Crafting a Robust Defense Against Defaults

In the fast-evolving world of debt crowdfunding, investors must navigate a landscape where each loan represents both opportunity and risk. While attractive interest rates and diversified borrower pools can yield compelling returns, default risk lurks beneath the surface. A single missed payment can ripple through a portfolio, eroding overall performance and sapping investor confidence. However, by adopting proactive strategies—ranging from thorough due diligence to dynamic portfolio adjustments—you can construct a resilient debt crowdfunding portfolio that thrives even when a few borrowers falter. In this exploration, we’ll unveil the techniques that top investors use to minimize default risk, preserve capital, and sustain long-term growth.

Delving Deep: Conducting Rigorous Due Diligence

Before committing a single dollar, diligent investors embark on a deep-dive into borrower profiles. Scrutinizing credit scores and credit reports is merely the first step. Seasoned debt crowdfunding participants know to probe more profoundly: they examine income statements, employment verifications, and spending patterns. They look for red flags—such as recent bankruptcies, large outstanding balances on revolving credit, or erratic income streams—that signal higher default probabilities. Beyond financial metrics, understanding a borrower’s narrative can uncover strengths or vulnerabilities that numbers alone may not reveal. For instance, a small business owner with steady year-over-year growth but a recent equipment lease may temporarily exhibit tighter cash flow. By contextualizing each borrower’s financial journey, investors can distinguish between short-term liquidity hiccups and persistent solvency concerns, thereby minimizing the risk of backing loans destined for default.

Spreading Risk: Building a Diversified Mosaic

Imagine a painter mixing countless pigments to achieve a vibrant masterpiece—each hue adds depth, reduces stark contrasts, and prevents any single color from dominating the canvas. Similarly, diversification is the investor’s palette for mitigating default risk in debt crowdfunding. Rather than concentrating capital in a handful of loans, seasoned lenders sprinkle investments across dozens, if not hundreds, of notes. They vary borrower credit grades, loan terms, industries, and geographic locations, ensuring that a struggle in one segment doesn’t decimate the entire portfolio. A consumer loan in the healthcare sector might offset the risk of multiple small business loans in retail. Furthermore, staggering loan maturities—spacing them out over different months and years—protects against sudden economic downturns, giving borrowers across vintages time to adapt. By weaving a tapestry of diverse investments, you dilute individual default threats and enhance the overall stability of your debt crowdfunding holdings.

Harnessing Credit Grading Systems with Discretion

Debt crowdfunding platforms typically assign credit grades based on proprietary underwriting models—categories like A through G or 1 through 7 often represent varying risk profiles. Smart investors treat these grades as guiding beacons rather than absolute truths. They analyze historical default rates associated with each grade and compare them against advertised interest rates. For instance, if Grade D loans historically default at 12 percent but carry a 14 percent yield, the net return may be narrow after factoring in losses. Investors often tilt their allocations toward grades that strike the optimal balance between yield and historical default frequency. In addition, they monitor platform updates to underwriting criteria. When a platform tightens or loosens credit thresholds, shifts in default trends often follow. By staying attuned to evolving credit grading mechanisms and adjusting exposures accordingly, investors keep default risk aligned with acceptable return profiles.

Securing Your Bets: Utilizing Collateral and Personal Guarantees

Anchoring investments with collateral can significantly reduce the severity of defaults. Some debt crowdfunding platforms offer secured loans—where tangible assets like real estate, equipment, or vehicles back the obligation. In case of borrower default, investors have recourse to liquidate the pledged asset, recouping a portion (or all) of the outstanding principal. Even when collateral isn’t fully recoverable, it often softens losses compared to unsecured notes. Moreover, personal guarantees—agreements where the borrower’s personal assets back a business obligation—offer an additional safety net. Although legal complexities can slow recovery, the mere presence of a guarantee often influences borrower behavior, incentivizing on-time payments. By prioritizing secured loans or those with strong personal guarantees, investors construct a buffer that mitigates outright losses when defaults materialize.

