Unlocking the Language of Crowdfunding

Stepping into the crowdfunding arena means mastering a whole new vocabulary—terms that dictate how you plan, launch, and deliver your campaign. From defining your Funding Goal to navigating Equity Stakes, each phrase carries strategic weight. This glossary distills the 100 most essential terms into bite-sized definitions and illustrative examples, organized into thematic sections. Whether you’re launching your first campaign or refining your fundraising playbook, these concise entries will help you speak the language of crowdfunding fluently and confidently.

Campaign Mechanics Basics (Terms 1–10)

All-or-Nothing: A campaign model where funds are collected only if the funding goal is met by the deadline. This guarantees you have the full budget needed to deliver on promises.

Flexible Funding: A model allowing creators to keep all funds raised, even if the goal isn’t reached. Ideal for small projects but risky if essential costs aren’t covered.

Funding Goal: The minimum amount required to execute your project. It’s the North Star that guides backer pledges and campaign planning.

Stretch Goal: An additional milestone unlocked after hitting the funding goal. These extra targets add new features or bonus rewards, keeping backers engaged.

Early Bird Special: A limited-time reward tier that offers backers a discount for pledging quickly. It jump-starts momentum by incentivizing early support.

Perks: Tangible or experiential rewards offered to backers in exchange for their pledges. They range from branded swag to exclusive behind-the-scenes access.

Match Funding: A partnership in which an organization doubles or matches backer contributions up to a set amount. This amplifies backer impact and drives urgency.

Soft Cap: The minimum funds needed to start your project, but below which you may still proceed. Falling short of true costs can jeopardize fulfillment.

Hard Cap: The maximum funding limit for a campaign. It prevents runaway budgets and helps creators plan production volumes accurately.

Deadline: The final date and time when pledges are accepted. It creates urgency and focuses marketing efforts on crossing the finish line.

Fees, Dates, and Disbursements (Terms 11–20)

Platform Fees: A percentage charged by crowdfunding sites for hosting your campaign. Factor this into your budget to avoid net-proceeds shortfalls.

Processing Fees: Charges levied by payment gateways (e.g., credit card companies). They typically range from 3–5% per transaction.

Disbursement: The moment when collected funds are released to the creator. All-or-nothing campaigns disburse only if goals are met.

Escrow: A holding account where backer funds reside until release conditions are satisfied. It protects both creators and backers.

Campaign Duration: The total run time of your campaign from kickoff to deadline. Common durations range from 30 to 60 days to balance urgency and momentum.

Kickoff Date: The launch date when pledges open. Proper pre-launch marketing ensures strong initial traction.

Currency Conversion: The process of translating pledges made in various currencies into your campaign’s base currency. Exchange rates can affect your net proceeds.

Creator Fees: Any additional percentage you set aside for unexpected expenses. Building in a contingency buffer of 10–20% is best practice.

Contingency Buffer: Extra funds included in your goal to cover unforeseen costs—like shipping price fluctuations or prototype revisions.

Refund Policy: The rules governing backer refunds if a campaign fails or creators cannot fulfill rewards. Transparency here builds trust.

Crowdfunding Models Explained (Terms 21–30)

