Exploring Regulation A+: A Gateway to Scalable Public Offerings

For entrepreneurs and small businesses seeking to raise significant capital without the burdensome cost and complexity of a traditional initial public offering, Regulation A+ represents a powerful lifeline. As an exemption under the JOBS Act, Reg A+ enables companies to offer and sell up to $75 million of securities to both accredited and non-accredited investors in a single 12-month period. Gone are the days when only Fortune 500 firms could access public markets; today, startups, growth-stage companies, and even established family businesses can tap into a broader pool of backers while benefiting from streamlined SEC requirements. Unlike full registration with the Securities and Exchange Commission, Reg A+ offers a balance of reduced legal hurdles and robust investor protections, making it an attractive alternative for issuers who need capital to accelerate product development, expand into new markets, or fund strategic acquisitions.

Since its expansion in 2015, Regulation A+ has reshaped how capital formation unfolds in the United States. Issuers leverage Tier 1 and Tier 2 structures to target offerings that suit their scale—Tier 1 supporting up to $20 million and Tier 2 up to $75 million per year. These tiers not only differ in offering limits but also in disclosure obligations, state-level review requirements, and ongoing reporting standards. For founders and their advisors, understanding these nuances is critical to crafting a successful campaign that meets compliance thresholds and resonates with prospective investors. At the same time, investors gain access to emerging ventures with the transparency of periodic financial statements and the liquidity potential that public market trading can provide. This comprehensive beginner’s guide unpacks every facet of Regulation A+, from eligibility criteria and tier selection to marketing strategies, fee structures, and post-offering responsibilities. Whether you are a first-time issuer evaluating capital-raising options or a curious investor exploring alternative asset classes, you will discover practical insights, real-world examples, and step-by-step recommendations. By the end of this article, you’ll possess the clarity and confidence to navigate Reg A+ offerings—transforming your fundraising ambitions into tangible milestones and fueling the next wave of American innovation.

Origins and Objectives of Regulation A+

Regulation A long predated the JOBS Act, originating in the 1930s as a modest securities exemption for smaller issuers. However, the original framework saw limited use due to restrictive offering caps and inconsistent state-level regulations. The JOBS Act of 2012 breathed new life into this exemption by launching Regulation A+, significantly increasing offering limits and creating two distinct tiers designed to accommodate diverse issuer needs. The overarching objective of Reg A+ is to democratize access to capital markets for growing businesses while preserving investor safeguards. By preempting state blue-sky laws for Tier 2 offerings and standardizing disclosure requirements, the SEC has fostered a more efficient, cost-effective fundraising ecosystem without compromising on transparency or regulatory oversight.

Distinguishing Tier 1 and Tier 2 Offerings

At the heart of Regulation A+ lie its two tiers—each tailored to different scales of capital raising. Tier 1 permits offerings up to $20 million in a 12-month period, with both SEC review and state securities law compliance required. This dual review process can slow down timetables for registration but offers greater flexibility for smaller deals. In contrast, Tier 2 allows issuers to raise up to $75 million and preempts state-level filing requirements, streamlining access to a national investor base. However, Tier 2 issuers must provide audited financial statements, adhere to ongoing reporting obligations (including annual, semiannual, and current event filings), and fulfill investor resale restrictions. By weighing these trade-offs—regulatory speed versus reporting rigor—companies can select the tier that best aligns with their growth trajectory and resource capabilities.

Eligibility and Suitability for Issuers

Not every company is suited for a Regulation A+ campaign. To qualify, the issuer must be a U.S. or Canadian entity that is not already a SEC-reporting company and has no disqualified affiliates or executive officers. Additionally, certain industries—such as investment companies, crypto-token ventures lacking clear asset backing, and issuers engaging in continuous solicited offerings—may face additional SEC scrutiny or even outright ineligibility. Founders must evaluate their readiness to meet disclosure standards, fund offering costs, and manage investor relations post-closing. Generally, startups with proven revenue streams or established businesses looking to expand are ideal candidates, as Reg A+ investors often seek both growth potential and demonstrable financial performance.

Offering Structure and Securities Selection

Under Regulation A+, issuers can offer a variety of securities—common stock, preferred shares, debt instruments, units combining stock and warrants, or convertible notes. The chosen security type influences valuation mechanics, investor rights, and future fundraising dynamics. For instance, preferred equity can grant investors liquidation preferences or dividend rights, enhancing attractiveness at higher funding targets but adding complexity to governance structures. Convertible notes may accelerate issuance but introduce potential dilution during conversion events. Crafting a security structure that balances issuer control, investor appeal, and regulatory clarity is a cornerstone of a successful Reg A+ strategy. Founders often collaborate with securities counsel to ensure that subscription agreements, offering circulars, and shareholders’ agreements are meticulously drafted and aligned with long-term business objectives.

