Navigating the Crowdfunding Crossroads

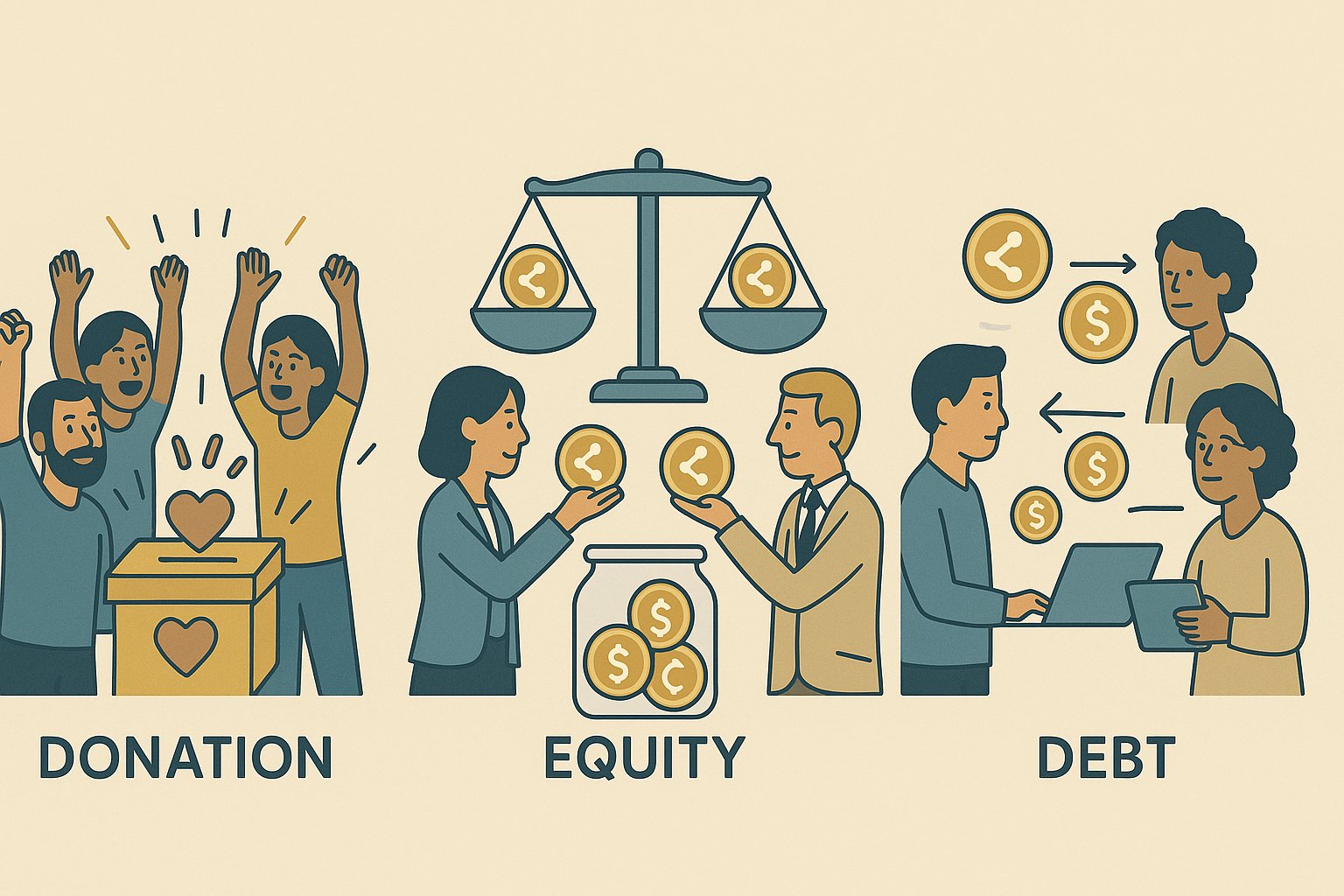

Embarking on a crowdfunding journey often feels like stepping into uncharted territory: a vast, dynamic landscape filled with innovative platforms, enthusiastic backers, and evolving regulations. At the heart of this ecosystem lie two dominant models—reward-based crowdfunding and equity crowdfunding—each offering distinct routes to finance your vision. While both invite crowds to fuel your project, they differ fundamentally in structure, risk, and the relationship you forge with supporters. Reward-based campaigns, spotlighted by platforms like Kickstarter and Indiegogo, invite backers to pre-order products or enjoy unique perks in exchange for their pledges. It’s a model built on anticipation and tangible rewards, perfect for creators seeking market validation and early adopters eager to secure exclusive offerings. Conversely, equity crowdfunding platforms such as SeedInvest and Republic transform backers into shareholders, offering them ownership stakes in exchange for capital. This high-stakes approach can propel startups toward rapid growth but demands rigorous compliance with securities laws and a compelling business case. Understanding these models is more than academic; it’s strategic. A misaligned choice can lead to delayed fulfillment, regulatory headaches, or diluted control. Conversely, selecting the right path can amplify your reach, deepen supporter engagement, and accelerate your trajectory. In this comprehensive guide, we’ll dissect the nuances of reward-based and equity crowdfunding—exploring their mechanics, benefits, challenges, and best practices—so you can chart a confident course toward funding success.

Reward-Based Crowdfunding: Igniting Passion with Perks

Reward-based crowdfunding is the poster child of creative campaigns, often capturing headlines with record-breaking projects and eye-catching gadgets. At its core, this model hinges on exchanging rewards—ranging from branded merchandise and limited-edition experiences to the very product in development—for pledges. The tiered structure of reward levels encourages backers to contribute more in exchange for enhanced perks, fostering a sense of exclusivity and community.

Creators launch campaigns with clear funding goals and deadlines, mobilizing digital marketing efforts to spark momentum. Early-bird specials entice the first wave of supporters, generating social proof that attracts broader audiences. As pledges accumulate, updates and stretch goals keep backers engaged, offering additional features or bonus content if funding milestones are surpassed. This iterative approach not only sustains excitement but also provides invaluable market feedback: creators can gauge demand, refine product features, and build brand ambassadors before mass production begins.

However, the allure of rewards carries operational complexities. Fulfilling physical goods demands meticulous planning around manufacturing, quality control, and global shipping logistics. Unanticipated delays—whether due to supplier setbacks or regulatory hurdles—can strain backer trust. Transparent communication is paramount: sharing candid progress reports, acknowledging setbacks, and outlining revised timelines helps preserve credibility. When executed with care, reward-based crowdfunding serves as both a fundraising engine and a marketing launchpad, turning backers into loyal advocates who feel personally invested in a project’s success.

