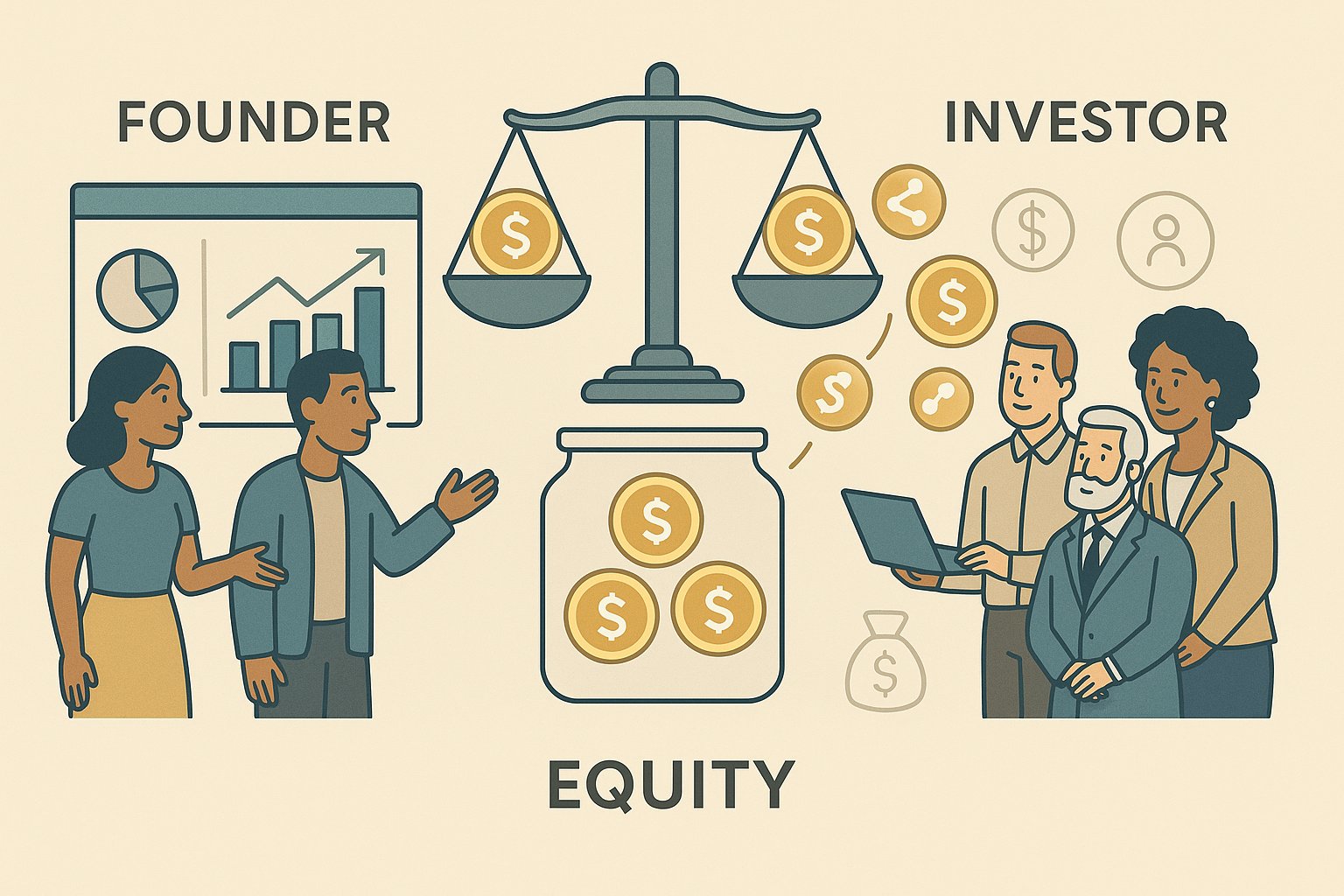

Imagine your most passionate fans not only cheering you on but owning a piece of your company. Equity crowdfunding flips the script by offering shares or convertible notes to backers through platforms like SeedInvest, Crowdcube, and Republic. Rather than pre-ordering a product, investors receive real equity—ownership stakes that align their success with the company’s growth trajectory.

This model caters to startups poised for rapid scale. Whether you’re disrupting healthcare with a novel device or launching a marketplace for handcrafted goods, equity crowdfunding opens doors to substantial capital from everyday investors. Unlike traditional venture capital, which often demands six-figure minimums and complex negotiations, equity platforms welcome smaller investments, democratizing access to high-potential opportunities.

