Empowering Innovation Through Collective Investment

In a world where groundbreaking startups and disruptive technologies emerge at breakneck speed, securing traditional venture capital can feel like scaling an insurmountable fortress. Enter equity crowdfunding—a democratized gateway that opens the doors of investment to founders and investors alike. By blending the energy of community-driven engagement with rigorous financial structures, equity crowdfunding transforms the funding landscape. Founders gain access to vital capital without surrendering total control to a handful of venture capitalists, while everyday investors can participate in early-stage opportunities once reserved for the elite. This model thrives on transparency and collaboration. Founders present their vision through compelling pitch materials, inviting a broad audience to evaluate, invest, and become ambassadors for the brand. Investors, in turn, diversify their portfolios by backing promising ventures at an early stage, with the potential for high returns if the startup scales successfully. But this synergy comes with its own set of rules, regulations, and strategic considerations. Navigating the legal frameworks, crafting an irresistible campaign narrative, balancing dilution concerns, and maintaining investor relations demand a deft touch. Whether you are a visionary entrepreneur ready to scale your dream or a discerning investor hunting for the next big disruptor, understanding equity crowdfunding is essential. In this comprehensive guide, we’ll explore the mechanics of equity crowdfunding, weigh its advantages and challenges for both founders and investors, dive into regulatory landscapes, and share best practices to help you launch or join a campaign with confidence. Prepare to unlock the power of collective investment and discover how equity crowdfunding might be the catalyst that propels your venture from concept to market domination.

