The Legal Checklist for Running a Reg A+ Crowdfunding Campaign

Launching a Regulation A+ crowdfunding campaign is an ambitious endeavor that can transform your company’s growth trajectory by opening up access to a broad base of both accredited and non-accredited investors. Yet alongside the excitement of potential capital infusion lies a complex web of legal requirements and compliance deadlines that demand meticulous attention. Unlike smaller exemptions such as Regulation CF, Reg A+ offerings—particularly under Tier 2—require audited financial statements, ongoing SEC reporting, and preemption of state blue-sky laws. Founders must navigate a multi-step process that spans entity structuring, document drafting, SEC filings, marketing approvals, and post-qualification obligations. Missteps along the way can lead to costly delays, enforcement actions, or the invalidation of your campaign, putting both funds and reputation at risk. This comprehensive legal checklist will guide you through every critical milestone, equipping you with the knowledge and practices needed to run a compliant, successful Reg A+ crowdfunding round. Whether you are steering your first public offering or refining your existing capital-raising infrastructure, the insights below will help you structure a campaign that meets regulatory standards while captivating investors.

Understanding the Foundations of Reg A+ Compliance

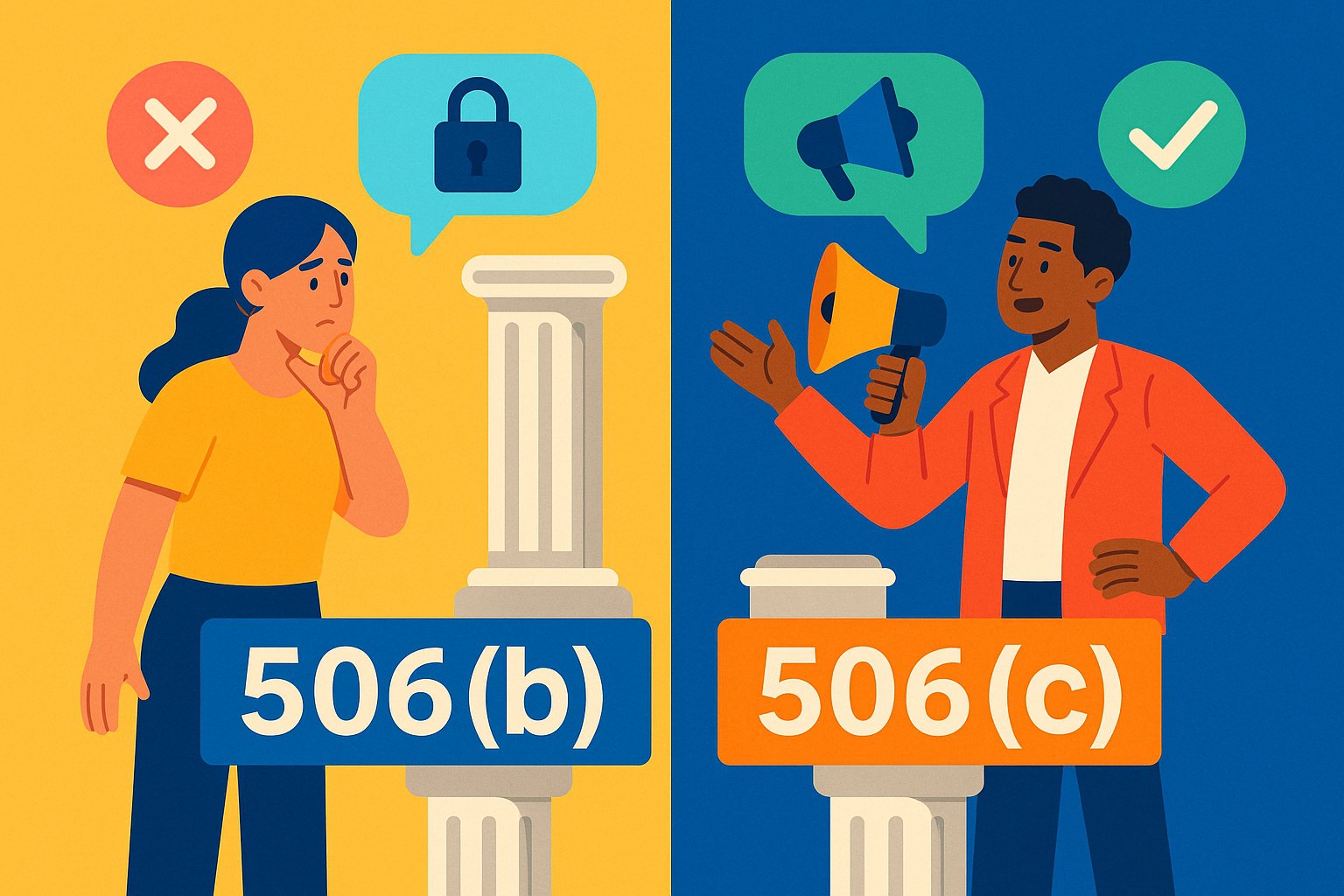

Before diving into document preparation and filings, it is essential to ground yourself in the foundational legal framework of Regulation A+. Enacted under Title IV of the JOBS Act, Reg A+ offers two distinct tiers: Tier 1, which allows raises up to $20 million in a 12-month period subject to both SEC and state blue-sky review, and Tier 2, which permits raises up to $75 million while preempting state securities laws but imposing more robust ongoing reporting. Unlike traditional IPOs, Reg A+ campaigns do not require full registration statements, yet they demand a rigorous offering circular, audited financial statements, and detailed risk factor disclosures. Issuers must also qualify their securities through the SEC’s review process, which can involve multiple rounds of comment and amendments. Understanding these requirements upfront sets the stage for efficient planning and avoids surprises when engagement with SEC examiners intensifies.

Forming a Suitable Issuing Entity and Governance Structure

Legal compliance for Reg A+ begins at the corporate level. Your issuing entity must be properly organized under state law—commonly as a Delaware C-corporation or LLC—and equipped with robust governance practices. Before preparing your offering materials, ensure that your corporate charter authorizes the issuance of new shares or debt instruments under the proposed terms. Update your certificate of incorporation or operating agreement to reflect any new classes of securities and voting rights. Establish a board of directors with independent members, if possible, to enhance credibility with both regulators and investors. Draft clear bylaws or operating procedures covering investor rights, transfer restrictions, and corporate governance protocols. Taking these structural steps early prevents legal obstacles when drafting your offering circular and reduces the likelihood of SEC requests for additional corporate documentation.

