Ushering in a New Era of Direct Finance

Imagine securing capital for your small business in just days, or earning attractive returns by lending directly to borrowers across the globe—all without the red tape of traditional banks. Debt-based crowdfunding, better known as peer-to-peer (P2P) lending, has rapidly evolved from a niche fintech experiment into a mainstream financing powerhouse. By leveraging sophisticated credit-scoring algorithms, digital marketplaces, and automated servicing tools, P2P platforms bridge the gap between qualified borrowers and yield-seeking investors, creating a transparent, efficient, and inclusive ecosystem. The catalyst for this transformation was twofold: on one side, small businesses and consumers faced mounting obstacles securing bank loans—lengthy applications, strict collateral requirements, and slow decision cycles. On the other, investors searched for reliable income streams in a low-interest-rate world, frustrated by meager returns from savings accounts and government bonds. Peer-to-peer lending addresses both challenges by offering borrowers faster access to capital at competitive rates and enabling investors to diversify their portfolios with predictable cash flows. This model isn’t just about speed and yield; it’s a paradigm shift in financial empowerment. Borrowers once marginalized by rigid underwriting criteria now find support through data-driven risk assessments that consider alternative metrics beyond traditional credit scores. Investors, meanwhile, can build fractional-loan portfolios—spreading risk across dozens or even hundreds of loans—while tracking performance in real time. Yet with innovation comes responsibility: platforms must safeguard against fraud, defaults, and regulatory pitfalls, while participants need strategies to mitigate risk and maximize returns. In this deep-dive, we’ll chart the rise of debt-based crowdfunding: its origins, operational mechanics, advantages and risks for borrowers and lenders, evolving regulatory frameworks, and cutting-edge trends shaping its future. Whether you’re an entrepreneur in need of agile financing or an investor exploring alternative asset classes, mastering the nuances of peer-to-peer lending is key to unlocking its full potential.

The Genesis of Peer-to-Peer Lending

Debt-based crowdfunding traces its roots to the mid-2000s, when visionaries saw the Internet’s potential to connect individual lenders with creditworthy borrowers directly. Early platforms began by facilitating small personal loans among community members, relying on trust networks and manual credit checks. As technology advanced, pioneers like Zopa in the UK and Prosper in the US introduced automated underwriting systems, enabling rapid risk assessment and loan matching at scale. The 2008 financial crisis proved a tipping point. As banks tightened credit standards and froze lending, P2P platforms stepped in to fill the void. Borrowers embraced the streamlined application processes—often completed online in minutes—and transparent fee structures, while investors welcomed yields well above those offered by traditional savings instruments. Venture capital poured into platforms such as LendingClub and Funding Circle, validating the model and attracting institutional participation.

Today, a global tapestry of P2P lenders spans developed and emerging markets alike, each tailored to specific borrower segments—from consumer debt consolidation to small business expansion. Technological innovations—machine learning credit models, mobile-first interfaces, and API-driven bank integrations—continue to refine underwriting accuracy and user experience, solidifying peer-to-peer lending as a permanent fixture of the financial landscape.

