Why Precision Pays Off

Deciding on the right valuation for your equity crowdfunding round is more than a numbers exercise—it’s a strategic decision that reverberates through your company’s trajectory. Set the valuation too high, and you risk alienating potential investors, stalling momentum, or leaving funding goals unmet. Price it too low, and you may raise capital quickly but dilute your ownership disproportionately, only to discover you have little room to negotiate at the next funding stage. In the equity crowdfunding arena, where hundreds of startups vie for attention, a thoughtfully calibrated valuation can be the difference between a fully subscribed round and a campaign that sputters out.

Equity crowdfunding platforms democratize access to investment, enabling non-accredited investors to participate alongside traditional financiers. This expanded investor base brings fresh capital and validation, but also heightens the importance of transparency and fairness in your pricing. Early backers want a stake that promises genuine upside potential, while you as a founder need to maintain sufficient leverage for future growth phases. Successfully navigating these competing demands demands a holistic understanding of valuation fundamentals, seasoned analysis of comparable deals, realistic future projections, and clear communication that builds investor confidence. In this comprehensive guide, we’ll explore each dimension of setting the right valuation for equity crowdfunding: unpacking core valuation concepts, examining critical financial and non-financial drivers, evaluating market comparables, projecting growth, and crafting narratives that resonate with backers. We’ll also address regulatory considerations, negotiation tactics, and common pitfalls to avoid. By the end, you’ll possess a structured framework to establish a valuation that aligns your startup’s ambitions with investor expectations—laying the groundwork for a successful raise and sustainable expansion.

What Valuation Means in Equity Crowdfunding

Valuation in equity crowdfunding represents the implied worth of your company prior to new investment. It establishes the price per share that investors will pay in exchange for equity. Unlike traditional venture capital rounds, where terms are often negotiated privately with a handful of seasoned investors, equity crowdfunding unfolds publicly on an online platform. Every prospective backer sees the valuation and gauges whether the price fairly reflects the company’s stage, market opportunity, and growth prospects. A transparent valuation signals credibility and can accelerate funding velocity, while an opaque or arbitrary figure may spark skepticism, leading investors to question your reasoning or the integrity of your financial projections.

Assessing Your Company’s Stage and Traction

The earliest step toward setting a defensible valuation is honestly assessing your company’s developmental milestone. Are you pre-revenue, generating recurring revenue, or scaling rapidly after multiple product launches? Each stage carries different risk profiles and expectations. Pre-revenue startups typically command lower valuations, grounded in team strength, prototype readiness, and market research. Companies with consistent revenue streams can justify higher valuations based on historical growth rates, customer acquisition costs, and unit economics. The nature of your traction—pilot agreements, letters of intent from strategic partners, or media accolades—provides tangible proof points that underpin valuation discussions. By aligning valuation to demonstrable progress, you anchor investor expectations and avoid misguided optimism or undervaluation.

Financial Metrics That Anchor Your Valuation

Key financial metrics serve as valuation anchors in equity crowdfunding pitches. Revenue growth rates, gross margins, and burn rates collectively paint a picture of financial health and capital efficiency. Startups exhibiting high gross margins and controlled burn can command higher valuations even if absolute revenue remains modest. Conversely, businesses with razor-thin margins or unpredictable capital needs may warrant more conservative pricing. Cash runway—how many months your existing funds will sustain operations—directly impacts investor risk appetite. Longer runways suggest stability and reduce dilution risk from future raises, enabling you to maintain a stronger negotiating position. By weaving these metrics into your valuation rationale, you demonstrate financial acumen that reassures both retail and sophisticated backers.