Engaging Qualified Securities Counsel and Audit Firm

No Reg A+ campaign proceeds without the guidance of experienced securities counsel and a reputable audit firm. Your securities attorneys will draft the offering circular, coordinate SEC submissions, and advise on marketing compliance, while your auditors will examine financial statements to satisfy Tier 2 requirements. Select counsel and auditors with a track record in Reg A+ offerings: they understand SEC comment patterns, blue-sky coordination under Tier 1, and the nuances of ongoing reporting obligations. Early engagement allows counsel to identify potential disclosure gaps and audit issues that could delay SEC qualification. Allocate sufficient budget and timeline for legal and audit fees, recognizing that thorough preparation accelerates SEC review and enhances investor confidence in your financial transparency.

Drafting the Offering Circular and Core Disclosures

The offering circular is the cornerstone of your Reg A+ campaign, serving as both a marketing document and a legal disclosure instrument. It must include a detailed business overview, management biographies, capitalization table, use-of-proceeds breakdown, risk factor analysis, and audited or reviewed financial statements. Draft each section with precision, ensuring that forward-looking statements are carefully qualified and that risk factors are both comprehensive and specific to your industry. Provide clear explanations of business models, revenue streams, and competitive landscapes to satisfy the SEC’s materiality standards. Work closely with counsel to balance marketing flair with legal sufficiency, using plain language in the body text while embedding legal disclaimers where required. An impeccably drafted offering circular mitigates the risk of SEC comment letters and fosters investor trust.

Coordinating SEC Filings and Responding to Comments

Once your offering circular draft is complete, your counsel will file it as Form 1-A with the SEC. Expect a clock that begins anew with each SEC comment letter—regulators typically review submissions within 90 days, providing lists of questions ranging from clarifications on financial footnotes to requests for additional risk disclosures. Organize a review team that includes legal, finance, and accounting representatives to address each comment comprehensively. Track comment deadlines rigorously, prepare redlines carefully, and maintain a record of change logs to facilitate SEC re-review. A proactive, collaborative approach to SEC comments often results in faster qualification, enabling you to launch your marketing campaign on schedule.

Navigating State Blue-Sky Requirements for Tier 1

If you select Tier 1, you must comply with state securities laws in every jurisdiction where you offer securities. This involves filing tailored blue-sky notices and paying filing fees specific to each state’s securities regulator. Compile a state filing matrix with timelines, document requirements, and payment schedules. Engage local counsel or bulb-sky service providers to prepare and submit these notices, ensuring no state’s deadline is missed. While time-consuming, early coordination reduces the risk of state regulatory holds that can halt your offering. Tier 2’s preemption of blue-sky laws may expedite later offerings, but for anyone targeting smaller raises under Tier 1, mastering state filing logistics is indispensable.