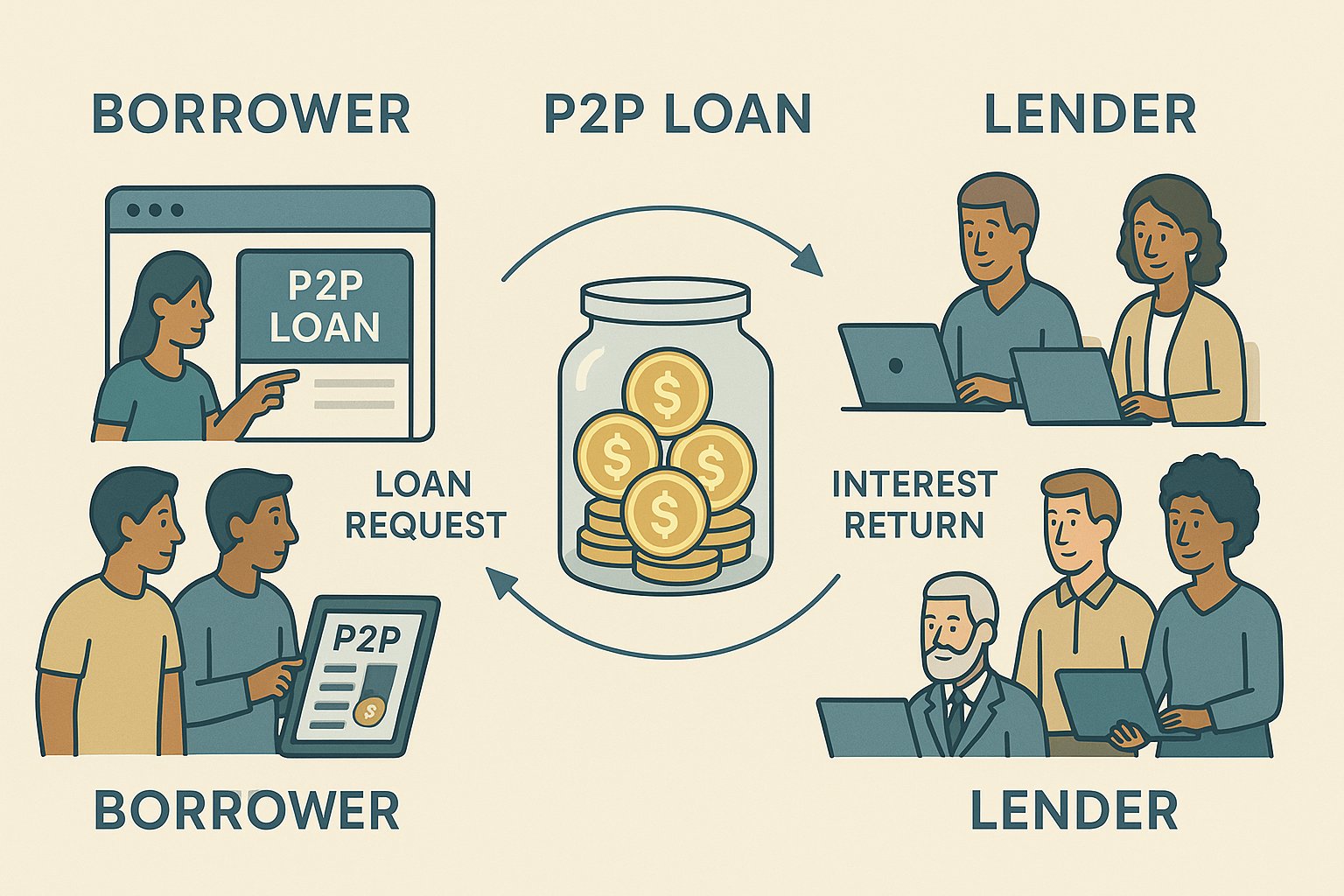

How Peer-to-Peer Lending Works

At its core, peer-to-peer lending platforms function as digital marketplaces. Borrowers submit online applications detailing their financing needs, credit history, and purpose of funds. Sophisticated algorithms analyze these inputs—drawing from credit bureau data, bank statements, and even alternative signals like education or employment stability—to assign a risk grade and corresponding interest rate. Once approved, loan requests appear on the platform’s marketplace with transparent terms: principal amount, interest rate, repayment schedule, and borrower profile. Investors browse these listings and commit capital, often in fractional increments across many loans to diversify risk. When funding thresholds are met, platforms disburse funds to borrowers and begin collecting monthly repayments, which are automatically apportioned—principal plus interest—to participating lenders’ accounts. Platforms sustain themselves through origination fees charged to borrowers and servicing fees deducted from lender returns. Advanced features—such as auto-investment rules, secondary loan markets, and portfolio analytics dashboards—enhance user engagement and streamline portfolio management for investors of all sizes. Automated payment reminders, collections services, and buyback schemes further bolster repayment performance and investor confidence.