Crafting the Offering Circular and SEC Review Process

The offering circular—filed as Form 8-A for Tier 1 or Form 1-A for Tier 2—is the linchpin document that educates investors about the business, financials, and risks. It must include a detailed business description, management biographies, capitalization tables, use-of-proceeds breakdowns, financial statements (reviewed or audited based on tier), and a comprehensive risk factor section. For Tier 1, state blue-sky reviews across multiple jurisdictions can extend the timeline, whereas Tier 2’s preemption of state laws expedites access to a coast-to-coast investor base. The SEC review process typically involves rounds of comments, where regulators request clarifications or additional disclosures. Founders should prepare for this back-and-forth, allocating sufficient time—often three to six months—for draft revisions, legal counsel coordination, and final blue sheets clearance. A well-prepared offering circular minimizes SEC comments and speeds up qualification.

Marketing and “Testing the Waters” Opportunities

One of the most compelling aspects of Regulation A+ is the ability to conduct “testing the waters” communications. Before filing the offering circular, issuers can gauge investor interest through broad solicitations—webinars, email blasts, social media posts—provided they include required disclaimers and clearly distinguish marketing materials from the formal offering documents. This pre-filing engagement gives valuable feedback on valuation expectations, market appetite, and campaign messaging. Once the offering circular is filed, general solicitation is permitted under Reg A+, allowing issuers to advertise nationally without fear of rule violations. Founders should execute a coordinated marketing plan—leveraging PR, digital advertising, influencer partnerships, and investor roadshows—to build momentum and establish a robust pre-order pipeline ahead of the qualification date.

Fees, Expenses, and Cost Management

While Regulation A+ reduces certain SEC registration expenses compared to a full IPO, founders must budget for a variety of costs. Legal fees—covering securities counsel, state blue-sky filings (for Tier 1), and SEC comment responses—can range from $100,000 to $200,000, depending on complexity. Accounting fees for financial statement reviews or audits typically add another $50,000 to $100,000. Marketing expenditures—outsourced PR, content creation, and digital campaigns—vary widely but often account for 5 to 10 percent of the target raise. Platform and broker-dealer fees, if utilized, may include subscription charges or percentage-based commissions. Effective cost management involves negotiating fixed fees with service providers, prioritizing must-have marketing channels, and leveraging in-house resources for outreach. Transparent budgeting not only preserves net proceeds but also demonstrates financial discipline to prospective investors.

Investor Protections and Disclosure Safeguards

While offering access to a wider audience, Regulation A+ mandates robust investor protections. Tier 2 issuers—especially—must furnish audited financial statements and adhere to ongoing reporting requirements, including annual Form 1-K, semi-annual Form 1-SA, and current event Form 1-U filings. These disclosures ensure investors receive timely updates on operating performance, material developments, and potential challenges. Reg A+ also imposes limits on non-accredited investor participation when offerings exceed $20 million, capping individual investment amounts to mitigate concentration risk. By embedding these safeguards into the offering structure and maintaining transparent communication channels—investor portals, regular webinars, and email newsletters—issuers cultivate trust and reduce the likelihood of future disputes or liability claims.

Liquidity, Secondary Markets, and Exit Horizons

A distinct advantage of Regulation A+ is the potential for securities to trade on public markets once qualified. Tier 2 offerings often list on alternative trading systems or secondary exchanges, granting investors liquidity options absent in traditional private raises. Although initial trading volumes can be modest, establishing a trading market enhances valuation discovery and attracts follow-on institutional interest. Founders should consider market maker arrangements and ticker symbol selection early in the process to ensure smooth post-qualification trading. Exit strategies—such as strategic acquisitions, IPOs, or tender offers—should be articulated in the offering circular, providing investors with a clear understanding of potential liquidity events. By setting realistic exit horizons and actively supporting secondary market development, issuers reinforce investor confidence and broaden their capital-raising toolkit.

Steps to Launching a Regulation A+ Offering

Launching a successful Reg A+ campaign entails a multi-phase roadmap. First, conduct a readiness assessment—ensuring organizational structure, financial controls, and governance practices meet public offering standards. Next, assemble a team of securities counsel, auditors, and marketing professionals to draft the offering circular and prepare financial statements. Engage in “testing the waters” to refine messaging and gauge investor demand. File the offering statement with the SEC and address regulator comments promptly. Once qualified, execute a coordinated marketing blitz—utilizing both digital and traditional channels—while preparing internal systems for subscription processing and investor onboarding. After the offering’s close, file the Form 8-A or 1-AU, facilitate share issuance, and initiate ongoing reporting and investor relations programs. Each phase demands careful project management, clear communication, and cross-functional collaboration.