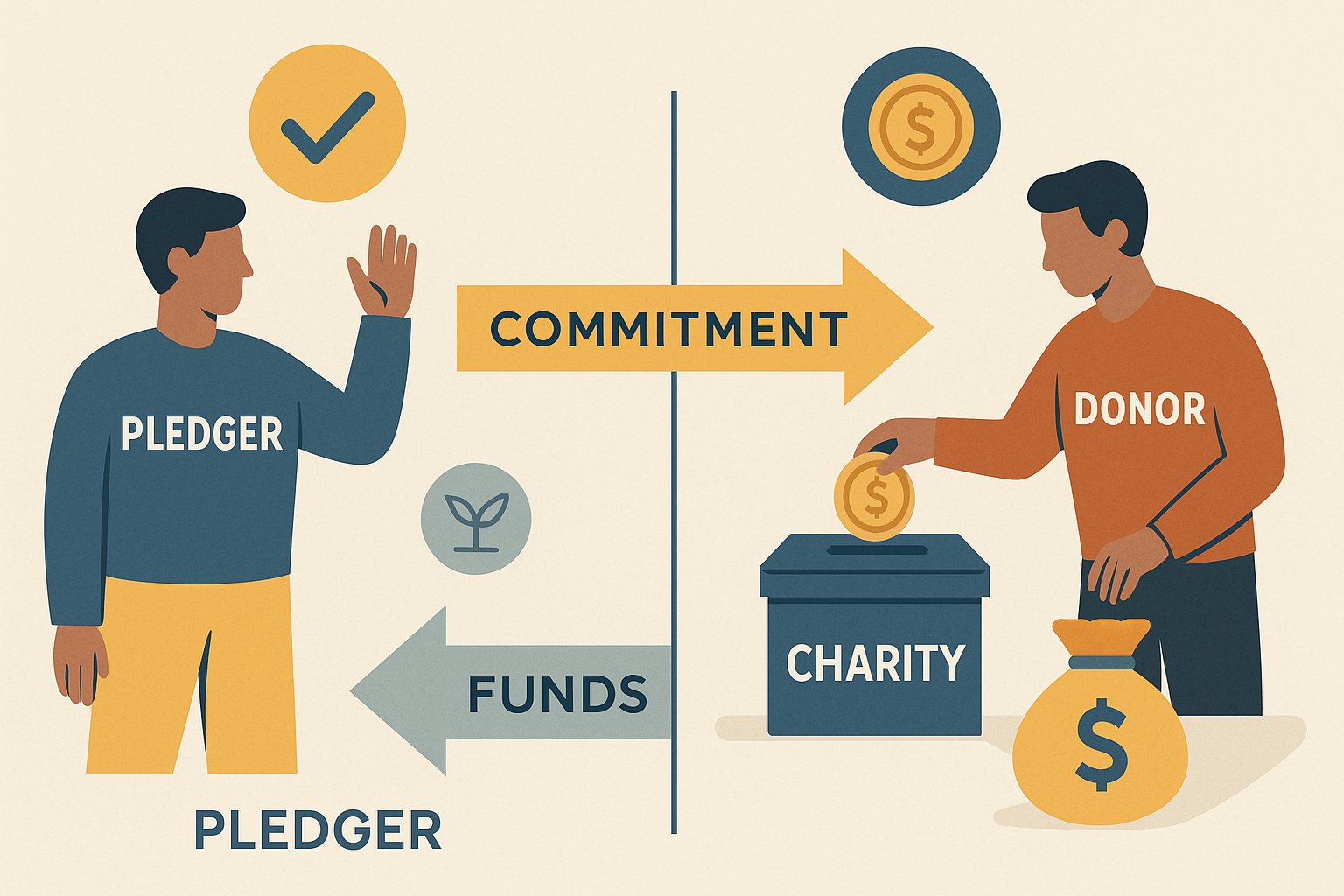

Reward-Based: Creators exchange tangible or experiential perks for backer pledges. Ideal for product launches and creative projects.

Donation-Based: Contributors give funds without expecting material returns. Common for charitable causes and personal fundraisers.

Equity-Based: Investors receive company shares in exchange for capital. Governed by securities laws and detailed disclosures.

Debt-Based: Also known as peer-to-peer lending, where backers lend money at agreed interest rates. Borrowers repay principal plus interest over time.

Peer-to-Peer Lending: A model connecting borrowers directly with investors via an online marketplace for faster, more inclusive credit.

Royalty-Based: Backers earn a percentage of future revenues until a capped return is reached. No equity dilution for creators.

Token Sale: A fundraising event where digital tokens are sold, often on a blockchain, to fund project development or decentralized platforms.

Initial Coin Offering (ICO): An early token sale without full regulatory oversight, where backers receive cryptocurrency tokens in exchange for investment.