Equity Crowdfunding: Cultivating Stakeholders in Your Vision

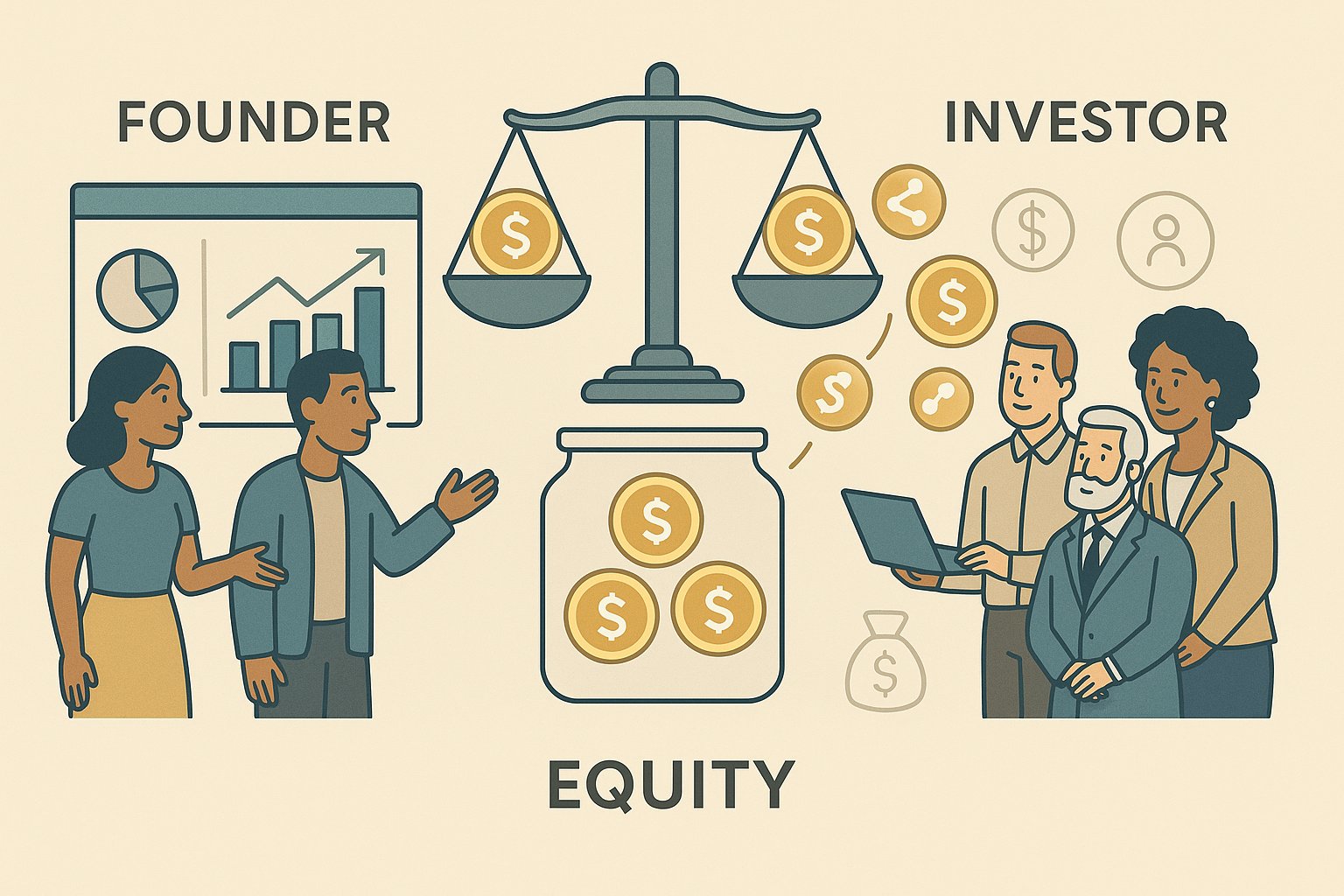

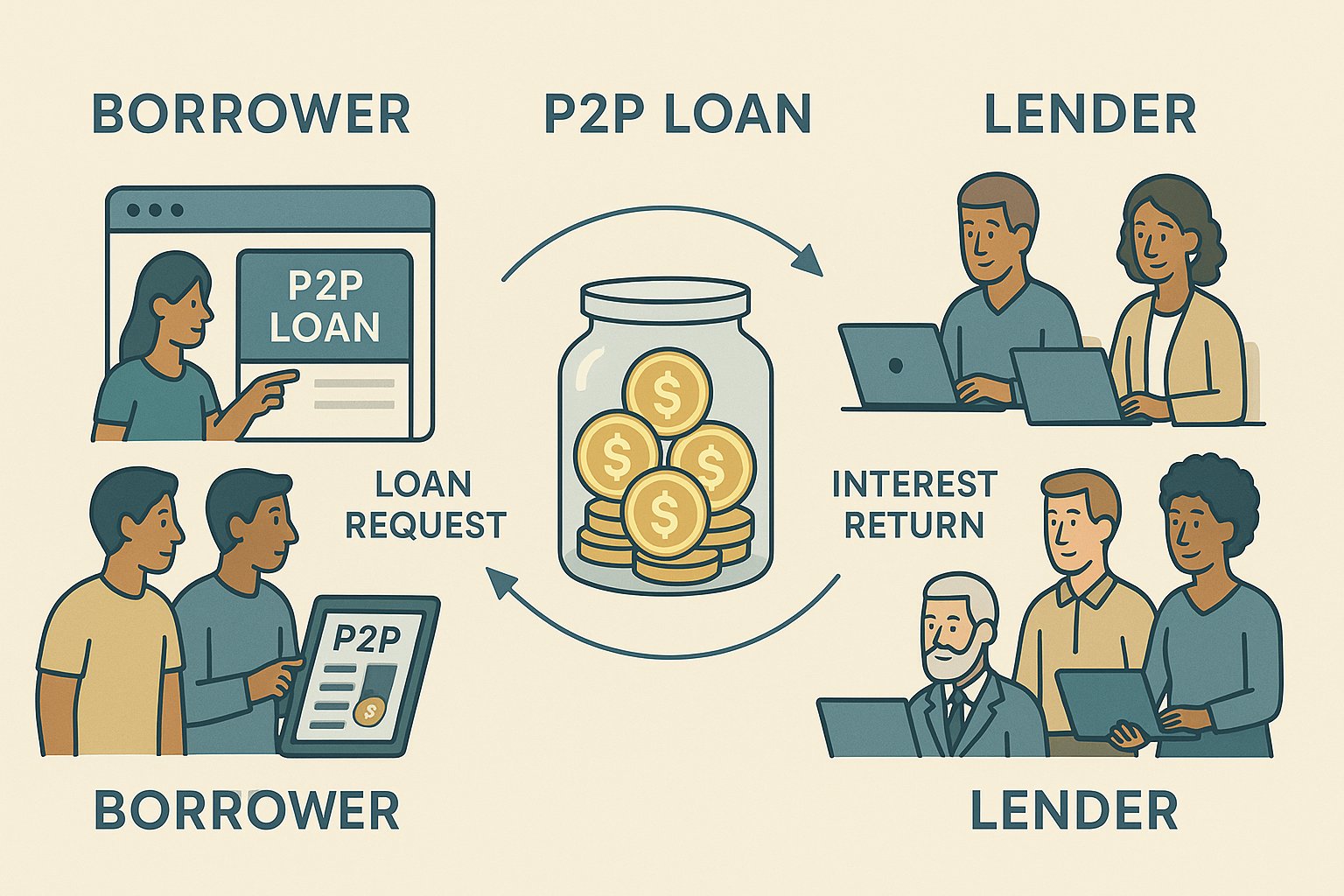

Equity crowdfunding transforms supporters from customers into genuine investors, offering shares or convertible notes in exchange for capital. Platforms such as Crowdcube, Wefunder, and Republic enable startups and growth-stage companies to raise funds from accredited and non-accredited investors alike. By granting equity stakes, businesses tap into a broader pool of capital while aligning investor incentives with long-term performance.

Unlike reward-based models, equity campaigns require comprehensive disclosures, including audited financial statements, business plans, and risk assessments. Securities regulations—varying by jurisdiction—govern investor eligibility, fundraising limits, and ongoing reporting obligations. Platforms often scaffold this process, providing legal templates and due diligence checklists, but the onus rests on founders to uphold rigorous transparency. In return, companies can attract substantial sums, sometimes surpassing traditional Series A rounds, while forging deep relationships with investors who can offer mentorship, industry connections, and channels for future funding.

For investors, equity crowdfunding delivers a rare chance to join the early stages of emerging ventures, potentially securing high-impact returns. Yet, startup failure rates underscore the risk: equity investors must conduct thorough due diligence, evaluating market size, competitive dynamics, and leadership strength. While the promise of equity dilution and exit events—such as acquisitions or IPOs—can be exhilarating, founders must balance fundraising ambitions against ownership control, board governance, and the responsibilities of shareholder relations.

