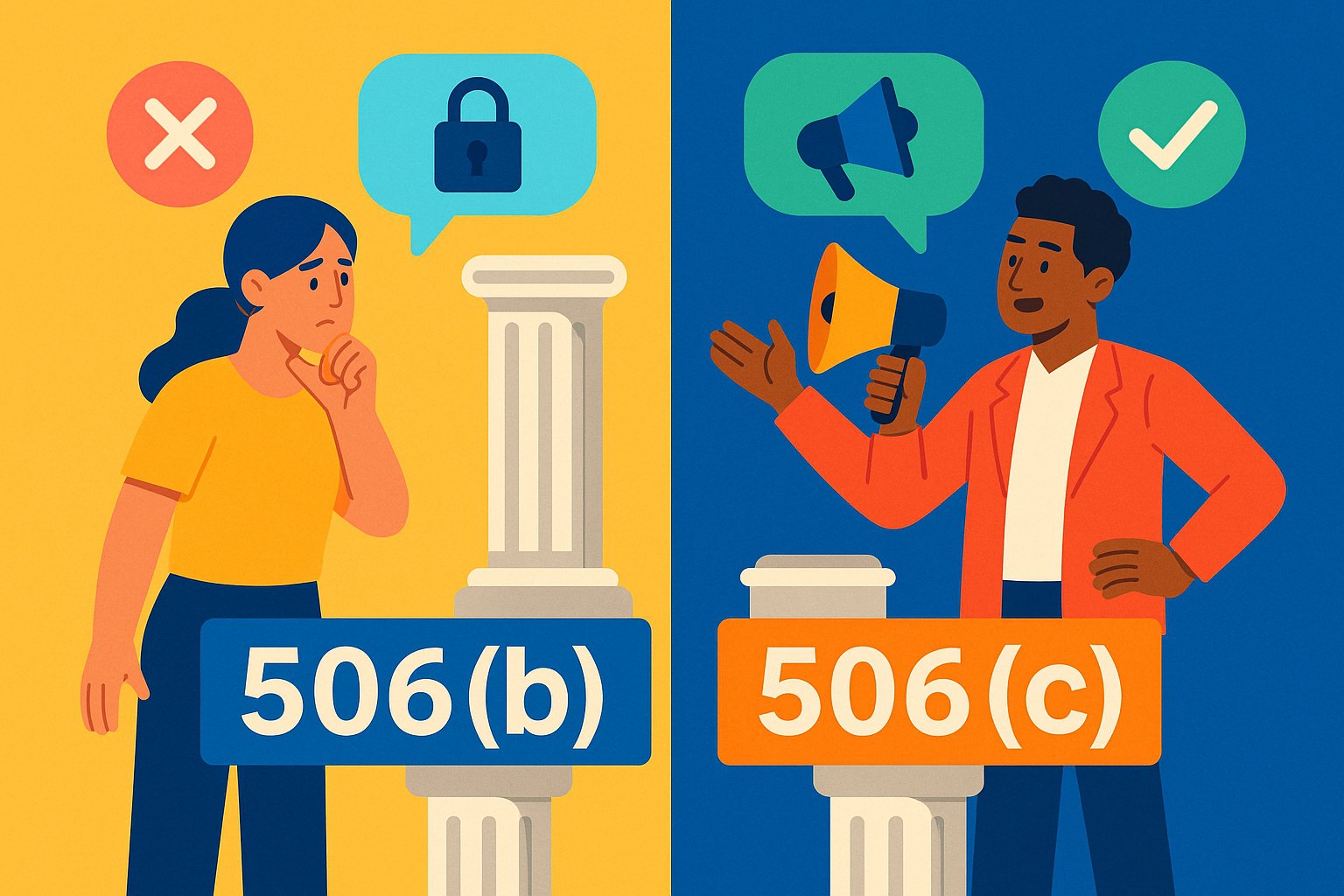

Setting the Stage: Regulation D’s Two Gateways

When founders seek to raise capital beyond the confines of Regulation Crowdfunding, Regulation D offers a proven roadmap for private offerings. Within this framework, Rules 506(b) and 506(c) stand out as the most frequently used exemptions, each unlocking distinct advantages—and potential drawbacks—for issuers. At its core, both provisions permit companies to solicit investments from accredited investors without registering with the SEC, streamlining compliance hurdles and enabling faster access to vital growth capital. Yet the devil lies in the details: Rule 506(b) prohibits general solicitation but allows non-accredited investors under strict suitability requirements, while Rule 506(c) permits broad advertising yet limits participation exclusively to verified accredited investors. Understanding which pathway aligns with your fundraising goals, investor network, and marketing strategy is critical. In this immersive exploration, we’ll journey through the origins, mechanics, and real-world applications of both Rules 506(b) and 506(c), arming entrepreneurs with the insights needed to choose wisely and execute a compliant, effective private placement.

