Opening the Valuation Toolbox: Mastering Methods for Startup Success

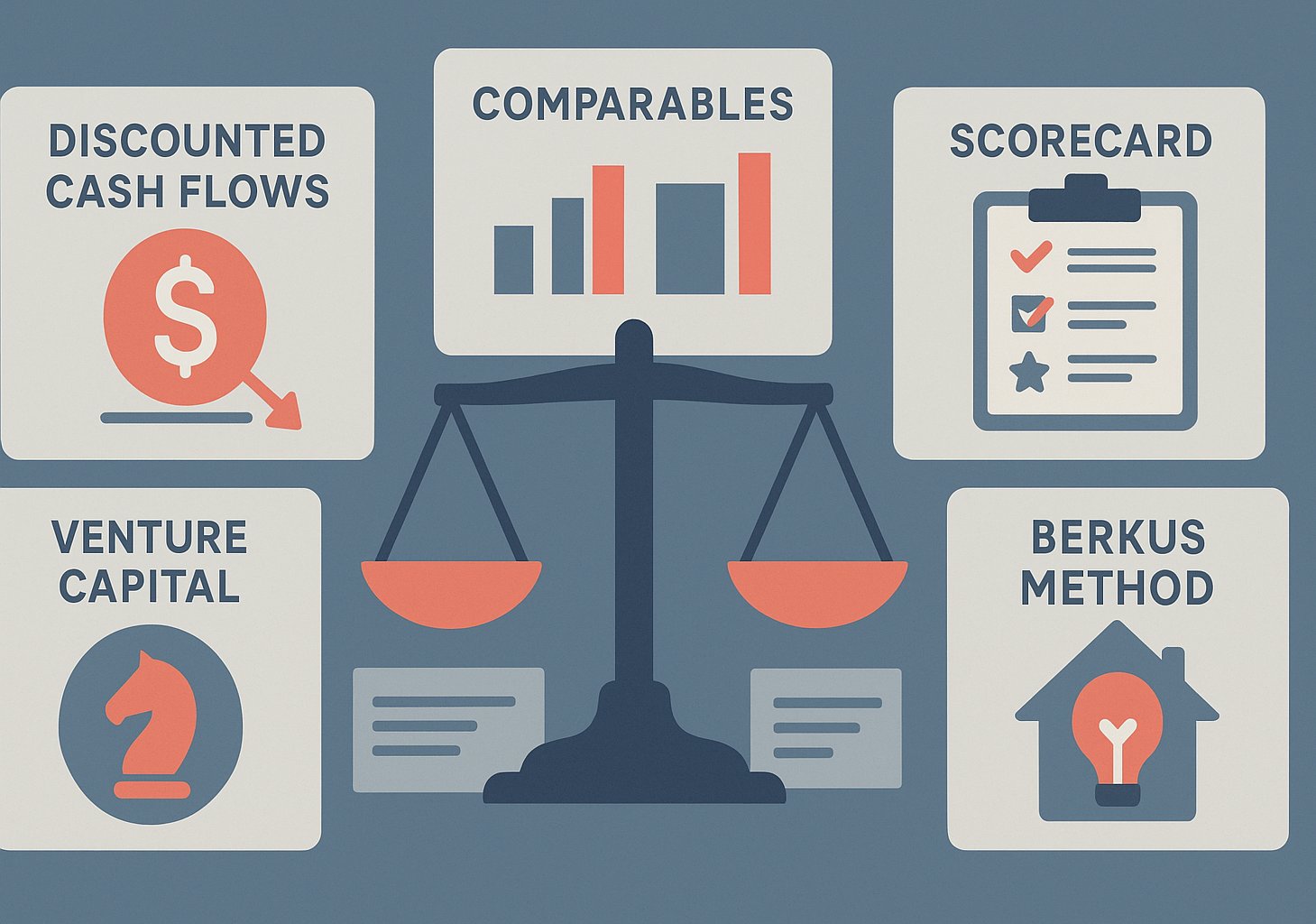

Valuation sits at the heart of every startup’s journey—defining not only how much capital you can raise but also the ownership you retain, the expectations you set, and the investor relationships you cultivate. From seed rounds to growth-stage financings, founders grapple with questions that hinge on valuation: How do I arrive at a defensible figure? Which metrics carry weight with sophisticated backers? How do I balance ambition with pragmatism? While no single method provides a perfect answer, understanding the key valuation approaches empowers you to navigate negotiations with clarity and confidence. In this guide, we’ll unpack five essential valuation methodologies—each offering unique insights into your company’s worth. By learning when to apply Discounted Cash Flow models, Comparable Company analyses, Precedent Transaction benchmarks, the Venture Capital method, and the Scorecard (or Berkus) approach, you’ll be equipped to craft compelling proposals, anticipate investor concerns, and maximize your startup’s potential in every funding round. Every valuation method carries its own assumptions, data requirements, and limitations. Some excel when you have tangible cash flow projections; others thrive in early-stage contexts where revenue is minimal, and investor judgment prevails. The art lies in selecting the right tool for your startup’s stage, industry, and growth trajectory, then combining insights to triangulate a realistic marketable valuation. Beyond calculations, successful founders complement quantitative rigor with narrative finesse—tying model outputs to their mission, market dynamics, and competitive moat. As you explore these five methods, consider how each aligns with your strengths and challenges: robust financial forecasts, peer company benchmarks, recent deal data, exit expectations, or qualitative milestones. Armed with this multifaceted perspective, you’ll not only survive valuation debates but steer them, transforming what often feels like a high-stakes gamble into a strategic lever for sustainable growth.

#1: Discounted Cash Flow (DCF) Method