What Is Equity Crowdfunding and Why It Matters

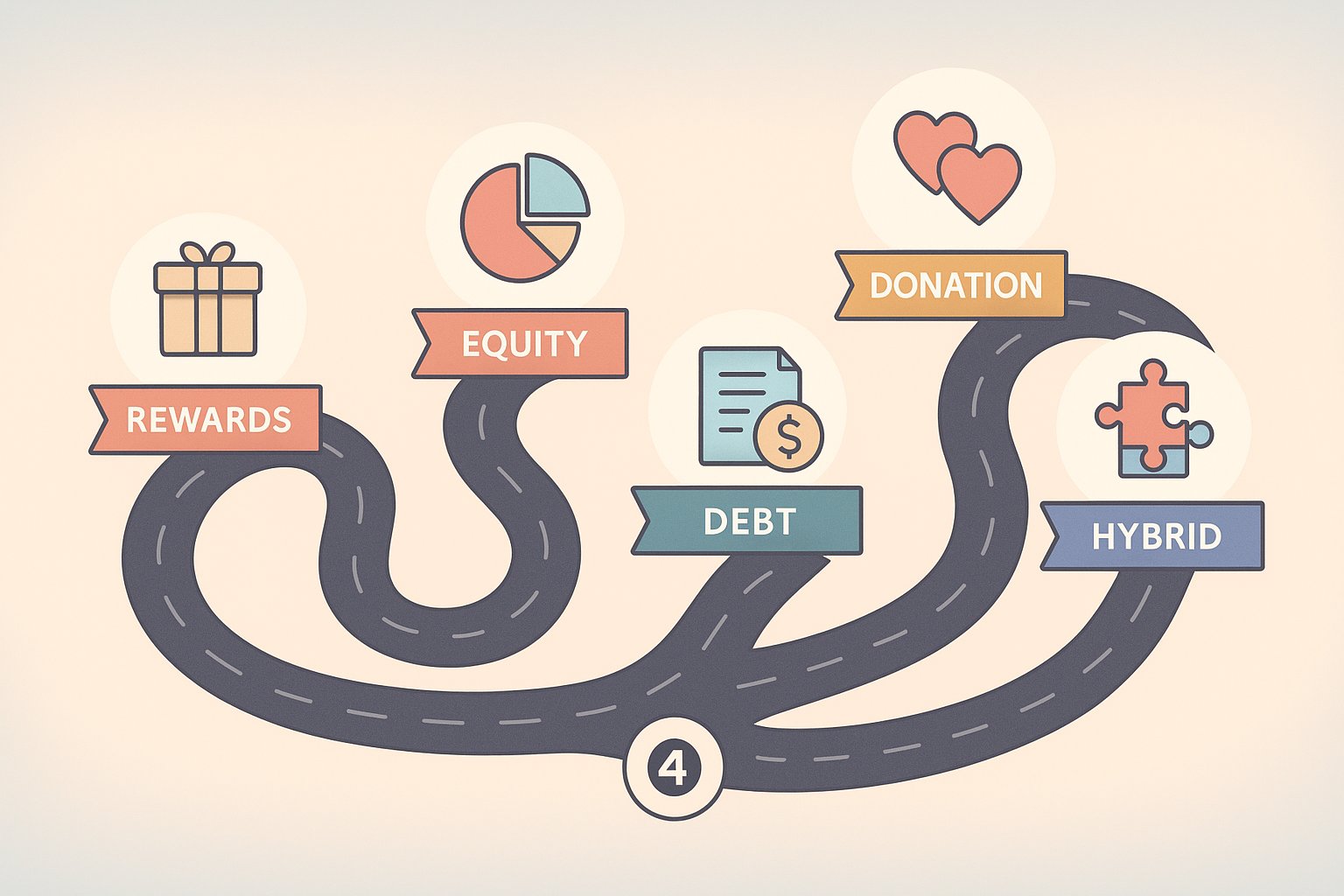

Equity crowdfunding is a financing method that enables companies—typically startups and growth-stage ventures—to raise capital by selling shares or convertible securities to a large pool of investors via online platforms. Unlike reward-based crowdfunding, where backers receive products or perks, equity crowdfunding grants investors a direct ownership stake in the company. This structure aligns investor interests with the long-term performance of the business, fostering a vested community of supporters who are motivated to contribute beyond their financial commitment. The rise of equity crowdfunding heralds a shift in power dynamics. Historically, founders relied on a narrow spectrum of angel investors and venture capital firms, navigating opaque term sheets and enduring protracted negotiations. Equity crowdfunding platforms—such as Republic, SeedInvest, and Crowdcube—streamline this process. They provide standardized due diligence, legal frameworks, and compliance tools, democratizing investment opportunities for accredited and non-accredited investors alike, subject to jurisdictional regulations. From an entrepreneurial perspective, equity crowdfunding can validate market demand, attract brand advocates, and expand reach through investor networks. For investors, it offers the allure of participating in high-growth ventures at inception, potentially securing equity at favorable valuations. Yet, the promise of windfall returns is tempered by inherent risks: startup mortality rates remain high, and illiquidity can tie up capital for extended periods. Recognizing its transformative potential—and reckoning with its challenges—equity crowdfunding has become a foundational strategy for innovation-driven economies.

How Equity Crowdfunding Works: From Pitch to Post-Funding Engagement

Launching an equity crowdfunding campaign begins with meticulous preparation. Founders craft a pitch deck that outlines the problem, solution, market opportunity, business model, competitive landscape, financial projections, and founder backgrounds. This narrative is supported by a term sheet detailing the type of securities offered, valuation, and investor rights. Platforms typically conduct a preliminary vetting process, ensuring campaigns meet regulatory and quality standards before going live.

Once approved, the campaign enters its funding phase, usually spanning 30 to 90 days. Founders engage prospective investors through digital channels—email outreach, social media, webinars, and PR—to generate momentum. Many platforms feature “early bird” incentives or tiered share pricing to reward prompt commitments. Throughout the campaign, real-time dashboards display funding progress, investor profiles, and engagement metrics. Regular updates from the founding team—highlighting milestones, answering FAQs, and celebrating endorsements—foster transparency and sustain enthusiasm.

After reaching the target raise, the platform facilitates the closing process: finalizing share issuance, updating cap tables, and ensuring compliance filings with securities regulators. But the journey doesn’t end there. Post-funding engagement is critical. Founders maintain open lines of communication through investor portals, quarterly reports, and virtual town halls. By involving investors in strategic milestones—product launches, partnership announcements, revenue achievements—companies preserve goodwill and may secure follow-on funding or strategic introductions. This ongoing relationship underscores equity crowdfunding’s distinction: investors are not passive financiers but active stakeholders invested in the company’s success.

