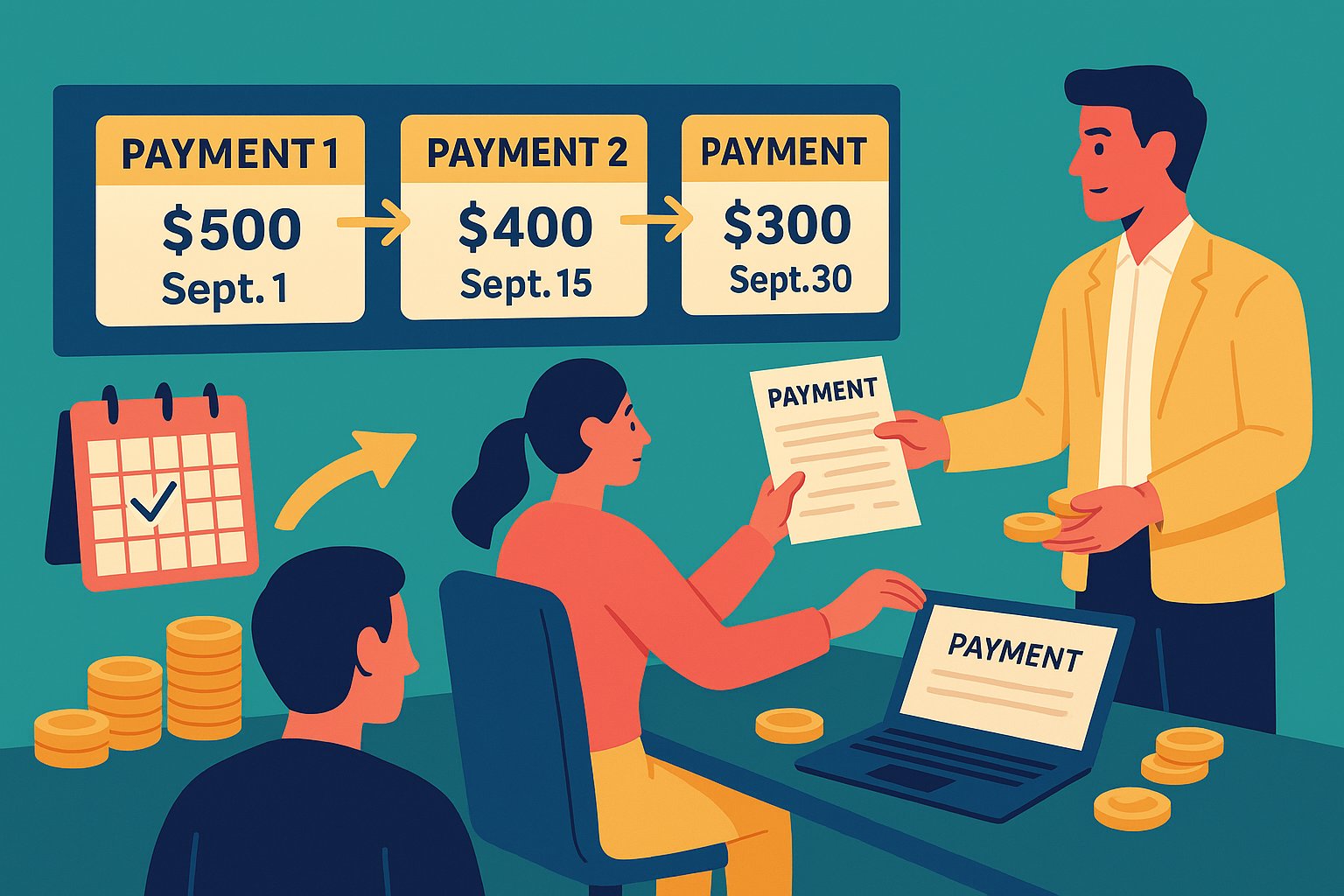

The Anatomy of Repayment Schedules

When you tap into the dynamic world of debt-based crowdfunding, understanding repayment schedules becomes your compass for navigating cash flow and risk. Every loan comes with a roadmap—a series of payments scheduled over a specific period. These schedules dictate not only how much you owe each month but also how interest accrues, how principal diminishes, and ultimately, how your obligations fit into your broader financial picture. Whether you’re a borrower seeking funds or an investor evaluating risk, grasping the nuances of repayment structures is essential. In this opening segment, we’ll unpack why repayment schedules matter and set the stage for an in-depth exploration of the options you’re likely to encounter.