Borrower Benefits: Speed, Access, and Transparency

Peer-to-peer lending delivers a compelling value proposition for borrowers. The streamlined digital application process can yield decisions in as little as 24 to 72 hours, a stark contrast to the weeks or months often required by banks. Funds are typically disbursed within days of approval—critical for businesses capitalizing on time-sensitive opportunities or individuals addressing urgent expenses. Moreover, P2P platforms often extend credit to applicants who may not meet conventional bank criteria. By incorporating alternative underwriting factors—such as cash-flow analytics and employment tenure—platforms can provide financing to entrepreneurs, freelancers, and consumers with limited credit histories. This inclusive approach fosters economic participation and supports growth in underserved communities. Competitive interest rates also distinguish peer-to-peer loans. By cutting out banking overhead and harnessing technology efficiencies, platforms can offer rates lower than credit-card APRs and many personal loans. Borrowers benefit from clear fee disclosures, amortized repayment schedules, and online account management tools that enhance financial planning and transparency.

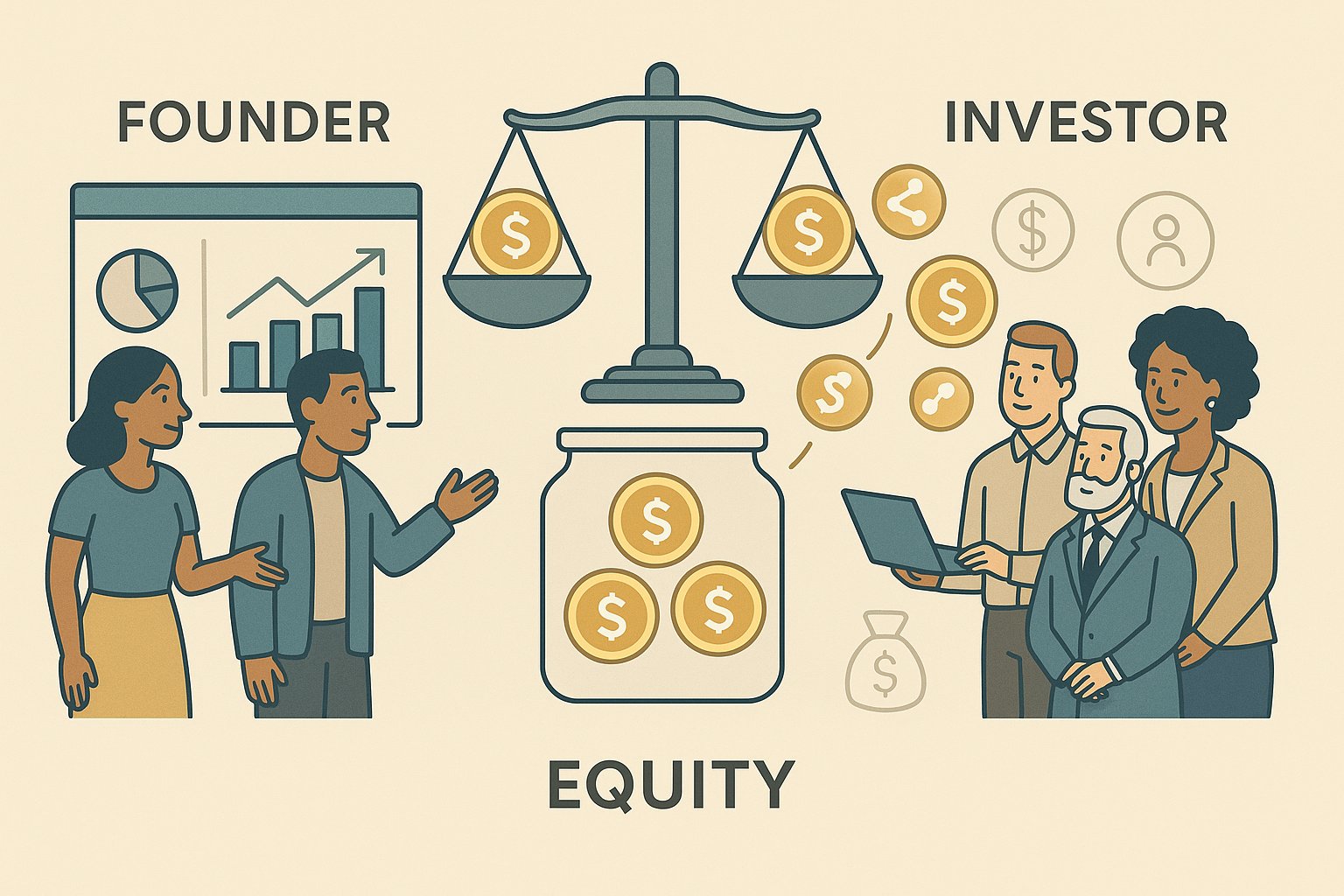

Investor Advantages: Diversification, Returns, and Impact

For investors, peer-to-peer lending presents an alternative asset class with attractive risk-adjusted returns. Average yields on P2P platforms often outpace those of traditional fixed-income securities and savings vehicles, reflecting the credit risk assumed. Fractional investing enables granular diversification, allowing lenders to allocate small amounts—sometimes as little as $25 or $50—to each loan segment, thereby mitigating the impact of any single default.

Real-time analytics dashboards and performance reports provide clear visibility into portfolio health, repayment rates, and net yields. Auto-invest features let lenders set criteria—desired interest rate range, loan grade, term length—and automatically deploy capital into matching loans. Secondary markets, where available, offer liquidity options for investors seeking early exit opportunities.

