Embracing a New Chapter in Startup Funding

Equity crowdfunding has revolutionized the way entrepreneurs secure capital, opening doors once reserved for venture capitalists and angel investors. This model invites a broad base of backers to purchase shares in a company, aligning their success with the venture’s growth. From dynamic tech startups to creative small businesses, founders harness this approach to build communities of passionate supporters who are invested both financially and emotionally. By democratizing access to equity, campaigns can capture momentum early, translate consumer interest into funding, and amplify marketing efforts through backer advocacy. Yet, as with any innovative financial tool, equity crowdfunding carries both promising advantages and critical considerations—decisions that shape not only your cap table but the company’s trajectory and long-term relationships.

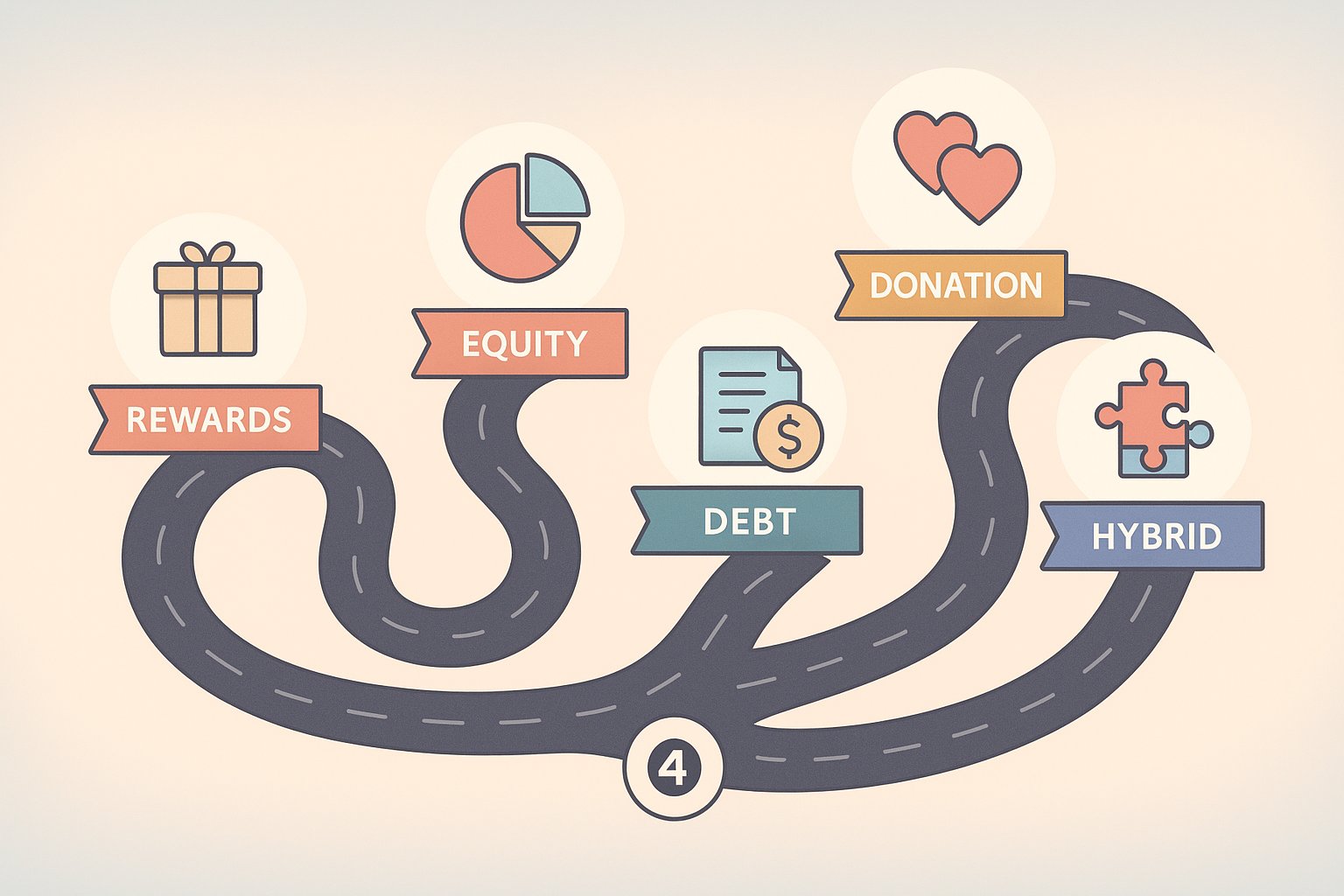

Understanding the Mechanics of Equity Crowdfunding

At its core, equity crowdfunding transforms supporters into stakeholders by offering ownership shares in exchange for investment. Unlike reward-based campaigns that deliver products or experiences, this method involves issuing securities governed by regulatory frameworks such as the SEC’s Regulation Crowdfunding in the United States or similar provisions abroad. Platforms like SeedInvest, Wefunder, and Republic facilitate the entire process, from due diligence and investor accreditation to share issuance and compliance reporting. Founders craft pitch materials—financial projections, business plans, and engaging videos—to persuade prospective investors, often leveraging social proof and milestone updates to build trust. The campaign structure typically includes minimum funding thresholds and tiered investor incentives, requiring clear communication and strategic marketing to reach funding goals.

The Upside of Collective Ownership

One of the most compelling benefits of equity crowdfunding lies in community building. When backers become shareholders, they gain a vested interest in your company’s performance. This sense of ownership fuels organic word-of-mouth promotion, as investors share campaign updates and future milestones within their networks. Early adopters often evolve into brand ambassadors, providing invaluable feedback on product design, user experience, and market fit. Such engaged backers can drive referrals, generate press coverage, and even participate in beta testing or advisory roles. The resulting loyalty can endure beyond a single funding round, forming a ready-made audience for subsequent launches or product enhancements. In essence, equity crowdfunding weaves a support network directly into your growth strategy.

Lowering Barriers to Capital