Establishing Marketing and “Testing the Waters” Protocols

Reg A+ allows issuers to “test the waters” communications to gauge investor interest before filing the offering circular. Ensure all pre-filing materials—such as pitch decks, teaser one-pagers, and webinars—comply with SEC requirements: they must be labeled “testing the waters” and clearly state that no securities are for sale until qualification. After filing, general solicitation is permitted, but all marketing collateral must align precisely with your qualified offering circular. Work with counsel to craft compliant email campaigns, social media ads, and roadshow presentations. Maintain a repository of all marketing content and distribution lists to demonstrate adherence to SEC and FINRA guidelines, thus avoiding any allegations of unauthorized or misleading solicitation.

Meeting Ongoing Reporting and Disclosure Obligations

Post-qualification, Tier 2 issuers must file an annual report on Form 1-K, a semiannual report on Form 1-SA, and current event reports on Form 1-UZ as material developments occur. Tier 1 requires ongoing notice filings in states that demand them. Develop an internal calendar of reporting deadlines and assign roles for financial compilation, legal reviews, and timely SEC submission. Invest in a compliance management platform or maintain a secure shared drive with version control to store all filings, proofs of submission, and investor communications. Establish a quarterly investor call or newsletter to complement formal filings, reinforcing transparency and reducing investor inquiries. Consistent, accurate reporting not only satisfies regulatory mandates but also strengthens investor relations and supports secondary market interest.

Structuring Share Issuance and Transfer Agent Coordination

After qualification, share issuance and registration must be handled precisely to avoid legal pitfalls. Engage a reputable transfer agent early to manage subscription processing, cap table updates, and issuance of electronic or paper certificates. Define subscription agreement terms clearly, including procedures for investor accreditation verification if required, payment modalities, and escrow arrangements. Establish escrow accounts with approved custodians to hold investor funds until closing. Coordinate with your transfer agent to ensure that stock issuances align with subscription thresholds and that all securities bear appropriate legends restricting resale where necessary. Accurate share issuance records protect you from future challenges regarding ownership disputes or regulatory scrutiny.

Planning for Secondary Market Liquidity

One of Reg A+’s chief advantages is the potential for secondary trading on compliant platforms once ongoing reporting obligations are met. Evaluate partnerships with alternative trading systems or broker-dealers to support a timely debut of your shares in the secondary market. Confirm that your offering circular discloses the anticipated trading platform, ticker symbol, and any market-making arrangements. Coordinate with market makers to ensure initial bid-ask spreads are reasonable and that sufficient liquidity is available to foster positive price discovery. Early planning for secondary market entry positions your company to attract institutional and retail investors seeking tradable securities, thus enhancing the overall success of your campaign.

Managing Investor Relations and Legal Risk Mitigation

Throughout your Reg A+ journey, proactive investor relations and risk management are paramount. Implement a secure online portal where investors can view official documents, submit inquiries, and receive updates. Craft an investor communication policy that outlines the cadence, content, and channels for all outreach, ensuring consistency with SEC-filed materials. Develop an internal escalation protocol for handling investor complaints or allegations of disclosure deficiencies, involving legal counsel at the outset to contain risks. Periodically review your compliance processes and documentation to identify areas for improvement, leveraging audit trails and compliance logs. A robust legal infrastructure not only mitigates liability but also emboldens investor confidence, paving the way for future fundraising success.

Learning from Best Practices and Common Pitfalls

Founders who have successfully navigated Reg A+ often emphasize early preparation, integrated project management, and transparent communication. Start preparations at least nine to twelve months before your target launch date, allowing ample time for entity structuring, counsel engagement, and audit completion. Use cross-functional teams to coordinate legal, financial, and marketing tasks under a unified timeline. Anticipate and address potential SEC comments by benchmarking against prior offerings and leveraging counsel’s historical data. Avoid common pitfalls such as underestimating state blue-sky timelines, neglecting investor communication during delays, or failing to update offer materials when business conditions change. Learning from others’ experiences streamlines your campaign and maximizes the likelihood of qualification on first review.

Securing Your Growth Future Through Reg A+ Mastery

Running a Regulation A+ crowdfunding campaign is a demanding but rewarding undertaking that bridges private equity dynamics with public offering benefits. By following this legal checklist—from entity formation and counsel engagement through SEC filings, marketing compliance, and post-qualification reporting—you equip your company to meet rigorous regulatory standards while captivating a diverse investor base. The discipline you apply in meeting legal and compliance milestones not only safeguards your fundraising but also establishes a foundation for future capital-raising endeavors and secondary market success. Embrace the diligence, lean on experienced advisors, and maintain transparent communication with stakeholders. In doing so, you will transform the promise of Reg A+ into tangible growth capital, propelling your company toward its next phase of innovation and market leadership.