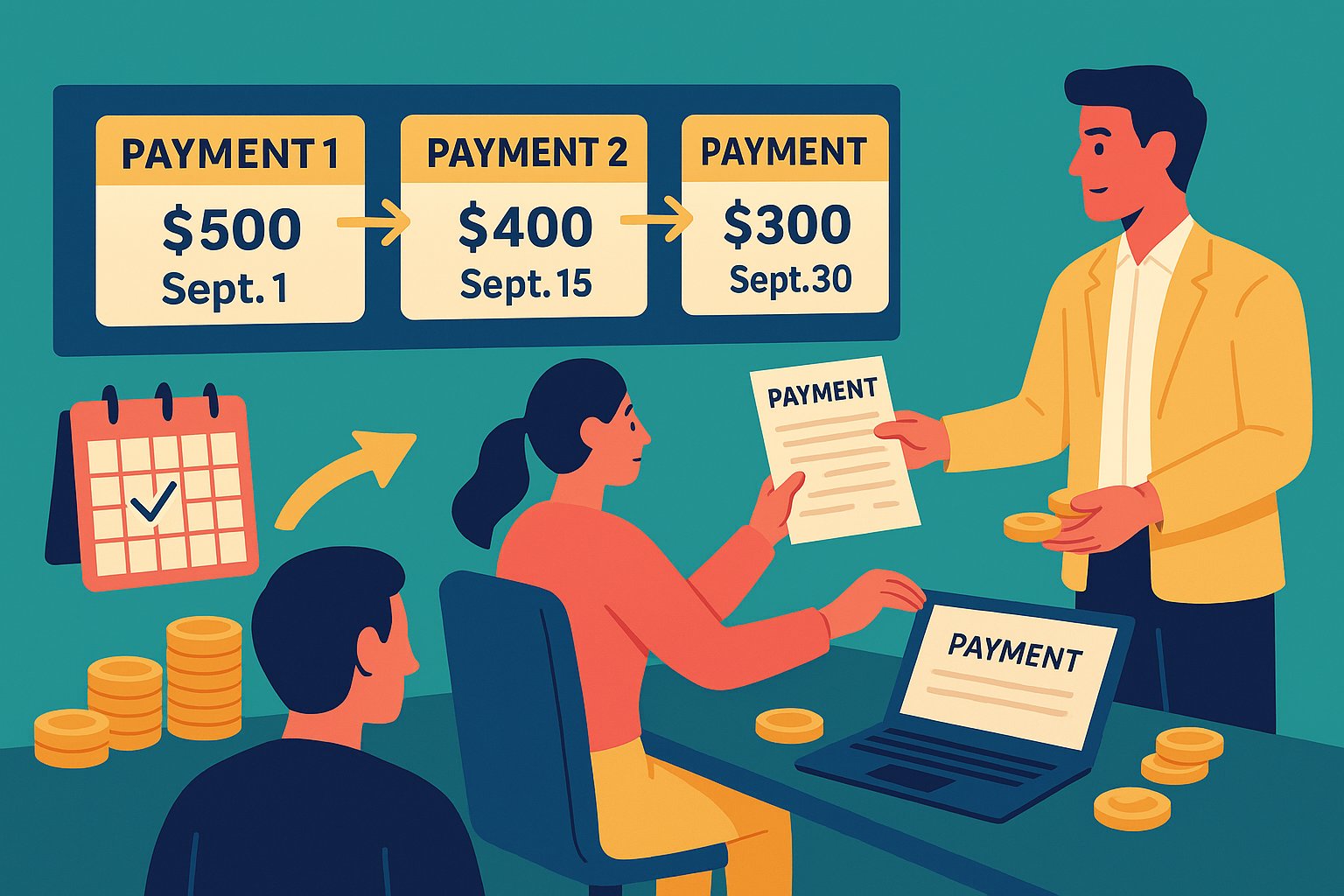

Eyes on the Horizon: Monitoring Early Warning Indicators

Default prevention isn’t solely about pre-commitment diligence; it requires vigilant, ongoing oversight. Just as a seasoned sailor watches for shifting winds and gathering clouds, successful investors monitor early warning signals in their portfolios. They pay close attention when a borrower falls just a day late—missing a payment due date can be a harbinger of deeper financial stress. Repeated small delinquencies, sudden spikes in credit utilization on revolving accounts, or unreported changes in employment status warrant swift action. Some investors subscribe to automated alerts provided by platforms, which flag loans entering delinquency or those requiring servicing interventions. By identifying trouble spots early, they decide whether to hold, sell on secondary markets, or proactively communicate with borrowers to arrange modified repayment plans. This active monitoring ensures that potential defaults can be addressed before they snowball into irrevocable losses.