The Discounted Cash Flow method stands as a cornerstone of traditional finance, prized for its logical foundation: a company’s intrinsic value equals the present value of its anticipated future cash flows. For later-stage startups with revenue traction and reasonably predictable expenses, DCF provides a rigorous framework to quantify value. The process begins by forecasting free cash flows—revenues minus operating costs, taxes, capital expenditures, and changes in working capital—over a projection period, typically five to ten years. Next, you determine a discount rate that reflects the risk profile of your venture, often derived from the weighted average cost of capital (WACC) or an investor-required rate of return that accounts for startup risk premiums. Finally, you calculate the terminal value at the end of the projection horizon, using either a perpetual growth model or an exit multiple approach, and discount both the intermediate cash flows and terminal value back to the present.

While DCF shines in its transparency and adaptability to company-specific assumptions, it also demands disciplined forecasting and credible discount rate estimation. Overly optimistic revenue trajectories or underestimated cost structures can produce inflated valuations that crumble under investor scrutiny. Moreover, early-stage firms often lack stable cash flow visibility, rendering DCF projections more speculative than substantive. Still, incorporating a DCF analysis—even as a directional check—enhances your valuation narrative by demonstrating financial literacy and a long-term value-creation mindset. To bolster credibility, pair DCF outputs with sensitivity analyses that illustrate how changes in growth rates or discount factors affect valuation, reinforcing that you’ve stress-tested assumptions and remain prepared for multiple scenarios.

#2: Comparable Company Analysis

When you lack extensive cash flow history, peer benchmarking offers an alternative lens: analyze publicly traded or recently funded private companies that mirror your startup’s business model, growth stage, and market positioning. Comparable Company Analysis (CCA) entails identifying a set of relevant firms—ideally operating in the same industry vertical and exhibiting similar revenue growth rates—and extracting valuation multiples such as Enterprise Value-to-Revenue (EV/Revenue) or Enterprise Value-to-EBITDA (EV/EBITDA). By averaging or mediamultiplying these peer multiples and applying them to your own metrics, you derive a market-aligned valuation. For instance, if comparable SaaS companies trade at 8x annual recurring revenue (ARR) and you forecast $5 million in ARR, a CCA suggests an enterprise value of around $40 million.