Head-to-Head: Comparing Reward and Equity Models

At a glance, both reward-based and equity crowdfunding share a common purpose: connecting creators with supporters. Yet the contrasts are profound. Reward campaigns emphasize product-centric engagement, with backers anticipating physical or experiential perks. Equity campaigns prioritize financial returns and shareholder rights, aligning investor interests with corporate growth.

Funding timelines differ as well. Reward campaigns typically run for 30 to 60 days, leveraging urgency to drive pledges before deadlines. Equity campaigns can span several months, given the complexity of regulatory filings and investor outreach. In terms of costs, reward campaigns incur production and fulfillment expenses—often estimated at 10–20% of raised funds—while equity campaigns face legal fees, platform commissions, and ongoing reporting obligations.

Control considerations also diverge. Reward creators retain full ownership and creative autonomy, free from investor governance. Equity founders must navigate shareholder expectations, board oversight, and potential dilution of decision-making power. Conversely, equity investors may become advocates, offering strategic guidance and opening doors to partnerships, whereas reward backers typically exit the relationship post-delivery.

Finally, psychological dynamics shape each model. Reward backers seek to be first adopters and community members; equity investors seek financial upside and portfolio diversification. Recognizing these motivations helps creators tailor messaging, perks, and engagement strategies—ensuring alignment between campaign structure and supporter aspirations.

Crafting a Compelling Reward Campaign

Launching a successful reward-based campaign demands more than a great product idea. It requires storytelling that kindles excitement, high-quality visuals that showcase prototypes, and a meticulously planned fulfillment roadmap. Your campaign page serves as a digital storefront: weaving narrative arcs around your mission, development journey, and the tangible benefits awaiting backers.

Striking the right reward tiers is both art and science. Start with an attractive entry-level pledge—often under $20—to lower the barrier for widespread participation. Build up to mid-range tiers that offer the core product at a modest discount, then introduce premium tiers with exclusive add-ons or personalized experiences. Always calculate production and shipping costs with generous buffers to avoid margin erosion.

Pre-launch marketing amplifies your reach. Cultivate an email list of early supporters, engage niche communities on social media, and collaborate with influencers or press outlets relevant to your niche. During the campaign, maintain a steady cadence of updates—celebrating milestone achievements, sharing behind-the-scenes glimpses, and unveiling stretch goals that incentivize increased pledges. In post-campaign phases, prioritize transparent communication: deliver on reward promises promptly, survey backers for feedback, and transform satisfied supporters into lifelong advocates.