Seizing Liquidity: Leveraging Secondary Markets Strategically

Even with the most robust diligence and diversification, defaults can’t be eliminated entirely. But investors have a powerful tool at their disposal: secondary markets. Many debt crowdfunding platforms allow lenders to list their notes for sale, transferring default risk to other buyers willing to wager on potential recovery through late fees or improved repayment. When an investor spots a loan crossing into higher delinquency brackets, they might choose to offload it at a discount, preserving capital for stronger performers. Alternatively, they might acquire discounted notes with the intent to participate in restructuring efforts, potentially capturing value through late fees or eventual borrower cure. By tactically engaging in secondary market trades—both selling and buying—investors optimize portfolio composition, shifting exposure away from high-risk notes and capitalizing on opportunities that others perceive as too fraught.

Cultivating Active Communication with Borrowers

Behind every default is a borrower grappling with real-world challenges. By fostering direct and empathetic communication, lenders can often help borrowers regain footing before payments cease altogether. Leading platforms facilitate messaging features where investors can reach out to borrowers—checking in, offering payment plan adjustments, or guiding them toward financial counseling resources. In more advanced arrangements, investors join forces with platform servicers to negotiate modified terms such as temporary payment deferrals or interest rate reductions. While these concessions may slightly alter projected returns, they often salvage loans that would otherwise slip into default, reducing net portfolio losses. By viewing borrowers as partners rather than faceless credit profiles, investors cement relationships that encourage collaboration, early issue resolution, and, ultimately, higher recovery rates.

Balancing Concentration with Thematic Exposure

While diversification is key, deliberate thematic exposure—investing in sectors with stable fundamentals—can further insulate portfolios from default waves. For instance, if an investor identifies a surge in demand for home renovation loans during a booming housing market, they might allocate a modest percentage of capital there while maintaining broad distribution elsewhere. However, they must avoid overconcentration, ensuring that no single theme exceeds a safe allocation threshold—often 5 to 10 percent of total portfolio value. Thematic bets work best when combined with robust due diligence, ensuring that each loan within the sector meets baseline credit criteria. By balancing concentration with overarching diversification, investors capture nascent trends without exposing themselves to systemic shocks, thereby keeping default rates in check.

Reinforcing Through Data-Driven Analytics

Advanced investors don’t rely solely on surface-level metrics; they harness data analytics to detect patterns invisible to the naked eye. By aggregating portfolio performance data across multiple platforms—tracking default frequencies by credit grade, delinquency timelines, or seasonal variances—they distill actionable insights. For example, analytics might reveal that self-employed borrowers experience higher default rates during tax season months, prompting lenders to adjust allocation timing or demand stronger income verification documentation. Some even employ machine learning models to predict default probabilities based on multifaceted borrower attributes. While such techniques demand technical expertise, they deliver a competitive edge: refined allocations that minimize exposure to loans with hidden risk factors. Data-driven analytics transforms gut instincts into quantifiable strategies, safeguarding portfolios against unexpected default surges.

Embracing Continuous Learning and Adaptation

The debt crowdfunding landscape is anything but static. Economic fluctuations, regulatory shifts, and evolving platform underwriting criteria continually reshape default risk profiles. Investors committed to minimizing losses adopt a mindset of perpetual learning. They participate in online forums, industry webinars, and platform-hosted workshops to stay informed about emerging risk factors—like changes in consumer spending patterns or macroeconomic indicators signaling an impending downturn. By refining strategies based on fresh insights—adjusting allocation limits, updating due diligence checklists, or diversifying into underexplored credit niches—they ensure portfolios remain resilient. In this dynamic environment, success belongs to those who view default risk management as an ongoing craft rather than a one-time initiative

Minimizing default risk in debt crowdfunding portfolios demands a holistic, proactive approach. From conducting rigorous borrower due diligence and building diversified portfolios to leveraging collateral, monitoring early warning signs, and engaging secondary markets, each strategy plays a vital role in safeguarding capital. By fostering open communication with borrowers, balancing thematic exposures, harnessing data analytics, and embracing continuous adaptation, investors can transform default mitigation from a reactive scramble into a disciplined, anticipatory process. When you integrate these techniques into your debt crowdfunding endeavors, you not only reduce the impact of defaults but also build a foundation for sustainable, long-term portfolio growth.