The strength of CCA lies in its grounding in real market data, providing an investor-friendly reference point that underscores how external stakeholders value similar ventures. It sidesteps the subjective intricacies of long-term forecasting, instead leveraging observable transaction prices. However, selecting the right peer group is critical: mismatched growth rates, profit margins, or business models can skew multiples. Additionally, market dynamics—such as a recent flurry of capital inflows or a shift in investor sentiment—can inflate or depress peer valuations, impacting your derived figure. To mitigate these challenges, refine your peer set by geography, customer segment focus, or product maturity, and adjust multiples to account for differences in scalability, end-market concentration, or growth trajectories. Presenting a nuanced peer analysis demonstrates that you understand market dynamics and can situate your startup within the broader valuation landscape.

#3: Precedent Transaction Method

Closely related to Comparable Company Analysis, the Precedent Transaction Method (PTM) focuses specifically on the valuations achieved in comparable financings or acquisitions. By examining recent deals—equity crowdfunding rounds, venture capital investments, or strategic acquisitions—in your sector, you capture the real money investors and acquirers have been willing to pay. This approach involves gathering data on transaction sizes, deal structures, and implied price per share or enterprise value metrics. For example, if three startups in your niche secured Series A funding at an average price of $10 per share, and your startup has ten million outstanding shares post-money, PTM implies a valuation of $100 million.

PTM offers the advantage of reflecting actual deal terms, including control premiums or strategic buyer synergies that peer multiples may overlook. It provides a practical benchmark for what the market currently deems acceptable in terms of price and terms. Yet the method also carries nuances: disclosed transaction details may be limited, and the presence of earn-outs, escrow provisions, or performance milestones can impact headline valuations. Furthermore, strategic acquirers often pay premiums above pure financial investors, so distinguishing acquisition multiples from typical funding rounds is essential. When leveraging PTM, clearly articulate the context of each precedent—deal stage, investor type, and any conditional terms—ensuring that your audience interprets the data appropriately and recognizes your valuation as a calibrated, real-world estimate.

#4: Venture Capital Method

The Venture Capital Method (VC Method) originated in the private equity world as a pragmatic framework for early-stage investors to estimate pre-money valuations based on anticipated exit values. The process reverses engineered exit expectations by identifying a plausible future exit price—often through an acquisition multiple of revenue or EBITDA at year five or seven—and dividing it by the target return multiple that investors seek (for example, 10x). The result is the post-money valuation you’d need at exit to satisfy investor return targets. Subtracting the investment amount yields the pre-money valuation for the current round.

For instance, if you anticipate a $200 million exit in five years and investors require a 10x return on a $2 million injection, the post-money valuation today would be $20 million, implying a pre-money valuation of $18 million. The VC Method excels in aligning present valuation with exit-driven investor expectations, highlighting the forward-looking, return-centric lens that venture capitalists employ. Yet it hinges on credible exit assumptions: overestimating future multiples or misjudging industry consolidation can generate unrealistic valuations. To mitigate risk, complement the VC Method with sensitivity scenarios—illustrating how lower exit multiples or higher required returns affect pre-money estimates. By transparently revealing these dynamics, you signal to investors that you’re attuned to exit realities and have built room for negotiation.

#5: Scorecard and Berkus Methods

Early-stage startups lacking revenue or formal financial metrics often turn to the Scorecard Method or its popular variant, the Berkus Method, to arrive at defensible valuations based on qualitative milestones. The Scorecard Method begins by establishing an average pre-money valuation for comparable seed-stage rounds in your region. Founders then adjust this baseline based on factors like strength of the founding team, size of the opportunity, product or technology readiness, competitive environment, sales channels, and the need for additional investment. Each factor receives a weight and a relative score, culminating in an adjusted valuation that reflects both market norms and company-specific strengths.

The Berkus Method streamlines this process by assigning fixed dollar amounts to five core success drivers: idea quality, prototype development, management team, strategic relationships, and product rollout or sales traction. For each category, founders receive up to a predefined dollar value (for instance, $500,000 each), summing to a total pre-money valuation ceiling (e.g., $2.5 million). Both methods enable early-stage founders to align valuation with tangible progress markers—transforming intangible elements like management experience and prototype validation into explicit financial terms.