However, equity crowdfunding operates within a complex regulatory framework. Legal disclosures, securities filings, and investor qualifications ensure that campaigns abide by securities laws. Platforms typically guide creators through this maze, but it’s incumbent upon entrepreneurs to maintain transparency and uphold rigorous reporting standards. Detailed pitch decks, financial projections, and risk disclosures become essential tools for building credibility.

For investors, equity crowdfunding combines the thrill of supporting early-stage innovation with the promise of financial returns. But with great potential comes inherent risk: many startups falter under market pressures, regulatory hurdles, or execution missteps. By conducting due diligence—studying market size, competitive landscape, and founding team expertise—investors can make informed decisions. When successful, equity crowdfunding forges a powerful bond between creators and backers, transforming communities of supporters into collaborative growth engines.

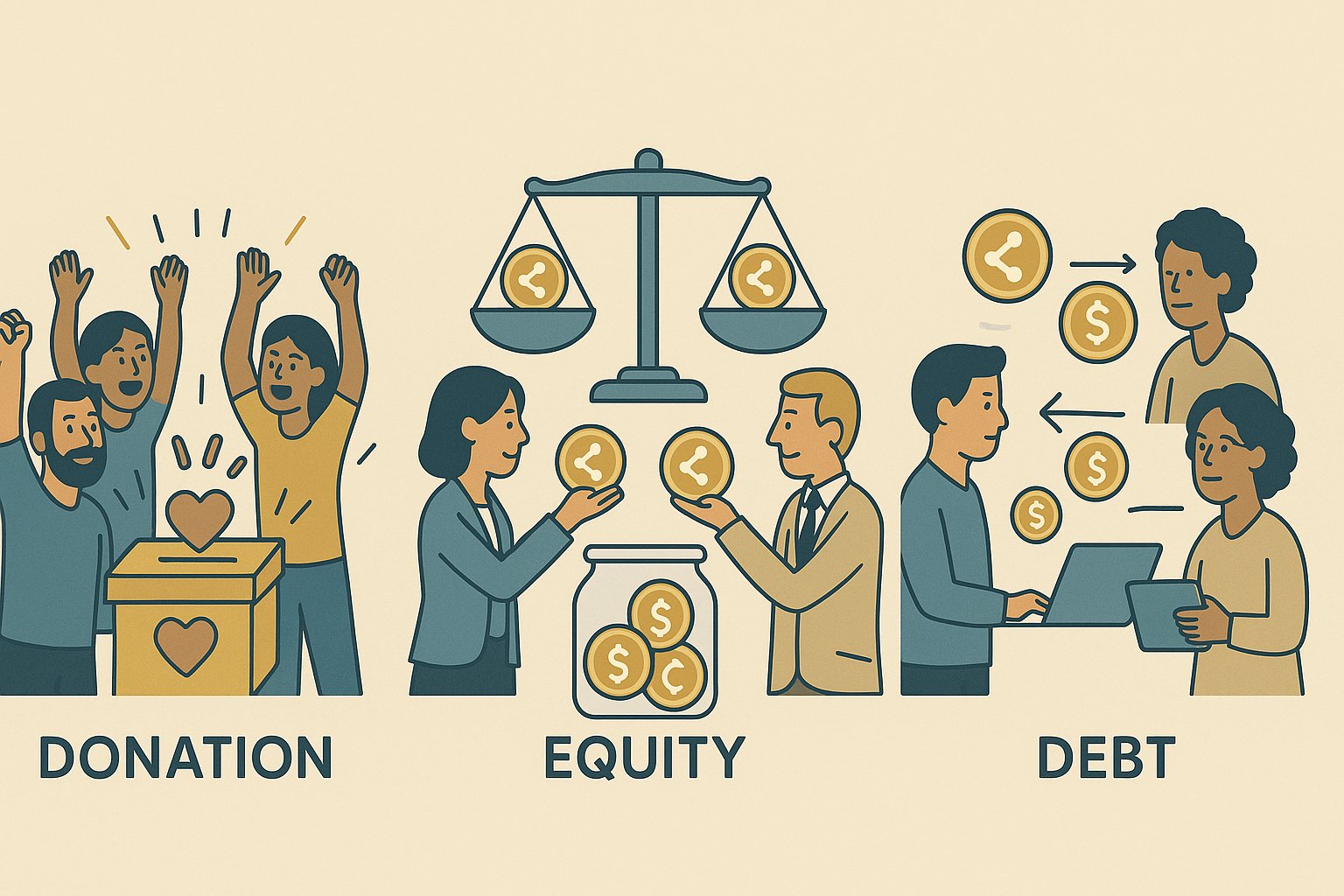

Empathy in Action: The Heart of Donation-Based Funding

Some stories transcend commerce and venture capital, tapping into the fundamental human impulse to help. Donation-based crowdfunding exemplifies this spirit, channeling goodwill toward personal emergencies, medical bills, educational expenses, and charitable causes. Platforms like GoFundMe and JustGiving enable individuals and nonprofits to share compelling narratives that resonate with compassionate backers worldwide.