Beyond financial benefits, P2P investments carry a social impact dimension. Investors often take pride in supporting real people—small business owners expanding operations, families consolidating debt, or individuals covering medical bills. This dual appeal—monetary gain coupled with positive social outcomes—resonates with impact-focused investors seeking alignment between their values and their portfolios.

Mitigating Risk: Strategies for a Resilient Portfolio

Every investment entails risk, and peer-to-peer lending is no exception. Successful platform operators and investors employ rigorous risk-management practices, such as:

-

Diversification Across Loan Grades and Sectors: Spreading capital across multiple risk tiers and borrower types reduces exposure to any single default event.

-

Fractional Investing: Small-ticket investments in hundreds of loans ensure that individual defaults have minimal impact on overall returns.

-

Utilizing Auto-Invest Tools with Conservative Criteria: Pre-defined filters—minimum credit scores, maximum loan-to-value ratios, and specified interest rates—help maintain portfolio quality.

-

Analyzing Historical Platform Performance: Reviewing default trends, recovery rates, and servicing practices provides insight into a platform’s underwriting rigor.

-

Leveraging Loan Protection or Buyback Guarantees: Some platforms offer partial protection against defaults, either through reserved funds or guarantees to repurchase late loans.

By combining these tactics with ongoing portfolio monitoring, investors can optimize risk-adjusted returns and build confidence in the peer-to-peer lending environment.

Regulatory Landscape: Balancing Innovation and Protection

As peer-to-peer lending has scaled, regulators worldwide have crafted frameworks to safeguard participants while nurturing innovation. In the United States, the Securities and Exchange Commission and state agencies oversee aspects of certain platforms—particularly those securitizing loans or offering investments treated as securities. Licensing requirements and money-transmitter regulations may apply, ensuring operational integrity and consumer protection.

In Europe, the European Crowdfunding Service Providers Regulation harmonizes rules across member states, mandating risk disclosures, capital reserves, and transparent fee structures. Emerging economies are likewise developing bespoke regulations to foster financial inclusion while preventing predatory practices—capping interest rates, mandating platform disclosures, and instituting borrower hardship programs.