Advantages for Founders: Beyond Capital Infusion

For entrepreneurs, the appeal of equity crowdfunding extends well beyond the infusion of capital. First, it offers market validation: when hundreds or thousands of individuals commit their resources, it signals genuine demand and strengthens the company’s value proposition. This validation can attract traditional investors or strategic partners who monitor successful crowdfunding campaigns as a barometer of public interest.

Second, equity crowdfunding builds a dedicated community of brand ambassadors. Early investors often champion the startup within their personal and professional networks, accelerating word-of-mouth referrals and opening doors to new markets. Their feedback—ranging from product feature suggestions to strategic introductions—can prove invaluable during critical scaling phases.

Third, equity crowdfunding can preserve founder control. Unlike venture capital rounds that may impose board seats or veto rights, crowdfunding rounds typically involve standardized shareholder agreements with limited governance intrusions. While dilution is inevitable, founders can carefully set valuation and share structures to balance capital needs with ownership retention. Furthermore, equity campaigns generate extensive media buzz, social proof, and SEO benefits. High-profile crowdfunding successes frequently garner press coverage, elevating brand visibility at a fraction of traditional marketing costs. The earned media pond creates a virtuous cycle: coverage attracts new investors and customers, which in turn fuels further coverage. For resource-constrained startups, this organic attention can be a game-changer.

Benefits for Investors: Access and Diversification

Equity crowdfunding democratizes early-stage investing by lowering minimum investment thresholds and opening opportunities to a broader investor base. Where traditional angel or venture capital investments often require six-figure commitments or accreditation, equity platforms may allow investments as low as a few hundred dollars. This accessibility enables retail investors to diversify their portfolios across multiple startups, spreading risk and increasing the chance of backing a successful venture.

In addition to potential financial returns from equity appreciation, investors gain a front-row seat in the company’s journey. Through regular updates, virtual events, and private investor communities, they receive insights into product roadmaps, strategic pivots, and operational challenges. This transparency fosters a sense of partnership, allowing investors to contribute advice, promotional support, or industry-specific introductions.

Furthermore, successful crowdfunding exits—whether through acquisitions, public listings, or secondary share transactions—can yield substantial returns. While the majority of startups will not achieve outsized exits, the portfolio approach inherent in crowdfunding mitigates this risk. By allocating modest sums across a range of ventures, investors maintain liquidity and preserve capital for reinvestment opportunities.

Finally, equity crowdfunding empowers impact-driven investors to support companies aligned with their values. Whether it’s clean energy, educational technology, or social enterprises, investors can target ventures that resonate with their personal beliefs, achieving both financial and societal returns.

Challenges for Founders: Navigating Dilution and Disclosure

Despite its many advantages, equity crowdfunding presents unique challenges for founders. Foremost is equity dilution. Each crowdfunding round increases the number of shareholders and reduces existing ownership percentages. Founders must carefully structure rounds—balancing the capital needed for growth against the long-term implications of ownership dispersion.

Another critical challenge is the heightened disclosure required. Regulatory frameworks such as the U.S. Regulation Crowdfunding impose stringent reporting obligations: audited financial statements, use-of-proceeds outlines, and risk disclosures must be filed with the SEC and kept current. Maintaining compliance demands legal and accounting resources, which early-stage startups may find burdensome. Failure to adhere to regulations can result in legal penalties, reputational damage, and even forced share repurchases.

Moreover, an expanded shareholder base can complicate governance. While crowdfunding investors typically lack direct veto powers, a large number of minor shareholders can generate divergent opinions and increase the volume of investor inquiries. Founders must establish robust communication channels, designate investor relations liaisons, and set clear expectations on engagement frequency and scope.

Finally, the public nature of crowdfunding campaigns means that strategic plans, valuation metrics, and project roadmaps become accessible to competitors. Founders must strike a delicate balance between transparency to attract investors and confidentiality to protect intellectual property and market positioning.