Building Investor Confidence in Equity Campaigns

Equity crowdfunding requires a different playbook—one rooted in financial rigor and investor relations. Your pitch materials must articulate a clear business model, addressable market size, competitive landscape, and projected revenue trajectories. Investors expect to see credible financial forecasts, risk mitigation strategies, and a seasoned management team capable of executing on ambitious plans. Compliance cannot be an afterthought. Engage experienced legal counsel early to navigate securities regulations, draft offering documents, and establish governance frameworks. Transparency builds trust: host virtual investor briefings, respond promptly to due diligence questions, and publish periodic performance updates post-funding. Cultivating lead investors—whether angel networks or micro-VCs—can accelerate momentum, signaling credibility to the broader investor pool. Offer tiered investment incentives, such as reduced share prices for early backers or bonus equity for those who commit above certain thresholds. Following a successful raise, focus on nurturing shareholder relationships: provide regular financial reports, solicit strategic guidance, and consider forming an advisory board comprised of influential investors. By demonstrating accountability and engaging investors as partners, you lay the groundwork for future funding rounds and long-term growth.

Regulatory Roadmap: Compliance and Aftercare

Both crowdfunding models carry regulatory obligations, albeit at different intensities. Reward-based campaigns must navigate consumer protection laws, import/export regulations for physical goods, and tax implications for revenue recognition. While platforms typically vet campaign creators, it’s the founder’s responsibility to secure necessary permits, adhere to labeling requirements, and ensure product safety standards.

Equity crowdfunding operates under securities regulations that vary by country. In the U.S., Regulation Crowdfunding (Reg CF) sets caps on how much can be raised annually and limits on individual investor contributions based on income or net worth. Detailed disclosures—covering financial statements, use of proceeds, and potential conflicts of interest—must be filed with the SEC and made publicly available. Post-funding, ongoing reporting obligations keep investors informed but demand administrative resources.

Ignoring compliance can trigger legal repercussions, platform delisting, and reputational damage. Successful creators build regulatory considerations into their project timelines, allocate budget for legal and accounting services, and implement robust governance structures. By treating compliance as a strategic advantage rather than a checkbox, you demonstrate integrity to supporters and position your venture for sustainable growth.

Aligning Strategy: Choosing Your Optimal Path

Selecting between reward-based and equity crowdfunding requires a holistic assessment of your goals, resources, and long-term vision. If your priority is rapid market validation, community engagement, and retaining full ownership, a reward campaign may be the ideal launchpad. Conversely, if you seek substantial capital infusion, strategic investor partnerships, and are comfortable sharing equity, an equity crowdfunding raise can catalyze transformative growth. Hybrid approaches are emerging, with some creators combining models sequentially—for example, using a reward campaign to validate product-market fit, followed by an equity offering to fund scaling. Others explore convertible instruments that blur the lines, offering early backers the option to convert rewards into equity stakes. As crowdfunding technology evolves, new structures—such as DAO-governed fundraising or tokenized equity—promise even more flexibility. Regardless of the path, meticulous planning remains essential. Conduct SWOT analyses to understand strengths, weaknesses, opportunities, and threats. Build financial models that reflect conservative, base-case, and upside scenarios. Engage mentors, advisors, and platform experts to stress-test your assumptions. By aligning your crowdfunding strategy with your broader business roadmap, you maximize the likelihood of not only hitting your funding goals but converting that capital infusion into lasting success.

Pioneering Your Crowdfunding Journey

The choice between reward-based and equity crowdfunding represents more than a funding mechanism—it shapes the narrative of your venture, the nature of your supporter relationships, and the trajectory of your growth. Reward campaigns transform backers into evangelists, celebrating each prototype iteration and unboxing moment. Equity campaigns forge investor alliances, blending financial backing with strategic counsel and shared ambition.

As you chart your course, remember that crowdfunding is as much about storytelling as it is about numbers. Whether you’re unveiling a breakthrough design or inviting investors to join your equity story, authenticity and transparency remain your greatest assets. Embrace the community-driven ethos that defines crowdfunding—nurture your supporters, honor your commitments, and remain agile in the face of challenges.

By mastering the nuances of reward-based versus equity crowdfunding, you empower yourself to select the model that aligns with your vision, fuels your ambitions, and cultivates the partnerships essential for enduring impact. The stage is set, the crowd awaits—choose your model, tell your story, and launch toward a future powered by collective possibility.