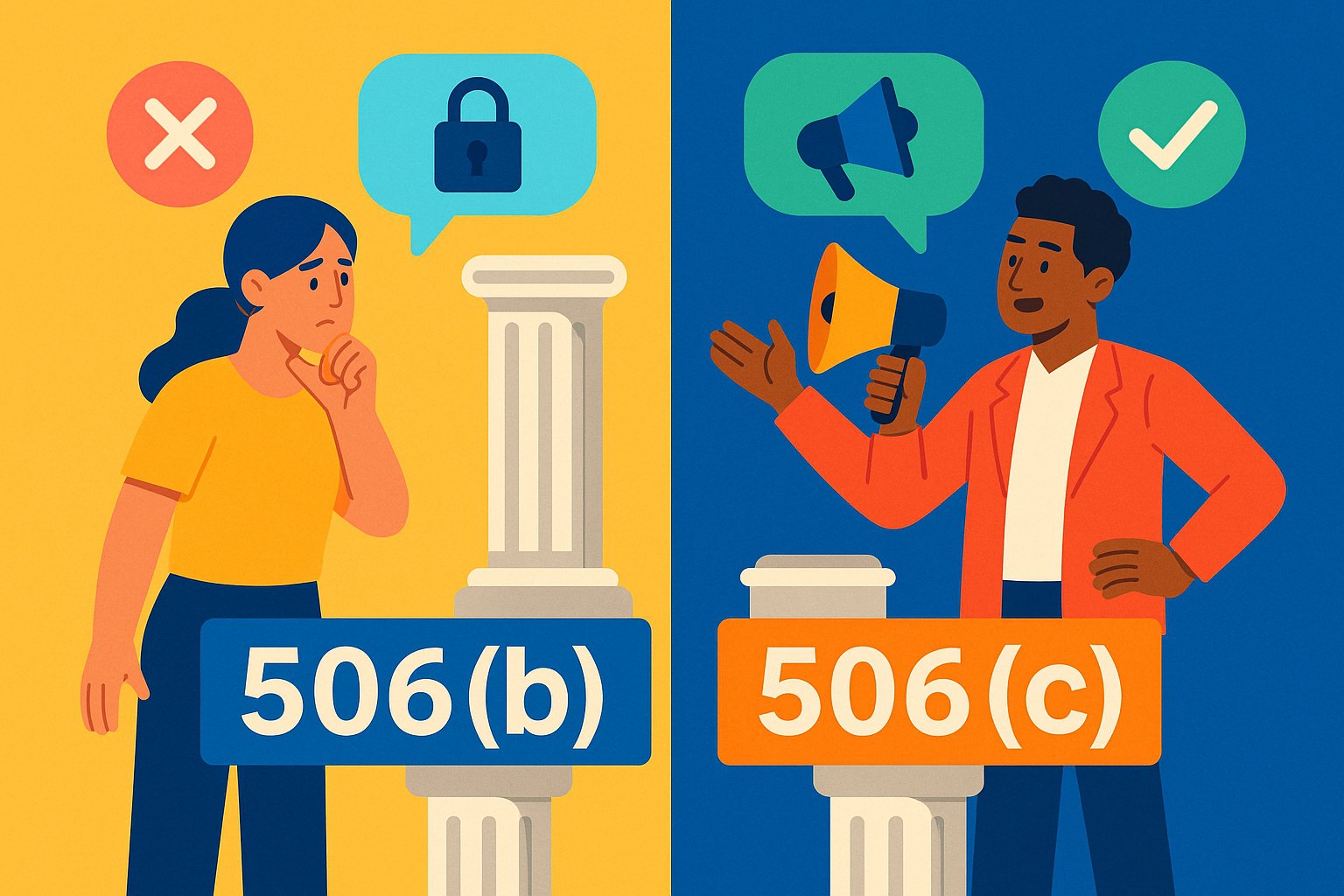

Comparing Regulation A+ to Traditional IPOs and Other Exemptions

Regulation A+ offers a hybrid path between private offerings and full-fledged IPOs. Unlike an IPO, Reg A+ does not require extensive SEC registration documents, roadshows for institutional investors, or adherence to exchange listing standards. Time to market is often shorter—typically six to nine months versus a year or more for an IPO. However, Reg A+ issuers forgo the prestige of major exchange listings and may face lower initial liquidity. Compared to private placements under Reg D, Reg A+ invites participation from non-accredited investors and employs more rigorous disclosure standards. Founders evaluating capital raising options should contrast Reg A+ against Reg D Rule 506(c), Reg CF, and crowdfunding portals—balancing investor reach, compliance burdens, and cost structures.

Emerging Trends and the Future of Regulation A+

Looking ahead, Regulation A+ is poised for continued evolution. Technological integrations—blockchain-based cap table management, AI-driven due diligence tools, and tokenized securities—promise to streamline compliance and democratize access further. Discussions around raising offering limits, harmonizing state-level reviews, and expanding international interoperability suggest a more fluid global capital market in the coming years. Issuers who embrace these advancements early—experimenting with digital asset platforms or engaging hybrid funding models—will set themselves apart as pioneers in the next generation of public offerings. For investors, greater standardization of data reporting and liquidity mechanisms will enhance transparency and broaden the appeal of Reg A+ investments across portfolios.

Charting Your Course with Regulation A+

Regulation A+ has opened a new frontier for capital formation, bridging the gap between private fundraising and public markets. By mastering its tiers, eligibility criteria, disclosure mandates, and marketing levers, founders can orchestrate high-impact offerings that attract diverse investor bases. While the path demands rigorous compliance, thoughtful structuring, and strategic outreach, the payoff is transformative access to growth capital and an engaged community of supporters. As the capital markets landscape continues to innovate, Regulation A+ stands as a confirmation to the power of regulatory reform in fueling entrepreneurial ambition. Armed with this beginner’s guide, you are now ready to chart your course, harness Reg A+ effectively, and propel your venture toward its full potential.