Traditional financing routes often impose high entry barriers, demanding proven track records, collateral, or extensive business history. Equity crowdfunding lowers these hurdles, enabling startups with innovative ideas but limited operating history to attract meaningful investment. By presenting a compelling story and demonstrating market potential, founders can tap into a diverse investor pool that spans friends and family, accredited investors, and retail participants. This broad base can accumulate significant funding, sometimes exceeding six- or seven-figure thresholds, without resorting to expensive debt or relinquishing large stakes to a single backer. For ventures operating in niche markets—such as sustainable products or social enterprises—crowdfunding offers a tailored path to capital that resonates with mission-driven supporters.

Enhancing Brand Credibility Through Due Diligence

Leading equity crowdfunding platforms conduct rigorous vetting processes to protect investors and maintain reputation. This due diligence examines financial statements, legal standing, and market viability, ensuring that only credible campaigns reach the fundraising stage. For founders, this vetting process becomes a badge of legitimacy—endorsements that can attract press attention, strategic partners, and additional funding sources. Platforms often provide coaching on pitch refinement, compliance best practices, and marketing strategies, equipping entrepreneurs with valuable resources that extend beyond mere fundraising. The transparency required throughout the campaign—regular updates, financial disclosures, and investor Q&A sessions—further builds trust in the marketplace, differentiating your venture from less vetted funding options.

Forging Long-Term Partnerships with Investors

Equity crowdfunding fosters relationships that extend well past the final pledge. Investors hold a genuine stake in your success, creating a collaborative dynamic akin to traditional shareholders but on a more personal scale. This network can open doors to new opportunities, such as strategic partnerships, supplier introductions, or even follow-on funding through angel groups and venture funds impressed by your campaign performance. The collective wisdom of diverse backers—ranging from domain experts to passionate customers—enriches decision-making and uncovers blind spots often overlooked by smaller founding teams. When managed effectively, this investor community becomes an ongoing source of innovation, advocacy, and resilience, providing both capital and invaluable insights as your company scales.

The Dilution Dilemma: Sharing Equity

While democratizing ownership offers many perks, it inevitably dilutes existing shareholders’ stakes. Founders must grapple with the fact that issuing new shares reduces their percentage of control and future upside. In early funding rounds, this dilution may seem manageable, but successive rounds can significantly erode founder equity—especially if valuations don’t increase as anticipated. Moreover, a cap table crowded with numerous small investors can complicate decision-making processes, requiring additional coordination for major corporate actions. To strike the right balance, founders must carefully model dilution scenarios, set clear funding targets, and consider employing mechanisms such as dual-class share structures or minimum investment thresholds to maintain control of key decisions.