Mapping Out Amortizing Repayment Structures

Amortizing schedules often take center stage in debt-based crowdfunding platforms, and for good reason: they balance principal and interest payments in a way that ensures complete payoff by the loan’s maturity date. Picture an amortization table that stretches across 36 or 60 months; each monthly installment remains consistent, yet the composition shifts. In early months, interest claims the lion’s share of your payment, while the principal portion remains modest. As time progresses, interest diminishes and principal repayment accelerates. This declining balance approach translates to predictable payments—an attractive feature for borrowers who prefer a fixed monthly obligation—and clear projections for investors eager to see principal returned over time. By the final payment, the loan is entirely extinguished, providing a clean break from that particular debt.

Exploring Interest-Only Payment Plans

For borrowers seeking lower initial payments, interest-only schedules have an undeniable appeal. In this structure, you pay only the accrued interest during an initial “interest-only” period, which might span six months, a year, or even the entirety of the loan term in some cases. Because your payment doesn’t touch the principal, the balance remains static until the interest-only window closes. At that point, you face either a balloon payment—where the entire principal is due in a lump sum—or a conversion to an amortizing schedule where both principal and interest are repaid over a defined period. While the allure of minimal upfront payments can be strong—especially for entrepreneurs or small businesses with tight early cash flow—borrowers must prepare for the larger obligations that follow. Investors also weigh higher risk in interest-only deals, since the principal remains outstanding for longer, increasing exposure to borrower default before any principal is repaid.

Unpacking Bullet and Balloon Payment Models

Bullet or balloon repayment models represent a more dramatic approach: instead of spreading principal across multiple installments, the borrower pays interest periodically—perhaps monthly or quarterly—and defers all or most of the principal to the very end of the loan term. Imagine borrowing $50,000 at 8 percent interest for three years: you’d make interest-only payments, and at the 36-month mark, a lump sum of $50,000 becomes due. This structure can appeal to businesses expecting a significant cash inflow near the loan’s maturity—such as the sale of an asset or a seasonal revenue boost. However, the concentrated payoff risk requires disciplined planning to ensure sufficient funds are available at the finish line. Lenders in debt crowdfunding often scrutinize the borrower’s ability to execute on that exit strategy before agreeing to bullet payment terms, as the principal remains entirely at risk until maturity.

Blending Flexibility: Hybrid Repayment Options

In response to diverse borrower needs, some crowdfunding platforms offer hybrid structures that blend features of amortization and bullet payments. For instance, you might make interest-only payments for the first six months, transition to partial principal amortization for the next 12 months, and then face a final balloon payment. This tiered approach can provide breathing room during early operational phases—when revenue may be unsteady—while still demonstrating intent to repay principal before the loan concludes. Hybrid models require meticulous cash flow forecasts, as miscalculating early repayment capacity can jeopardize your ability to make principal payments later. Yet for borrowers with irregular income streams—perhaps seasonal businesses or startups anticipating a funding event—such flexible structures can align repayment with real-world revenue scenarios, enhancing the odds of successful loan completion.

Assessing Cash Flow Implications of Each Schedule

No matter which repayment path you choose, the critical question remains: how will these payments fit into your monthly, quarterly, or annual budget? Amortizing loans demand steady cash flow, as payments rarely waver. Interest-only or bullet models may deliver lower initial outlays, but they carry the risk of steep later payments that must be planned for well in advance. To evaluate the fit, construct a cash flow projection that overlays estimated revenues or income streams with scheduled debt payments. If your business follows a seasonal pattern, aligning higher principal payments with peak months can smooth overall financial stress. Conversely, if your revenue is consistent, an amortizing schedule might offer simplicity and predictability. By mapping payments against cash flow, you gain clarity on sustainable borrowing levels and avoid unpleasant surprises when a larger repayment arrives.

Navigating Early Prepayment and Penalty Clauses

Some debt crowdfunding offerings encourage borrowers to pay down principal ahead of schedule—potentially lowering total interest costs—while others impose prepayment penalties that neutralize savings. Before you commit to a loan, scrutinize the fine print: does prepaying early trigger a fee? If so, how is it calculated? Prepayment penalties can range from a fixed percentage of the remaining balance to a sliding scale based on time elapsed. While prepayment flexibility is valuable—especially for entrepreneurs who anticipate an influx of cash from a product launch or equity financing—penalties can erode the benefits of paying down debt early. On the flip side, if a loan has no prepayment penalty, taking advantage of windfalls to retire debt can significantly improve your financial standing. Understanding these clauses allows you to strategize repayment: if you see no penalty, early lump-sum contributions may be wise, whereas a punitive prepayment structure suggests prioritizing consistent, on-time payments instead.