Leveraging Comparable Deals and Market Benchmarks

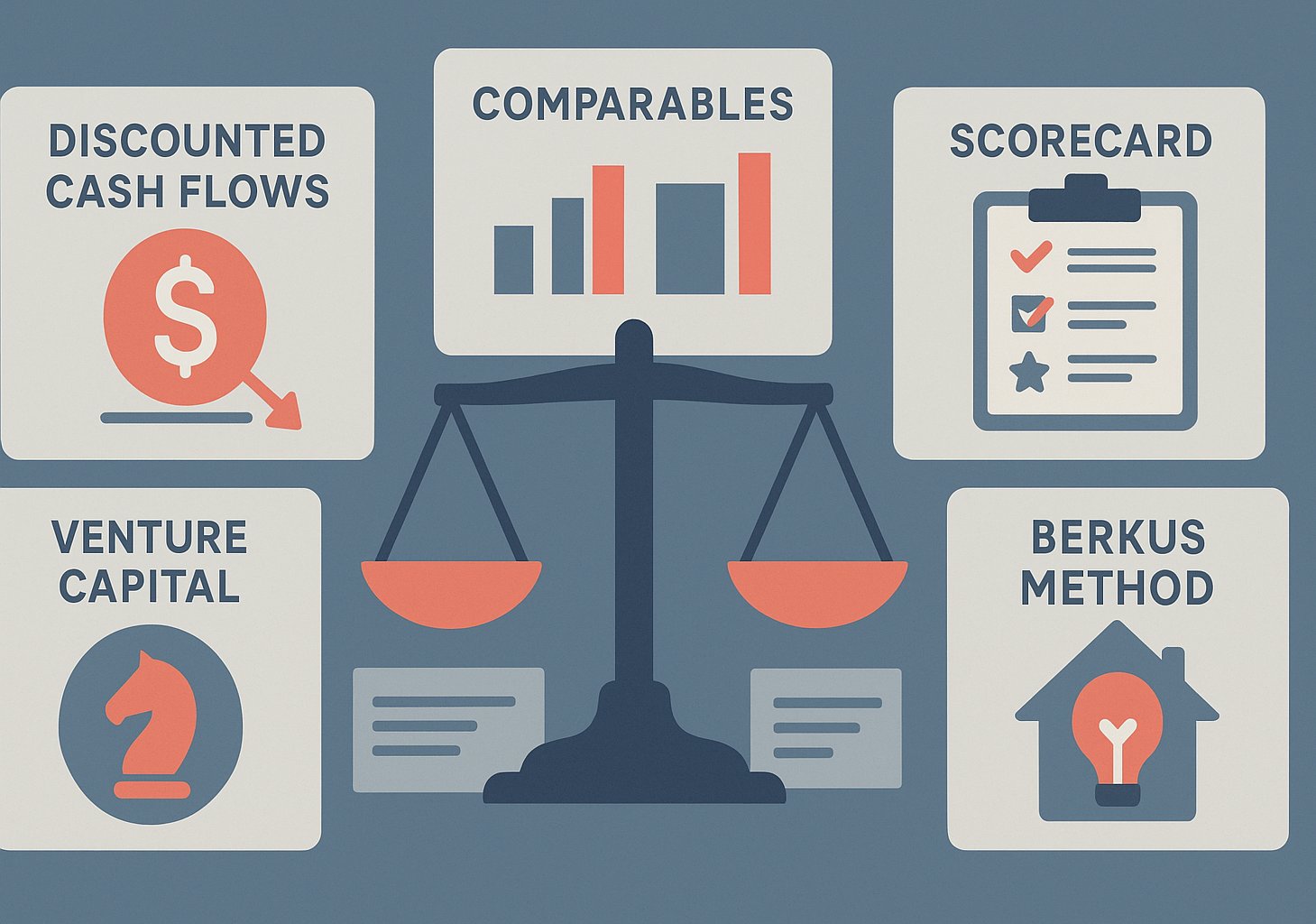

A reliable method for calibrating your valuation is examining comparable transactions in your sector and geography. Identify recent equity crowdfunding rounds, venture deals, or M&A outcomes for startups with similar business models, customer bases, and growth trajectories. Platforms often publish anonymized deal data, while specialized market research reports can fill gaps. Observing how comparable companies were valued—on revenue multiples, user-base benchmarks, or technology moats—provides a credible reference frame. However, beware of exact replication: slight differences in team pedigree, intellectual property strength, or competitive positioning can justify premium or discount adjustments. Employ comparables as a sanity check rather than a rigid formula, using qualitative factors to refine the baseline valuation.

Projecting Future Growth to Justify Valuation

Investors in equity crowdfunding rounds pay close attention to your forward-looking projections. A vision of sustainable, scalable growth backed by clear milestones can elevate perceived value. Craft multi-year financial models that translate market opportunity into realistic revenue forecasts, accounting for market penetration rates, pricing strategies, and cost efficiencies that scale with volume. Clearly articulate assumptions underpinning each projection: customer acquisition cost decreases over time, expansion into adjacent markets, or the impact of strategic partnerships. When your growth roadmap displays credible step-changes tied to launch events, product releases, or geographic rollouts, investors gain confidence that the valuation compensates for both current achievements and future upside.