Security Token Offering (STO): A regulated token sale where tokens represent real-world assets or securities, subject to investor protections.

Convertible Note: A debt instrument that converts into equity under specified conditions, bridging traditional debt and equity financing.

Investor Profiles and Regulations (Terms 31–40)

Accredited Investor: An individual or entity meeting income or net-worth thresholds, eligible for certain private securities offerings.

Non-Accredited Investor: Investors without accredited status, subject to lower investment caps and specific regulatory safeguards.

Regulation Crowdfunding (Reg CF): A U.S. framework allowing companies to raise up to $5 million annually from retail and accredited investors.

Regulation D (Reg D): U.S. rules that permit private offerings to accredited investors with fewer disclosure requirements than public offerings.

Regulation A+ (Reg A+): A scaled public offering exemption enabling companies to raise up to $75 million with simplified SEC review.

Cap Table: A capitalization table listing all shareholders, their equity stakes, and ownership percentages. Critical for equity-based campaigns.

Equity Stake: The percentage of ownership an investor holds in a company. Stakes change with each funding round and dilution event.

Share Certificate: A formal document issued to equity investors as proof of ownership in the company.

Investor Cap: Platform-enforced limits on how much an individual can invest in a campaign, protecting non-accredited backers from overcommitment.

Automation Tools: Software features that streamline regulatory compliance—automated filings, identity verification, and investor accreditation checks.

Financial Fundamentals (Terms 41–50)

Use of Proceeds: A clear breakdown of how raised funds will be allocated—development, marketing, operations, or other expenses.

Financial Projections: Forecasts of revenue, expenses, and cash flow used to demonstrate viability to backers and investors.

Pre-Money Valuation: The company’s valuation before new capital is injected, informing share pricing in equity fundraising.

Post-Money Valuation: The company’s worth after including new funds raised, calculated as pre-money valuation plus capital influx.

Dilution: The reduction in existing shareholders’ ownership percentage when new shares are issued.

Valuation Cap: A maximum valuation at which convertible notes will convert into equity, protecting early investors from overvaluation.

Discount Rate: A percentage reduction offered to early convertible note investors, giving them shares at a lower effective price.

Vesting Schedule: A timeline over which founders’ or employees’ equity grants become fully owned, aligning incentives over time.

Liquidation Preference: The order and amount investors receive in the event of a company sale or liquidation, often before common shareholders.

Return on Investment (ROI): A performance metric comparing net gains from an investment against its cost, guiding backer expectations.

Legal and Compliance Essentials (Terms 51–60)

Know Your Customer (KYC): Verification processes that confirm investor identities to prevent fraud and comply with regulations.

Anti-Money Laundering (AML): Policies and checks designed to detect and report suspicious financial activities.

GDPR: European data-protection regulations that govern how backer personal data must be collected, stored, and processed.

Terms of Service: The contractual agreement between platform, creator, and backer outlining rights, obligations, and dispute resolution.

Confidentiality Agreement: A legal contract protecting sensitive project information shared with investors during due diligence.

Patent Pending: A notice indicating a patent application has been filed, protecting inventions while awaiting formal grant.

Trademark: Legal protection for brand names, logos, or slogans, ensuring exclusive rights to use and license.

Copyright: The exclusive legal right to reproduce and distribute original creative works—text, images, music, or software.

Intellectual Property: Collective term for patents, trademarks, copyrights, and trade secrets that safeguard innovations and brand assets.

Data Privacy: The practice of protecting backer information—names, payment details, and personal identifiers—from unauthorized access.

Engaging Your Community (Terms 61–70)

Customer Acquisition Cost (CAC): The average cost to acquire a backer or customer through marketing and outreach efforts.

Lifetime Value (LTV): The total projected revenue a backer or customer will generate over their entire engagement with your brand.

Viral Coefficient: A measure of how effectively backers refer new supporters, amplifying campaign reach through word-of-mouth.

Social Proof: Validation from other backers—testimonials, pledge counts, and endorsements—that builds campaign credibility.