These qualitative approaches shine when quantitative data is scarce, offering investors a structured, transparent framework for assessing risk and potential. However, they also depend on accurately benchmarking regional valuations and agreeing on weightings or dollar caps—both of which require market insight and open dialogue. By presenting a scorecard analysis alongside more quantitative methods, founders demonstrate that they’ve considered both hard metrics and softer but crucial qualitative factors, painting a comprehensive valuation picture even in nascent stages.

Integrating Multiple Methods for Robust Valuation

No single valuation approach reigns supreme across all startup stages. Savvy founders blend insights from multiple methods to triangulate a balanced valuation range that reflects both intrinsic value and market reality. For example, early-stage ventures might combine the Berkus Method with peer multiple checks, verifying that qualitative adjustments align with comparable seed round valuations. Later-stage startups can juxtapose DCF outputs with Comparable Company multiples and Precedent Transaction benchmarks, ensuring that their forecast-based valuations resonate with market-derived figures. By cross-validating methods, you mitigate the blind spots inherent in each approach and present investors with a cohesive valuation rationale anchored in diverse evidence.

Communicating Your Valuation with Confidence

Beyond mastery of valuation tools, success hinges on storytelling finesse. Communicate your valuation process clearly, guiding investors through each method’s rationale and highlighting how your company’s unique attributes influence model inputs. Use straightforward visuals—charts depicting multiple valuation ranges or tables summarizing peer multiples—to reinforce transparency without resorting to bullet lists. A narrative that explains why you prioritized certain metrics, how you benchmarked precedents, and the contingencies you built into sensitivity analyses fosters trust and positions you as a collaborative partner rather than an adversarial negotiator.

Navigating Negotiations and Building Consensus

When valuation discussions begin, anticipate divergent investor perspectives: some may favor DCF rigor, others peer multiples, and others exit-driven VC logic. Listen actively to understand each party’s biases and tailor your responses accordingly. For instance, emphasize exit-based models with venture capitalist leads while showcasing peer multiple data for syndicate investors seeking market validation. Remain open to iterative adjustments—introducing caps on post-money valuation or commit-to-achieve milestones that trigger valuation increases—demonstrating flexibility and goodwill. Effective negotiation balances firmness in your valuation foundations with a readiness to incorporate reasonable investor feedback, cultivating consensus that expedites deal closure.

Keeping Valuation Dynamic Through Growth Phases

Valuation is not a one-time milestone but an evolving barometer of your startup’s progress. Revisit and refine your valuation approaches at each funding stage. As you accumulate revenue history, lean more heavily into DCF and comparable multiples. When your sector experiences consolidation or valuation resets, refresh your precedent transaction dataset. When you achieve critical qualitative milestones—like patent grants, key hires, or strategic partnerships—reevaluate Berkus or Scorecard inputs. By treating valuation as an ongoing strategic tool rather than a static number, you empower both founders and investors to align expectations dynamically, ensuring that every round accurately reflects your company’s maturation and market position.

Empowering Founders Through Valuation Mastery

Navigating startup valuation demands a blend of analytical rigor, market savvy, and persuasive storytelling. By mastering the five core methods—Discounted Cash Flow, Comparable Company Analysis, Precedent Transaction benchmarks, the Venture Capital Method, and Scorecard/Berkus approaches—founders gain a versatile toolkit to derive defensible valuations across all stages of growth. Integrating quantitative models with qualitative insights enables you to triangulate a valuation range that resonates with diverse investor preferences while preserving room for negotiation. As valuation debates unfold, clear communication, transparent assumption disclosure, and collaborative negotiation pave the path to successful fundraises that balance capital needs with ownership retention. Armed with these methodologies and the strategic mindset to apply them dynamically, you’ll convert valuation from a source of stress into a lever for unlocking sustainable capital and driving your startup’s next phase of innovation.