Risks for Investors: Illiquidity and Startup Mortality

Equity crowdfunding carries intrinsic risks for investors—chief among them illiquidity. Unlike publicly traded stocks, shares in private startups are not readily bought or sold on open markets. Many platforms facilitate secondary transactions, but these are often infrequent and subject to platform rules, lock-up periods, and limited buyer demand. Investors may find capital locked up for years before realizing any return. Additionally, startup failure rates remain high. Even ventures with stellar pitches and promising early traction can stumble due to scaling challenges, competitive pressures, or market shifts. Without rigorous due diligence—including assessment of management experience, financial projections, and competitive landscapes—investors risk backing ventures that lack sustainable business models. Valuation accuracy is another concern. Crowdfunding campaigns may set valuations that reflect growth ambitions rather than realistic benchmarks, potentially leading to overvaluation. Investors must scrutinize pre-money valuations, compare them against industry norms, and gauge whether projected returns justify the associated risks. Furthermore, minority shareholders often lack governance influence and may have limited recourse if the company deviates from its stated roadmap. While platforms enforce minimum standards for disclosure, investors must remain vigilant—monitoring updates, questioning discrepancies, and collaborating with fellow shareholders to uphold accountability.

Navigating Regulatory Landscapes: Compliance for Success

Equity crowdfunding regulations vary by country but share common principles: investor protection through disclosure, fundraising caps, and platform oversight. In the United States, Regulation Crowdfunding allows companies to raise up to $5 million per year from both accredited and non-accredited investors, subject to individual investment limits tied to income and net worth. European markets feature similar frameworks, such as the UK’s FCA-regulated crowd-investing environment.

Founders must engage legal counsel experienced in securities law to draft offering documents, ensure proper disclosures, and file necessary reports with regulators. Platforms often provide templates and guidance, but ultimate responsibility lies with the issuer. Post-funding, ongoing obligations include annual financial statements, updates on material changes, and mechanisms for investor communications.

Investors, meanwhile, should verify that platforms are registered with relevant authorities and that offerings include clear risk disclosures. Understanding local regulations around secondary share transfers, tax treatment of gains, and investor accreditation criteria protects against unforeseen liabilities. Collaboration with tax advisors and legal professionals ensures that both founders and investors navigate compliance seamlessly, transforming regulatory requirements from hurdles into strategic advantages that enhance credibility and trust.

Best Practices for Founders: Crafting a Winning Campaign

Successful equity crowdfunding campaigns blend authentic storytelling with robust financial rigor. Founders begin by articulating a compelling mission—a narrative that resonates emotionally while substantiating market opportunity with data. High-quality visuals, explainer videos, and infographics help convey complex concepts in an accessible manner. Financial transparency is equally critical. Presenting realistic, data-backed revenue projections, clear use-of-proceeds breakdowns, and contingency plans for potential setbacks bolsters investor confidence. Demonstrating early traction—such as pilot customers, strategic partnerships, or prototype milestones—further de-risks the investment thesis.

Investor relations should be baked into the campaign strategy. Establish dedicated communication channels—newsletters, virtual pitch events, and platform forums—to maintain momentum and address investor questions promptly. Highlight early lead investors as social proof; their involvement often attracts additional backers. Post-close, honor reporting commitments, share progress milestones, and solicit feedback to foster a collaborative investor ecosystem. Finally, build momentum off-platform. Engage industry media, secure thought leadership opportunities, and activate personal networks to drive traffic to your campaign page. A multifaceted approach—combining organic reach, paid promotions, and strategic partnerships—maximizes visibility and elevates campaign performance.

Unlocking Shared Potential Through Equity Crowdfunding

Equity crowdfunding stands at the nexus of innovation, finance, and community. For founders, it offers a powerful avenue to secure growth capital, validate market demand, and cultivate a passionate base of brand advocates. For investors, it presents an unprecedented opportunity to participate in the next generation of disruptive ventures, balancing risk with the potential for significant returns.

Yet the promise of equity crowdfunding demands thoughtful execution. Founders must navigate regulatory complexities, manage dilution, and sustain post-funding engagement. Investors must embrace due diligence, weigh illiquidity risks, and build diversified portfolios. By adhering to best practices—emphasizing transparency, compliance, and strategic storytelling—both parties can harness the transformative power of collective investment. As equity crowdfunding continues to evolve—driven by regulatory innovations, technological advancements, and shifting investor appetites—those who master its nuances will shape the future of entrepreneurship and capital markets. Whether you’re a visionary founder or a forward-looking investor, the era of democratized funding is here. Embrace the possibilities, prepare meticulously, and unlock the shared potential that equity crowdfunding uniquely delivers.