Conversion Rate: The percentage of campaign page visitors who become backers, indicating how persuasive your pitch is.

Click-Through Rate (CTR): The ratio of users who click on your campaign ad or link versus those who view it, guiding ad optimization.

Email List: A curated database of subscribers who receive campaign updates, exclusive previews, and personalized calls to action.

Influencer Marketing: Collaborations with social media personalities whose endorsements expand campaign visibility to target audiences.

Press Release: A formal announcement sent to media outlets to secure coverage and drive new traffic to your campaign.

SEO: Techniques—keyword targeting, meta descriptions, backlinking—that improve your campaign’s organic search rankings.

Crafting and Iterating Your Project (Terms 71–80)

Prototype: An early working model used to demonstrate functionality and gather initial backer feedback.

Minimum Viable Product (MVP): The simplest version of your product that satisfies core user needs, validating market demand.

Beta Test: A trial run with a select group of backers who provide feedback on usability and performance before full launch.

Pilot Program: A small-scale rollout that tests operational processes and reward fulfillment in real-world conditions.

Survey: A structured questionnaire sent to backers to collect opinions, feature requests, and prioritization insights.

Feedback Loop: Continuous cycles of collecting backer input and refining product features or campaign messaging accordingly.

Community Manager: The individual responsible for moderating discussions, responding to comments, and fostering backer engagement.

Milestone: A significant achievement—prototype completion or pre-order threshold—that is publicly celebrated to sustain momentum.

Update Feed: The campaign page section where creators post progress reports, media, and announcements to keep backers informed.

Backer Engagement: The spectrum of interactions—comments, surveys, live events—that keeps supporters invested in your project’s success.

From Campaign to Delivery (Terms 81–90)

Manufacturing Lead Time: The estimated duration from production start to finished goods, critical for setting accurate delivery dates.

Quality Assurance (QA): Processes that inspect and test products to ensure they meet promised standards and backer expectations.

Inventory Management: Systems for tracking stock levels, variants, and backer orders to prevent over- or under-stocking.

Shipping Logistics: Coordination of packaging, carriers, and tracking to deliver rewards to backers on time and in good condition.

Customs Duties: Import taxes and fees that may apply when shipping products across international borders.

Drop Shipping: A fulfillment model where products are shipped directly from manufacturer or third-party vendor to the backer.

Digital Download: Instant delivery of virtual goods—software, e-books, or media—via secure online links or portals.

License Key: A unique code granted to digital backers, activating software or content under agreed terms.

Fulfillment Plan: The end-to-end strategy outlining how rewards will be produced, packaged, and shipped to backers.

Backer Survey: A post-campaign questionnaire that collects shipping addresses, reward selections, and customization details.

Navigating Platform Ecosystems (Terms 91–100)

Staff Pick: A curated feature selected by platform editors, dramatically increasing a campaign’s visibility and credibility.

Trending Page: A dynamic showcase of rapidly rising campaigns, driven by surges in pledges and social engagement.

Category Tags: Keywords assigned to your campaign that help backers discover projects in specific niches or interests.

Search Algorithm: The platform’s method for ranking and recommending campaigns based on relevance, popularity, and engagement.

Analytics Dashboard: A real-time interface displaying visitor metrics, pledge patterns, and conversion data to guide optimizations.

API Integration: Connections that allow your campaign to sync with external tools—email platforms, CRMs, or analytics services.

Third-Party Plugin: An add-on that extends platform functionality, such as custom countdown timers or chat widgets.

Secondary Market: A post-campaign venue where equity-based backers can buy and sell shares, adding liquidity to private investments.

Investor Portal: A secure area where equity or debt investors access documents, updates, and governance tools.

Community Features: Built-in forums, live chat, and comment sections that foster real-time interaction between creators and backers.

With these 100 terms at your fingertips—each spaced for easy reading—you’re now equipped to design smarter campaigns, communicate clearly with backers, and navigate the nuances of every crowdfunding model. Good luck, and happy fundraising!