Origins and Evolution: The History Behind 506(b) and 506(c)

The origins of Regulation D trace back to 1982, when the SEC introduced a set of exemptions intended to reduce barriers for smaller companies seeking private capital. Rule 506(b) became the flagship exemption, offering a safe harbor for issuers to raise unlimited amounts from accredited investors—and up to 35 sophisticated non-accredited investors—without extensive registration. For decades, 506(b) dominated private placements, driven by its flexibility to include friends, family, and business associates as investors. But the landscape shifted in 2012 with the passage of the Jumpstart Our Business Startups (JOBS) Act. Among its many innovations, the JOBS Act authorized general solicitation for certain offerings, leading the SEC to adopt Rule 506(c) in 2013. This new provision ushered in a modern era of online private placements, enabling broad advertising to accredited investors while imposing rigorous accreditation verification requirements. The evolution from a strictly private model to a hybrid public-private approach reflects the regulatory balancing act between capital formation and investor protection.

Accredited Investors: Who Can Participate?

A cornerstone of both Rule 506(b) and 506(c) is the concept of the accredited investor—a status defined by income, net worth, or professional credentials. Accredited investors include individuals with annual incomes exceeding $200,000 (or $300,000 jointly with a spouse) for the past two years, or net worth above $1 million excluding primary residence. Entities such as banks, trusts, and venture funds also qualify under certain conditions. Under 506(b), issuers may include up to 35 non-accredited investors who possess sufficient knowledge or experience in financial matters to evaluate the risks and merits of the investment. These investors must demonstrate sophistication, either through prior investment experience or professional expertise, but do not have to meet the stringent accredited thresholds. Conversely, Rule 506(c) restricts participation exclusively to accredited investors, with no allowance for non-accredited individuals regardless of sophistication. For companies with limited networks of wealthy individuals, 506(c) can streamline eligibility; for those with dedicated early supporters who are not accredited, 506(b) may remain the preferable route.

Solicitation Spectrum: Navigating the General Solicitation Rules

General solicitation encompasses any form of public communication—online ads, email blasts to unverified lists, social media posts, or press releases—designed to attract potential investors. Under Rule 506(b), issuers must rely on pre-existing relationships to market their offerings, meaning they cannot advertise broadly or solicit strangers through public channels. This constraint preserves the private nature of the offering but limits outreach to embedded networks—friends, family, angel groups, or professional contacts. Rule 506(c), by contrast, embraces general solicitation as a tool for capital formation. Startups may run targeted ad campaigns, publish RFIs on crowdfunding portals, or host public webinars to drum up interest. However, this broader marketing license carries the weighty obligation to verify each investor’s accredited status before accepting funds. The choice between a closed marketing approach and a public-facing campaign hinges on a company’s existing network, branding strategy, and willingness to invest in verification processes.

Disclosure Demands: Documentation and Reporting Essentials

Regardless of exemption, both Rule 506(b) and Rule 506(c) demand strict adherence to anti-fraud provisions under Section 10(b) of the Securities Exchange Act and Rule 506(c)’s own requirements. Issuers must provide investors with full and fair disclosures concerning material facts, ensuring that all statements in offering materials—pitch decks, private placement memoranda, subscription agreements—are truthful and non-misleading. Under 506(b), when non-accredited investors participate, the SEC mandates delivery of financial statements: for smaller raises up to $107,000, issuer-certified statements suffice; larger raises require reviewed or audited financials. Rule 506(c) offerings typically involve only accredited investors and therefore often avoid the financial statement requirement, though many issuers elect to provide them voluntarily to enhance credibility. In both cases, meticulous record-keeping of investor communications, subscription documents, and verification procedures is essential. Well-structured documentation not only facilitates a smooth closing but also shields the offering from potential SEC scrutiny.