At its core, donation crowdfunding thrives on authentic storytelling. Campaign creators craft narratives that spotlight specific needs, illustrate the human impact of each contribution, and showcase milestones as funds accumulate. Visual elements—photos, video testimonials, progress updates—heighten emotional engagement, making donors feel intimately connected to the outcomes they’re fueling.

While donors receive no material rewards, many derive intangible benefits: the satisfaction of easing suffering, the joy of community solidarity, and in some cases, tax deductions when donating to registered nonprofits. Campaign momentum often hinges on social sharing; once a story gains traction, the ripple effect of retweets, Facebook shares, and media coverage can propel donations to new heights.

Challenges in donation crowdfunding revolve around accountability and transparency. Backers expect clear reporting on how their funds are used, which necessitates frequent updates and detailed expense breakdowns. Creators who honor their commitments—whether rebuilding homes after natural disasters or funding life-saving treatments—often cultivate a loyal base of long-term supporters. Through the lens of donation-based crowdfunding, hope and generosity intersect, illustrating the profound impact of collective action.

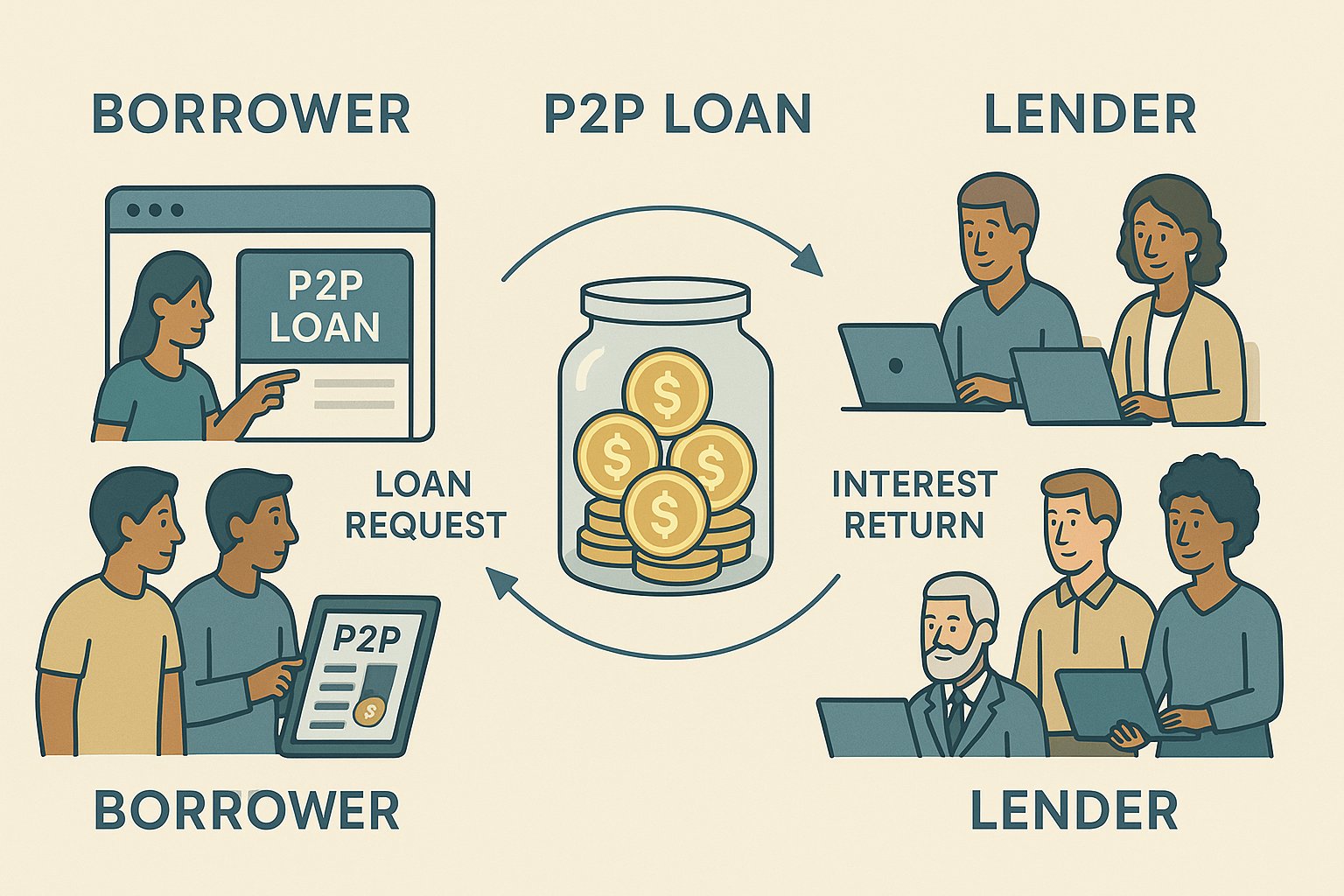

Bridging Credit Gaps: The Rise of Peer-to-Peer Lending

When traditional banks turn away borrowers or impose prohibitive interest rates, peer-to-peer (P2P) lending platforms step in to connect individual and institutional lenders with borrowers in need. Operating on sites like LendingClub, Prosper, and Funding Circle, debt crowdfunding democratizes credit by offering streamlined loan applications, transparent rate determination, and monthly repayments that reward lenders with interest income.

Borrowers—ranging from small business owners seeking expansion capital to individuals consolidating student debt—submit detailed loan requests complete with credit histories and repayment plans. Platforms employ advanced risk-scoring algorithms to assign interest rates that reflect borrower profiles. Lenders can diversify risk by funding fractional loan segments across multiple borrowers, creating a portfolio that balances yield potential with default mitigation.

For entrepreneurs, P2P lending can unlock competitive rates and swift approval processes, bypassing slow-moving bank bureaucracy. Lenders, in turn, gain access to alternative investment opportunities that often outpace traditional savings accounts or bonds. Nonetheless, risks persist: economic downturns can elevate default rates, and platform fees can erode net returns. Some platforms address these challenges through loan securitization or buyback guarantees under certain conditions.

By fostering direct connections, debt crowdfunding promotes financial inclusion and encourages responsible lending practices. Borrowers gain a pathway to funds, lenders build diversified portfolios, and communities witness the tangible benefits of peer-supported credit.

Revenue Partnerships: The Innovation of Royalty-Based Models