Factoring in Platform Fees and Servicing Charges

Repayment schedules in debt crowdfunding extend beyond principal and interest; they often embed platform fees or servicing charges that financially shape your obligations. Some platforms deduct an origination fee upfront—reducing the disbursed amount—yet still structure your repayment as if you received the full principal. Others charge ongoing servicing fees as a percentage of the outstanding balance, which can slightly inflate each scheduled payment. Accurately modeling your repayment structure means incorporating these fees into your projections. If a three-year amortizing loan charges a 1 percent annual servicing fee on an initial $100,000 principal, expect an added $1,000 in fees the first year—decreasing as the balance declines. By embedding platform costs into the schedule, you avoid underestimating monthly or quarterly cash requirements and ensure that your repayment roadmap reflects the true cost of borrowing.

Mitigating Refinancing and Extension Risks

Borrowers occasionally face situations where cash flow falters, deadlines approach, and refinancing or loan extensions become tempting lifelines. Understanding your repayment schedule helps you gauge the feasibility of seeking extensions or negotiating new terms. If you have a bullet payment looming in a few months but anticipate a funding delay, proactively engaging with lenders and demonstrating an adjusted revenue plan may yield a short-term extension—often at an incremental rate. However, extensions and refinancings carry their own costs: new origination fees, potential increases in interest rates, and a fresh amortization schedule that could extend your debt horizon. By anticipating these scenarios within your repayment framework, you can make informed decisions about when to absorb short-term pain or when a strategic refinance aligns better with long-term goals.

Communicating Your Repayment Strategy to Backers

Transparency is paramount in debt crowdfunding. When you present your campaign, clearly articulate how your chosen repayment schedule aligns with your revenue model and risk profile. If you opt for an amortizing loan, explain how consistent monthly payments fit neatly into your projected cash flow. If you select a bullet payment, outline the specific source—such as a major sale or equity infusion—that will generate the lump sum. Demonstrating that you understand the mechanics and timing of your payments builds lender confidence. In your campaign narrative, weave in the rationale behind your chosen schedule: show that you’ve simulated cash flow scenarios, accounted for fees, and have contingency plans if revenue dips. This level of detail not only impresses backers but also reduces skepticism, paving the way for faster, more robust funding commitments.

Leveraging Repayment Insights for Future Financing

Mastering repayment schedules delivers benefits that extend beyond a single campaign. By monitoring how payments track against actual revenues, you glean invaluable data for future borrowing. If your amortizing payments prove sustainable, you may comfortably handle a larger loan next time. If interest-only periods expose unexpected cash crunches, you might shift toward shorter interest-only windows or fully amortizing terms moving forward. Additionally, lenders often track your repayment history across platforms—consistent, on-time payments enhance your borrower profile, potentially unlocking lower interest rates or priority access to new funding rounds. Armed with this track record, you strengthen your negotiating position, showing prospective backers that your chosen repayment structures aren’t arbitrary but instead reflect thoughtful, outcome-oriented planning.

Mastering Timely Payments to Fortify Your Reputation

A repayment schedule serves as both a financial roadmap and a reputation yardstick. Late payments, skipped installments, or unexpected defaults can severely damage your credibility—both on the platform you’re using and within the broader crowdfunding community. Lenders communicate and share borrower data; missing a payment can lead to higher interest rates or shorter funding horizons in future campaigns. To safeguard your reputation, adopt automated payments wherever possible, set calendar reminders for upcoming installments, and maintain an emergency fund specifically earmarked for debt service. When you consistently honor your repayment schedule—whether amortizing, interest-only, or balloon—you cultivate trust, lower perceived risk, and make it easier to secure financing down the road. Remember, your repayment history is a living testimonial to your financial discipline and commitment.

Crafting a Sustainable Path Forward

Understanding repayment schedules in debt-based crowdfunding transcends mere arithmetic; it’s about forging a sustainable relationship between your financial ambitions and your actual capacity to repay. Whether you choose an amortizing structure for predictability, an interest-only model for early flexibility, or a bullet payment for strategic timing, the key lies in aligning the schedule with your cash flow realities. By factoring in platform fees, modeling scenarios for refinancing, and communicating your plan transparently, you transform what could be a daunting obligation into a well-charted financial journey. As you embark on—or continue—your crowdfunding path, let each repayment schedule serve as both a guidepost and a testament to your credibility, enabling you to access capital with confidence, satisfy backers, and pave the way for future financial opportunities.