Safeguarding Investors: Anti-Fraud and Suitability Considerations

Investor protection lies at the heart of securities regulation, and both 506(b) and 506(c) offerings are subject to rigorous anti-fraud rules. Issuers must refrain from misrepresentations or omissions of material information, and they must ensure that advertising claims—especially under 506(c)’s general solicitation—do not overstate potential returns or underplay risks. In 506(b) offerings involving non-accredited investors, issuers have an added duty to verify that each participant possesses sufficient financial sophistication to understand the speculative nature of private equity investments. This suitability assessment may involve questionnaires, documented interviews, or third-party certifications. Rule 506(c) transfers this burden to investor accreditation: by verifying income or net worth, issuers implicitly confirm a baseline financial capacity. Nonetheless, the suitability of the investment for each individual—considering their broader portfolio and liquidity needs—remains a best practice rather than a strict requirement. Transparent risk disclosures and clear investor communications are vital strategies for meeting both regulatory and ethical obligations.

Marketing Mechanics: Crafting Your Fundraising Strategy

A successful private placement begins with a targeted marketing playbook that aligns with your chosen exemption. Under 506(b), relationship-driven outreach demands careful mapping of your current network: alumni groups, industry associations, previous investors, or advisory board members. Personalized email campaigns, private invitation events, and one-on-one coffee meetings become the backbone of your fundraising effort. You’ll need to balance exclusivity—maintaining the private nature of your offering—with momentum, ensuring that enthusiasm spreads organically through referrals. Under 506(c), you can harness digital advertising strategies: pay-per-click campaigns on Google or LinkedIn, sponsored content on industry blogs, or promoted posts on social media. Each channel can direct traffic to a compliant portal or investor sign-up page, where your accreditation verification protocol kicks in. While 506(c) offers broader reach, it also requires investment in marketing budgets and verification infrastructure. Your choice of strategy should reflect both the depth of your network and the breadth of audiences you can realistically engage.

Cost and Complexity: Weighing Expenses and Administrative Burdens

Choosing between 506(b) and 506(c) inevitably involves a trade-off between compliance costs and fundraising potential. Rule 506(b) campaigns often incur lower direct expenses, relying primarily on legal fees for drafting a private placement memorandum, subscription agreements, and conducting financial reviews. The absence of general solicitation reduces marketing budgets but increases time spent on personalized outreach and follow-up. Rule 506(c) offerings, by permitting broad advertising, may demand substantial marketing investments—agency fees, advertising buys, content creation—and incur additional costs for third-party accreditation verification services. Some issuers engage specialized platforms that streamline 506(c) processes, bundling marketing, verification, and documentation into a single package at a premium. Furthermore, 506(c) campaigns may close more quickly due to wider awareness, justifying higher upfront costs. Startups must weigh these financial factors against their capital targets and time sensitivity: a lean operation with a strong insider network may favor 506(b), while a growth-stage company seeking rapid scale could justify a 506(c) spend.

Strategic Selection: Aligning Your Offering with Business Goals

The optimal choice between 506(b) and 506(c) hinges on your company’s unique context. For pre-revenue startups still iterating product-market fit, a 506(b) offering can lock in supportive insiders—mentors, early adopters, and passionate advocates—while maintaining control over investor mix and messaging. The intimacy of a private rollout fosters trust and secures early feedback. In contrast, companies with proven traction, robust branding, and aggressive growth ambitions may leverage 506(c) to spotlight their offering across broader market segments. Technology firms with viral hooks or consumer products with mass appeal can transform general solicitation into a potent customer-cum-investor acquisition tool. Additionally, 506(c) may prove advantageous for companies located in regions with limited high-net-worth networks; by tapping the global pool of accredited investors, they can overcome local fundraising constraints. Ultimately, your strategic aim—be it community building, rapid scale, or targeted investor curation—should guide your selection of the appropriate Reg D pathway.