While compliance imposes additional costs and operational complexity for platforms, it ultimately strengthens market confidence. Borrowers gain assurance that lending standards and fund-safeguarding measures are enforced, and investors derive peace of mind knowing clear redress mechanisms exist for disputes or defaults. Staying abreast of evolving regulations—and partnering with legal experts—enables platforms and participants to navigate requirements proactively.

Platform Innovations: Shaping the Future of P2P Lending

Leading peer-to-peer platforms continually innovate to enhance user experiences and broaden market reach. Cutting-edge developments include:

-

AI-Driven Underwriting: Machine learning models process vast datasets—bank transaction histories, social media signals, and alternative credit indicators—to refine risk assessments and tailor interest rates.

-

Blockchain-Enabled Loan Tracking: Distributed ledger technology promises immutable records of loan origination, payments, and ownership transfers, boosting transparency and reducing settlement times.

-

Embedded Finance Partnerships: Collaborations with banks, fintech apps, and payment processors integrate P2P lending within broader financial ecosystems, enabling seamless loan offers at point-of-sale or within digital wallets.

-

Specialty Loan Pools: Thematic investment offerings—such as green energy financing, affordable housing loans, or minority-owned business support—cater to socially conscious lenders seeking targeted impact.

-

Mobile-First Experiences: Intuitive apps streamline borrower applications and investor portfolio management, broadening accessibility in mobile-centric markets.

These innovations not only improve operational efficiency but also attract diverse user segments, from tech-savvy millennials to institutional asset managers. As platforms explore tokenization, DeFi integration, and global marketplace expansions, peer-to-peer lending stands at the cusp of its next growth phase.

Emerging Trends: What’s on the Horizon

Several key trends are set to shape the evolution of debt-based crowdfunding in the coming years:

The rise of impact lending, where investors fund loans with explicit social or environmental goals, tracking measurable outcomes alongside financial returns. Advanced open banking integrations will grant platforms real-time access to borrowers’ financial data, enabling dynamic interest-rate adjustments and personalized repayment plans. Regulatory sandboxes in emerging markets will facilitate experimentation, unlocking credit for micro-entrepreneurs and underserved populations. Lastly, secondary market liquidity enhancements—perhaps through tokenized loan assets—could alleviate illiquidity concerns and attract new capital sources. As these developments unfold, the peer-to-peer lending sector will continue blending traditional finance principles with cutting-edge technology, further democratizing credit access and investment opportunities worldwide.

Is Peer-to-Peer Lending Right for You?

Debt-based crowdfunding attracts both borrowers and investors seeking alternatives to conventional financial channels, but it’s not one-size-fits-all. Borrowers should evaluate platforms based on interest rates, origination fees, underwriting transparency, and customer support responsiveness. A thorough cost-benefit analysis—comparing P2P rates against bank loans or credit-card debt—ensures the chosen solution aligns with financing needs and repayment capacity.

Investors must consider risk tolerance, portfolio diversification strategies, and desired liquidity. Conducting platform due diligence—reviewing historical default rates, servicing procedures, and regulatory compliance—lays the groundwork for informed participation. Those comfortable with technology-driven underwriting and long-term capital commitments can harness P2P lending to enhance portfolio yields and contribute to economic empowerment.

Embracing the Peer-to-Peer Lending Revolution

Debt-based crowdfunding has indelibly altered the financing landscape, offering faster, more inclusive, and transparent credit solutions for borrowers, alongside attractive, impact-oriented investment options for lenders. By leveraging advanced technology, rigorous underwriting, and engaged communities, P2P platforms continue to push the boundaries of what’s possible in digital finance. As regulations evolve and innovations—from AI credit models to blockchain settlements—gain traction, the future of peer-to-peer lending promises even greater efficiency, accessibility, and social impact. For entrepreneurs seeking agile capital and investors pursuing diversified, purpose-driven returns, embracing this revolution can unlock new avenues for growth and empowerment. The question today isn’t whether peer-to-peer lending will shape the future of finance—it’s how you’ll position yourself to seize its transformative potential.