Balancing Upside for Investors and Retaining Control

Equity crowdfunding investors seek sufficient upside to justify early-stage risk. Your valuation must leave room for share price appreciation as milestones are met and subsequent funding rounds occur. At the same time, founders need to preserve enough ownership to maintain decision-making control and reap rewards from future liquidity events. This balancing act involves calculating post-money dilution scenarios across current and anticipated financing rounds. By modeling cap table outcomes under various valuation and funding scenarios, you can identify the valuation sweet spot—high enough to minimize dilution anxiety yet low enough to attract financial commitments. Transparently sharing these cap table models with prospective backers conveys professionalism and deepens trust in your governance approach.

Navigating Regulatory and Platform Requirements

Equity crowdfunding is regulated under securities laws (such as Regulation Crowdfunding in the U.S.) that impose limits on raise amounts, investor protections, and disclosure requirements. Platforms may cap the maximum allowable valuation for certain campaign categories or require standardized financial reporting. Familiarize yourself with platform-specific guidelines on pre-money and post-money valuation disclosures, and ensure your legal and accounting teams vet all filings. Compliance not only avoids regulatory pitfalls but also signals to investors that your campaign is structured according to industry best practices. A platform partnership that offers educational materials and valuation calculators can further assist you in aligning with regulatory norms while refining your valuation strategy.

Communicating Your Valuation Rationale

Even the most meticulously researched valuation can fall flat if not communicated effectively. Craft a clear narrative that walks investors through your reasoning step by step: introduction of your traction stage, financial metric highlights, comparables overview, forward-looking projections, and dilution modeling. Use concise language that avoids jargon, and illustrate key points with intuitive charts or infographics—such as simplified cap tables or growth trajectory curves. Emphasize transparency by sharing sensitivity analyses that show how minor changes in revenue growth or cost structure could affect valuation outcomes. An investor who understands the logic behind your valuation is more likely to trust and invest, whereas opaque or overly technical presentations may raise red flags.

Handling Negotiations and Price Discovery

Some equity crowdfunding platforms enable dynamic pricing mechanisms, including early-bird discounts or tiered valuation tranches that reward initial backers. Others fix the valuation at campaign launch, leaving little room for mid-campaign adjustments. Evaluate which approach aligns with your community-building objectives. Early tranche discounts can stimulate momentum, but they also create valuation discontinuities that may complicate cap table management. If you opt for dynamic pricing, set clear rules around tranche sizes, pricing differentials, and timelines. In fixed-valuation scenarios, conduct thorough pre-campaign outreach to gauge investor appetite, refining your price point until you achieve a comfortable balance between demand and dilution targets.

Adjusting Valuation Throughout the Campaign Lifecycle

Equity crowdfunding campaigns often span several weeks or months, during which new information emerges—product enhancements, partnership announcements, or shifts in market sentiment. Be prepared to revisit your valuation narrative in response to these developments. If substantial new traction materializes mid-campaign, consider refreshing investor communications to highlight why this progress merits revaluation in future rounds. Conversely, if unexpected challenges arise, proactively address them with transparency and outline measures you’re taking to mitigate impact. While you cannot modify the valuation live on most platforms, responsive communication builds credibility and sets the stage for favorable perceptions in subsequent fundraising efforts.

Common Pitfalls and How to Avoid Them

Several recurring mistakes can undermine valuation strategy on equity crowdfunding platforms. Overreliance on optimistic projections without backup evidence often breeds skepticism. Ignoring dilution modeling or failing to account for future financing rounds can lead to founders losing control too early. Overlooking platform regulatory nuances—or misrepresenting valuation assumptions in campaign materials—carries legal risks and reputational damage. To sidestep these pitfalls, engage experienced financial advisors and legal counsel, stress-test your models under conservative assumptions, and solicit feedback from trusted mentors or early backers before public launch. A culture of rigorous preparation and continuous refinement ensures your valuation withstands investor scrutiny.

Striking the Right Balance for Long-Term Success

Setting the right valuation for equity crowdfunding is both an art and a science, requiring a nuanced blend of data-driven analysis, market awareness, and transparent communication. By grounding your price point in current traction, financial metrics, and comparable benchmarks, while projecting realistic future growth and modeling dilution scenarios, you establish a defensible valuation that aligns founder and investor incentives. Navigating regulatory requirements, articulating your rationale clearly, and remaining adaptive throughout the campaign lifecycle further enhances credibility and fundraising momentum. Ultimately, the valuation you choose not only determines capital raised today but also influences investor relationships, control dynamics, and future funding prospects. Approach valuation as a strategic foundation for your startup’s journey—one that balances ambition with prudence, maximizes support without sacrificing ownership, and sets the stage for enduring growth.