Navigating Regulatory Complexity

Equity crowdfunding operates within stringent legal and regulatory frameworks, varying by jurisdiction. In the United States, Regulation Crowdfunding caps individual investments based on income levels and mandates detailed disclosures, annual reports, and ongoing communication with shareholders. Non-compliance can result in hefty fines, legal challenges, and campaign shutdowns. International campaigns face even more complexity, juggling cross-border securities laws, tax implications, and platform-specific requirements. While platforms streamline much of this compliance burden—handling documentation, accreditation checks, and filings—founders cannot remain passive. Engaging experienced legal counsel, establishing robust record-keeping practices, and adhering to investor relations protocols are vital steps to safeguard both your campaign and your company’s reputation.

The Reporting Burden and Investor Relations

Once your campaign closes, the responsibilities of equity crowdfunding shift to investor management. Shareholders expect transparent, timely updates on financial performance, product development, and strategic milestones. This ongoing reporting obligation demands a structured communication cadence—quarterly letters, annual financial statements, and ad hoc announcements for material events. While this transparency builds trust, it also consumes time and resources, particularly for small teams without dedicated investor relations staff. Founders must develop streamlined processes—leveraging CRM tools, investor portals, or automated email sequences—to manage inquiries, collect shareholder feedback, and fulfill regulatory reporting. Balancing these obligations with core business operations is essential to maintain momentum and positive investor sentiment.

Facing Market Saturation and Competitive Campaigns

The rapid growth of equity crowdfunding has led to a more crowded fundraising landscape. As platforms onboard increasing numbers of campaigns, standing out requires innovative marketing strategies and compelling narratives. Founders must invest in pre-launch buzz, social media engagement, and influencer partnerships to capture investor attention amid fierce competition. Campaign timing also plays a role; launching during peak market activity can boost visibility but risks being overshadowed by larger, hyped projects. To differentiate your campaign, focus on clear value propositions—demonstrating product-market fit, showcasing real-world traction, and highlighting unique team expertise. Ultimately, success hinges on blending persuasive storytelling with data-driven marketing, ensuring that your equity offer resonates in a sea of alternatives.

Preparing for Possible Downturns and Exit Challenges

Equity crowdfunding aligns backer returns with company exits—acquisitions, mergers, or public offerings. However, startups face significant hurdles in achieving liquidity events, and many ventures remain privately held for years or indefinitely. When exits stall, early investors may feel trapped, eroding community goodwill and complicating future fundraising efforts. Founders must set realistic expectations from the outset—educating investors on typical timelines, potential exit paths, and contingency plans for lower-than-expected outcomes. Transparent dialogue around challenges, pivots, or strategic shifts fosters understanding and long-term support. In some cases, companies explore share buybacks or secondary market arrangements to provide partial liquidity, but these options require additional legal and financial structuring.

Aligning Equity Crowdfunding with Your Growth Strategy

Equity crowdfunding is not a one-size-fits-all solution; its suitability depends on your business model, industry dynamics, and strategic ambitions. High-growth technology ventures may leverage equity campaigns to unlock significant capital and tap into tech-savvy investor communities. Conversely, niche consumer brands or social enterprises might prioritize community alignment and advocacy over rapid scaling, making equity crowdfunding a natural match. Before launching, conduct scenario modeling—projecting funding needs, dilution impact, and investor engagement metrics—to assess alignment with long-term objectives. Engage advisors who have navigated similar campaigns and solicit feedback from potential backers through pilot surveys or focus groups. Such preparatory work ensures that your campaign resonates authentically and drives outcomes aligned with your vision.

Charting Your Course Through Equity Crowdfunding

Equity crowdfunding presents a powerful avenue to secure funding, build an engaged community, and validate market demand. The promise of collective ownership, enhanced brand credibility, and broadened investor networks can propel ventures to new heights. Yet these benefits arrive alongside important trade-offs: dilution of control, regulatory complexity, reporting burdens, and the discipline to maintain transparent investor relations. By carefully weighing these pros and cons—modeling cap-table scenarios, partnering with reputable platforms, and orchestrating strategic marketing—you equip your venture to harness equity crowdfunding’s full potential. As you step into this democratized funding frontier, embrace both the opportunities and responsibilities it offers, steering your company toward sustainable growth and lasting stakeholder confidence.