What if backers could share directly in the sales success of a project without taking on equity? Royalty-based crowdfunding offers this unique hybrid, enabling supporters to earn a percentage of future revenues. Platforms such as Royalty Exchange and Kickfurther empower creators to pledge royalty streams tied to product sales, licensing fees, or service subscriptions—turning supporters into revenue partners.

This model particularly suits businesses with predictable sales cycles or intellectual property assets. Imagine a fashion designer offering backers a portion of profits from each garment sold, or a software company sharing royalties from annual subscriptions. By structuring campaigns with clear caps—either duration-based or total payout limits—creators maintain control over financial obligations while incentivizing backers with potential upside.

Royalty crowdfunding demands robust financial projections and thorough communication. Creators present realistic sales forecasts, pricing strategies, and distribution plans, building credibility and aligning expectations. Backers evaluate campaigns based on market size, growth potential, and competitive positioning, much like in equity evaluations, but with the assurance of revenue-linked returns rather than ownership stakes.

Although less common than other crowdfunding forms, royalty-based models carve out a niche for ventures seeking capital without diluting stock or assuming traditional debt burdens. By sharing revenue, creators and backers embark on a joint journey toward mutual financial success.

Charting Your Crowdfunding Course

Selecting the right crowdfunding model hinges on multiple factors: your project’s nature, funding requirements, desired relationship with supporters, and risk tolerance. Reward-based campaigns excel for tangible products and creative projects, offering market validation and pre-sales. Equity crowdfunding invites investment community participation in your company’s equity, ideal for high-growth startups. Donation-based campaigns shine when human stories and social causes drive momentum. Debt crowdfunding democratizes credit access, empowering borrowers and lenders alike. Royalty-based crowdfunding fosters revenue partnerships without diluting ownership.

Each path demands careful planning. Craft compelling narratives, set realistic goals, and maintain transparent communication throughout your campaign lifecycle. Engage your community with regular updates, celebrate milestones, and address challenges candidly. For backers, due diligence matters: review campaign details, assess creator credibility, and align your goals—whether you seek an innovative product, a philanthropic impact, a financial return, or a revenue share.

As crowdfunding evolves, new hybrid models and platform features continue to emerge, further enriching this ecosystem. By understanding the nuances of each model and leveraging best practices, you can transform your vision into reality with the support of a global community. Whether you’re unleashing the next breakthrough gadget, rallying support for a vital cause, or financing your business’s expansion, the collective power of crowdfunding awaits—ready to propel your ambitions skyward.