Real-World Scenarios: Case Studies in 506(b) and 506(c) Success

Consider a biotech startup that initially raised $1.2 million under Rule 506(b) from a consortium of medical researchers, family offices, and healthcare professionals. By maintaining a private circle of sophisticated investors, the company secured critical domain expertise and established a board of advisors that accelerated its clinical trials. When it was time for a larger raise, the same firm transitioned to a Rule 506(c) campaign, drawing on public outreach to accredited investors interested in biotech innovation. The result was a rapid $4 million follow-on round, funded within weeks of launch. In another example, a consumer-facing app with strong social media presence bypassed 506(b) entirely, opting for a 506(c) offering that harnessed targeted Facebook and Instagram ads. Although the marketing spend was significant, the broad solicitation yielded an infusion of capital that fueled an aggressive user-acquisition push, propelling the app into the top charts within months. These case studies illustrate how each exemption can serve distinct stages of a company’s journey.

Common Pitfalls: Avoiding Regulatory Missteps

Even seasoned issuers can stumble when navigating Reg D nuances. One frequent error in 506(b) offerings is inadvertently engaging in general solicitation—sharing offering materials on LinkedIn or pitching to cold outreach lists—thereby jeopardizing the exemption and exposing the company to potential SEC enforcement. Conversely, some 506(c) issuers underestimate the rigor of accredited verification, accepting self-certifications without proper documentation, which can invalidate the entire offering. Another pitfall arises when issuers fail to update investor lists: investors who qualified at the time of investment may lose accredited status in subsequent rounds, complicating follow-on raises. To avoid these traps, engage counsel familiar with Reg D nuances, implement robust internal controls—such as standardized verification checklists—and conduct periodic compliance audits. Vigilance in process and documentation not only safeguards your exemption but also signals credibility to sophisticated investors.

The Future Outlook: Evolving Crowdfunding and Reg D’s Role

The private capital market continues to evolve in response to technological innovation and regulatory reform. Crowdfunding portals and digital platforms increasingly integrate Reg D offerings alongside Reg CF and Reg A+, creating seamless investor experiences across exemption types. Blockchain-based tokenization trials promise to democratize private placement liquidity, potentially reshaping how Reg D securities trade in secondary markets. Meanwhile, the SEC has signaled interest in refining accredited investor definitions and modernizing solicitation rules to reflect today’s digital realities. For issuers, staying abreast of these developments is critical: emerging trends may influence the relative attractiveness of 506(b) versus 506(c), reshape marketing strategies, or introduce new compliance requirements. By cultivating a mindset of continuous learning and adaptive strategy, founders can position their companies—whether pre-seed ventures or growth-stage enterprises—to leverage Reg D’s full potential in a dynamic funding landscape.

Making the Choice: A Step-by-Step Decision Framework

To determine whether Rule 506(b) or 506(c) best suits your offering, begin by mapping your existing investor network and assessing its accredited composition. If a substantial portion of your contacts are non-accredited yet financially sophisticated, 506(b) may prove optimal. Next, evaluate your marketing ambitions: are you prepared to invest in broad outreach campaigns and accreditation services, or do you prefer a heavily relationship-driven approach? Factor in your timeline—506(c) often accelerates deal closure through publicity—versus the deliberate pace of private solicitation. Analyze the costs: legal fees, financial statement requirements, marketing budgets, and verification services. Finally, align these practical considerations with your strategic goals: community building, rapid scaling, investor quality, and exit pathways. By systematically scoring each dimension, you arrive at an evidence-based decision that harmonizes regulatory compliance with fundraising efficacy.

Charting Your Course: Next Steps for Your Reg D Offering

Armed with an in-depth understanding of Rules 506(b) and 506(c), you are equipped to architect a private placement that balances agility, compliance, and strategic reach. Your next steps involve selecting experienced legal counsel to draft or review offering documents, choosing a secure platform or placement agent that accommodates your chosen exemption, and building a comprehensive marketing and verification plan. Develop a project timeline that sequences document preparation, investor outreach, verification protocols, and closing workflows. Equip your team with training on anti-fraud rules and investor communication best practices. As you embark on this journey, view your Reg D offering not merely as a capital-raising event but as an opportunity to forge lasting relationships with investors who will champion your mission. By making an informed choice between 506(b) and 506(c), you lay the groundwork for a compliant, efficient, and resonant private offering—one that propels your company toward its next milestone and establishes a robust foundation for future growth.